July PCE Inflation as Expected, Confirming Fed Pivot to Labor Market Mandate

July PCE Inflation as Expected, Confirming Fed Pivot to Labor Market Mandate

- Treasury yields are a bit higher on the short end this morning as the Fed’s preferred inflation measure came as expected but that dented the odds of a 50bps rate cut vs. 25bps, at least until we see the August jobs report next Friday. Currently, the 10yr note is yielding 3.87%, unchanged on the day, while the 2yr is yielding 3.92%, up 3bps on the day.

- The highly anticipated core PCE inflation reading for July came in at a “low” 0.2% (0.16% unrounded), matching expectations, and the YoY rate remained at 2.6% vs. 2.7% expected. We’ve mentioned for a while the second half of 2024 would be more challenging for improving YoY rates and we’re seeing that here. Meanwhile, the 3-month annualized rate slowed to 1.7%, the lowest this year. The cool inflation read follows similar reports from June CPI and PPI and will keep a September rate cut firmly in place, but the 25 or 50bps question will be answered by next Friday’s August jobs report. Overall PCE rose 0.2% (0.16% unrounded) vs. 0.1% in June. That kept the YoY rate at 2.5%, just below the 2.6% expectation.

- Personal spending for July came in at 0.5% MoM, matching expectations, and above June’s 0.3%. Real spending (net of inflation) rose 0.4%, above the 0.3% expectation, and matching the upwardly adjusted 0.3% pace in June. Recall, the retail sales series for July was better-than-expected and the solid results here, which are more comprehensive, confirm a consumer who continues to come through month-after-month.

- Personal income for July rose 0.3% MoM, beating the 0.2% expectation, and June’s 0.2% gain. After a pop of 1.1% in January, income gains have oscillated between 0.2% and 0.4% which works out to a YoY rate close to the 3.6% Average Hourly Earnings gain from the July jobs report. That implies wage gains continue to moderate and are approaching the 3.5% target at the Fed. That moderation in wage gains also works well with the expected September rate cut.

- In addition, we received the second estimate of 2nd quarter GDP yesterday and the report beat expectations as GDP improved to 3.0% vs. 2.8% in the first estimate, which was also the expectation, and well above first quarter’s 1.4% growth rate. The pick-up in GDP was driven, once again, by the consumer as personal consumption increased from the first estimate’s 2.3% to 2.9%. The expectation was for it to tick lower to 2.2%. Once again, the warning should be heeded: never bet against the American consumer. Growth was also helped by increased government spending (remember those ongoing fiscal stimulus programs: Infrastructure Act, CHIPs Act, and IRA). For the third quarter, the Atlanta Fed has its latest estimate at 2.0%. While not 3.0% it’s far from recessionary territory too. The Soft-Landing Scenario lives on.

- Also from yesterday’s report, the quarterly inflation series was a tad cooler than the first estimate with core PCE coming in at 2.8% annualized vs. 2.9% in the first estimate. That’s much improved from the first quarter’s 3.7% annualized rate.

- In all, the Personal Income and Spending report for July was close to expectations and will do nothing to dissuade the Fed from targeting a September rate cut. The monthly inflation numbers, both overall and core, were on the “low” side of 0.2% (.0.16% unrounded), so it paints another picture of cooling inflation, and confirms that Powell’s Jackson Hole pivot to the labor market was the correct call.

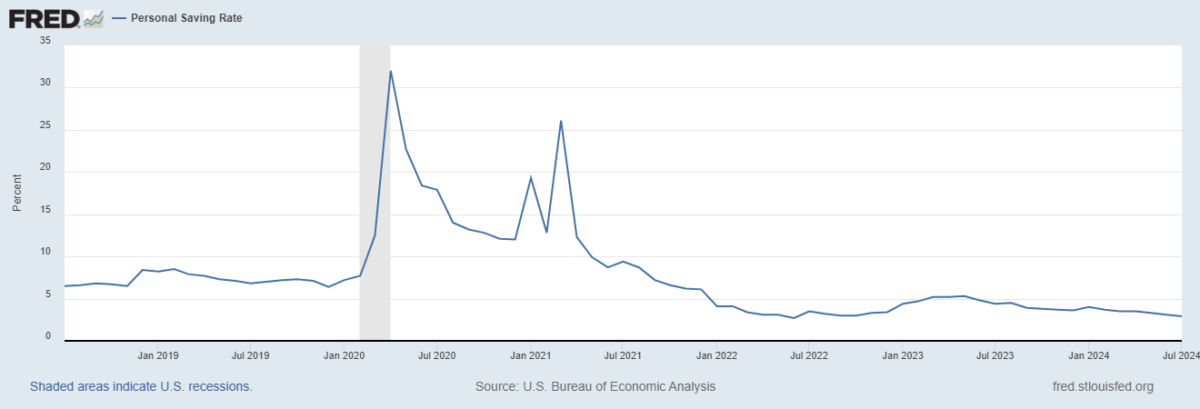

- However, despite a solid increase in income (0.3%), spending increased more (0.5%) leading to a decrease in the savings rate to 2.9%, the lowest in two years. That will eventually weigh on the consumer’s ability to continue spending at their recent pace, but as we’ve said before calling for the demise of the consumer has been a losing trade for over a year.

- Finally, this week I was joined by Joe Keating, portfolio manager in our wealth group and a frequent quest of the show, to discuss what we learned from Jackson Hole and what that may mean for the economy and for Treasury yields in the coming months. Joe is always an engaging and informative guest so give it a listen. You can find the podcast link here.

Personal Savings Rate at a Two-Year Low: Will That Slow the Consumer? So far the Answer is No

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.