June Jobs Report Reflects Some Softening in the Labor Market

June Jobs Report Reflects Some Softening in the Labor Market

- Nonfarm payroll gains for June were 206 thousand vs. 190 thousand expected and 218 thousand in May (revised down from an initial 272 thousand). April was revised lower by 57 thousand jobs, bringing the two-month revisions to -111 thousand and that continues a year-long trend of downward revisions, some rather substantial. The gain in June jobs was just under the 12-month average of 220 thousand. Meanwhile, private sector jobs increased 136 thousand vs. 160 thousand expected and 193 thousand in May (revised down from an initial 229 thousand).

- Yet again, the Household Survey (which generates the unemployment rate, etc.) reported a different picture, albeit not as stark as previous months. For June, the survey reported a smaller increase of 116 thousand jobs and saw 408 thousand jobs lost in May. As we’ve said before, combined with the usual downward revisions in the Establishment Survey, and the conflicting message in the Household Survey, it does give one pause as to how much to conclude definitively from these BLS reports, at least with the initial release.

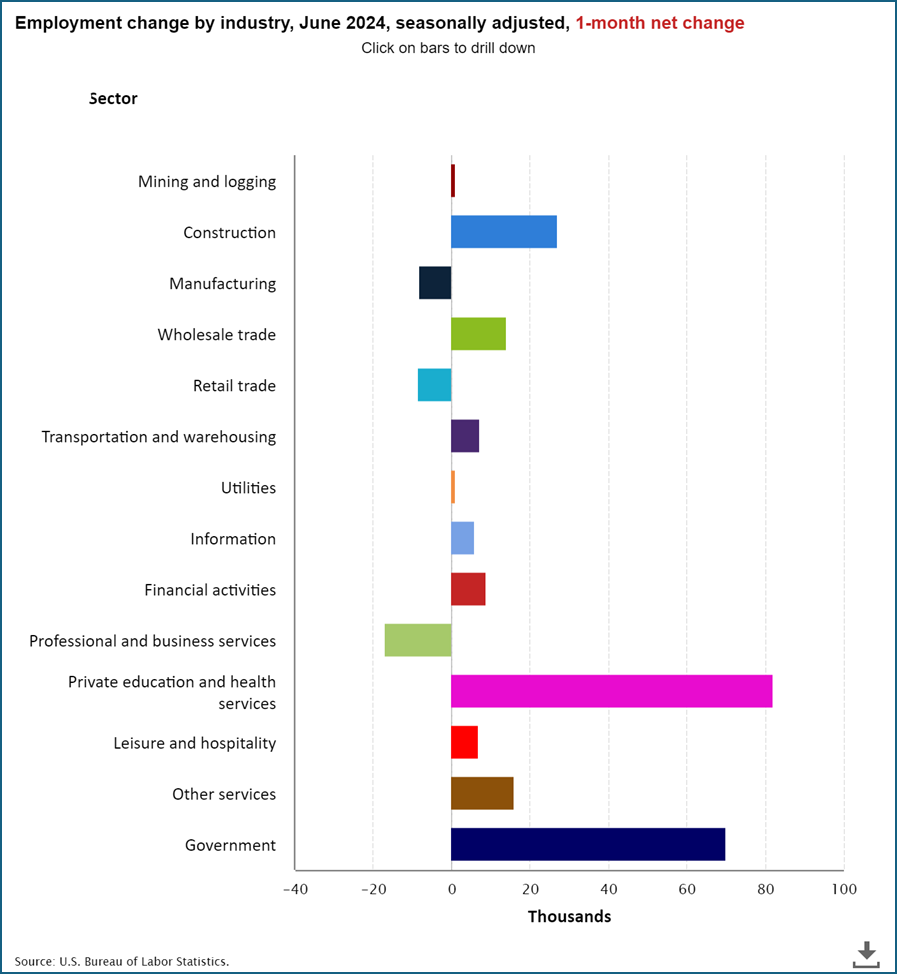

- Job gains were notable in healthcare/social assistance (82k), and government (70k), 74% of total new jobs, while hiring slowed in leisure/hospitality (7k), a previously hot sector. Job losses occurred in professional/business services (-17k), retail trade (-9k), both previously strong sectors, and for the third straight month temporary help services shed jobs, this time 49 thousand. This is a continuing trend and could signal softening with firms reducing temp help as demand slows before moving to cut full-time workers.

- Average Hourly Earnings dipped in June to 0.3%, matching the expectation and just below the 0.4% gain in May. The year-over-year pace decreased to 3.9%, matching expectations and down from 4.1% in May. Average weekly hours worked was unchanged at 34.3 hours, matching expectations. Weekly hours peaked at 35.0 a year ago, and it seems to be settling in the low 34-hour range, certainly not a sign of increasing labor demand.

- The moderation in wage gains is what the Fed wants to see as it diminishes the potential for a wage-price spiral. Ideally, the Fed wants that YoY number to drift to 3.5%, or less, just above the 2% inflation benchmark. Monthly prints in the 0.2% – 0.3% range will do the trick.

- The unemployment rate rose a tenth to 4.1% (4.053% unrounded), missing the 4.0% expectation, as the Household Survey reported an increase of 162 thousand in the ranks of the unemployed and an increase of 277 thousand in the labor force, reversing the drop in May. The number of unemployed persons has increased 800 thousand over the last year.

- The increase in the labor force increased the Labor Force Participation Rate one-tenth to 62.6% matching the expectation and a tenth above May’s 62.5%. The participation rate a decade prior to the pandemic averaged 63.3% while the average over the past year has been 62.6%. As we’ve noted recently, we seem to be at a near-term plateau in the size of the labor force.

- After a noisy, but strong, employment report in May, today’s BLS report clearly indicates some softening in the labor market, albeit not dramatic yet. The slight headline beat was offset by the sizeable downward revisions to the prior two months and the moderation in wage gains from May will be welcome news at the Fed. While there remains a divergence between the two surveys the differences this month were less stark. Previously hot sectors like leisure/hospitality are slowing and the job losses in temp help services continued for a third straight month. This report is more in-line with other labor-related reports that paint a picture of moderation in the employment market and that should keep a September rate cut firmly on the table.

- Programming Note: We’ll be off next week so the next Market Update will be on Monday, July 15th. See you then!

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.