July Jobs Report Misses and Big Downward Revisions Makes it Worse

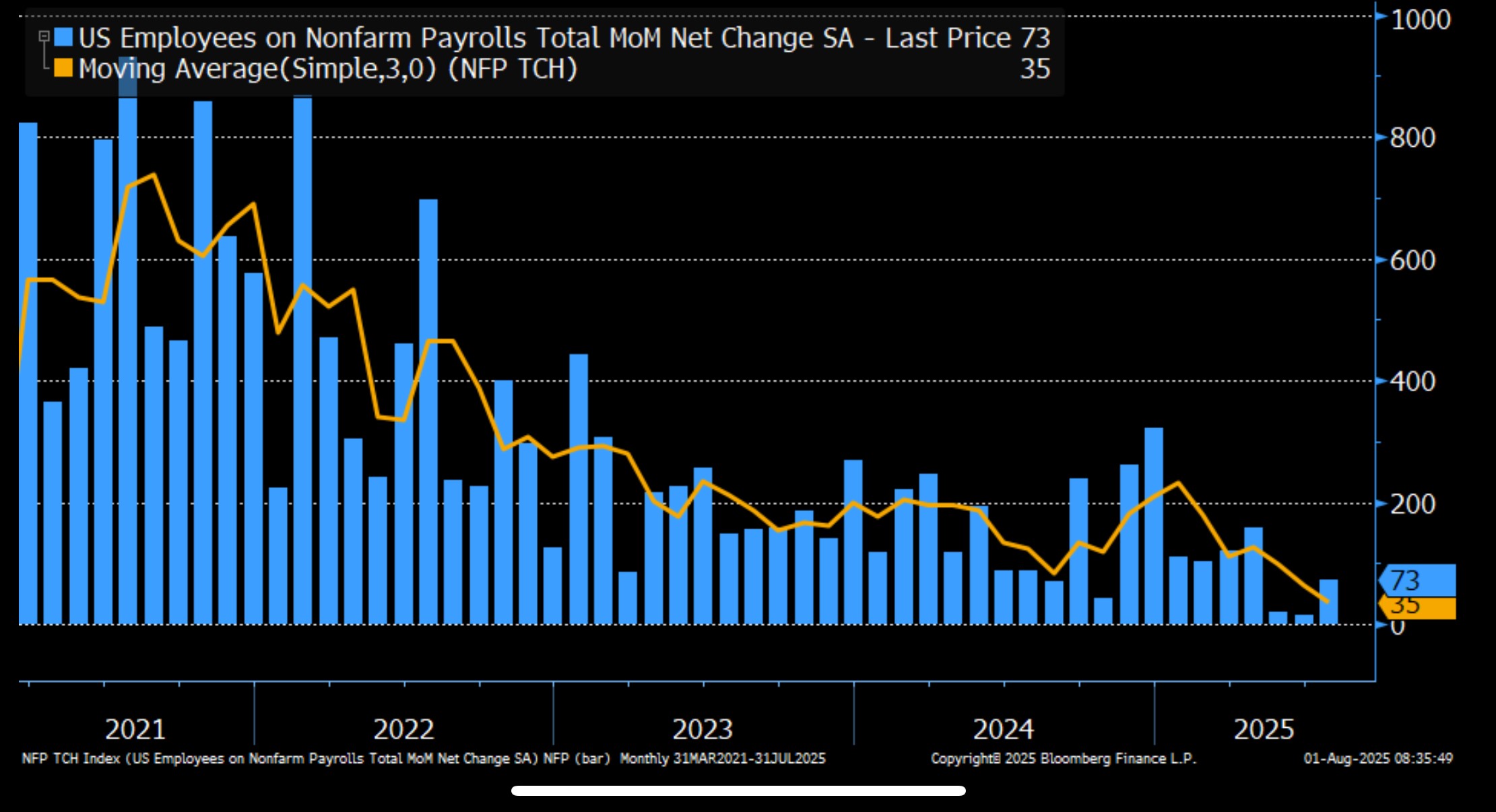

- July nonfarm payrolls rose only 73 thousand, missing the 105 thousand expected but slightly ahead of the 14 thousand increase in June (significantly revised lower from an initial 147 thousand increase). Speaking of revisions, May was revised down by 125 thousand jobs bringing two-month revisions to an astounding 258 thousand. Private sector job growth was 83 thousand which was short of the 100 thousand expected but well ahead of the downwardly revised 3 thousand in June (originally reported at 74 thousand).

- Monthly revisions have almost exclusively been to the downside for well over a year, and while that wasn’t the case initially with last month’s report, the downward trend returned in today’s report with a vengeance. The BLS’s birth/death model of new business creation/demise has generally overstated net business formation since the pandemic and that has been a big piece of the downward adjustment trend. The BLS has worked on adjusting the birth/death model to accurately reflect today’s economy but obviously it has more work to do in this area. In any event, post revisions, the average monthly gain over the last three months was 35 thousand overall and 52 thousand private sector jobs, a virtual standstill labor market.

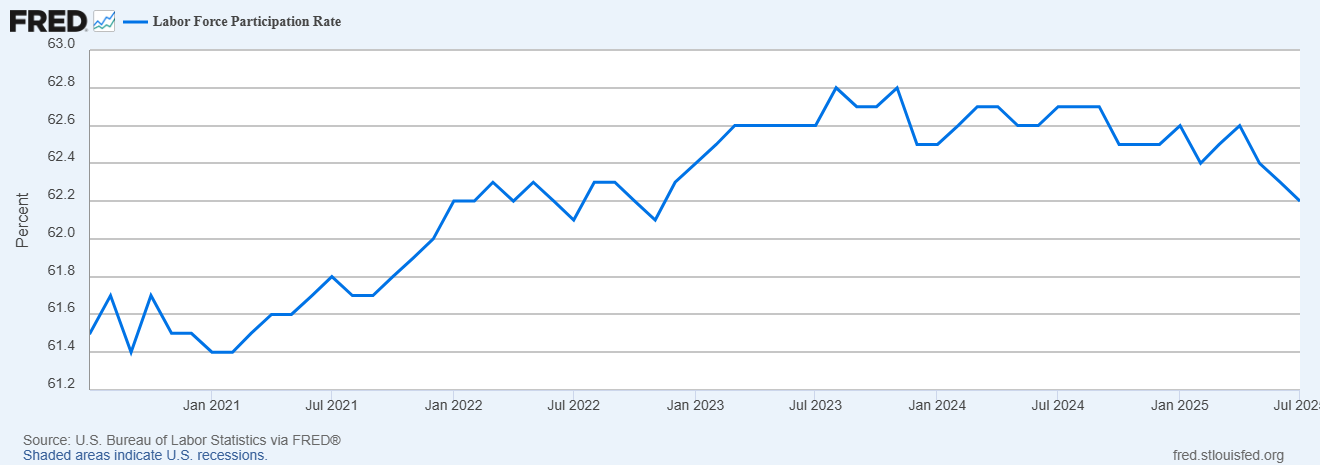

- The Household Survey, which is smaller than the Establishment Survey generates the unemployment rate, labor force participation rate, etc.. The survey reported a decrease of 260 thousand jobs and a 221 thousand increase in unemployed persons. The difference between the two led to the labor force shrinking for a third straight month, this time by a slight 38 thousand. The unemployment rate increased a tenth to 4.2% (4.248% unrounded vs. 4.117% in June) matching expectations but not far from a rounded 4.3% and the highest since October 2021. The increase in the unemployment rate was once again limited by a decrease in the labor force as deportations and slowing immigration are shrinking the labor force rather than those former workers showing up as unemployed. This is not how one typically grows an economy.

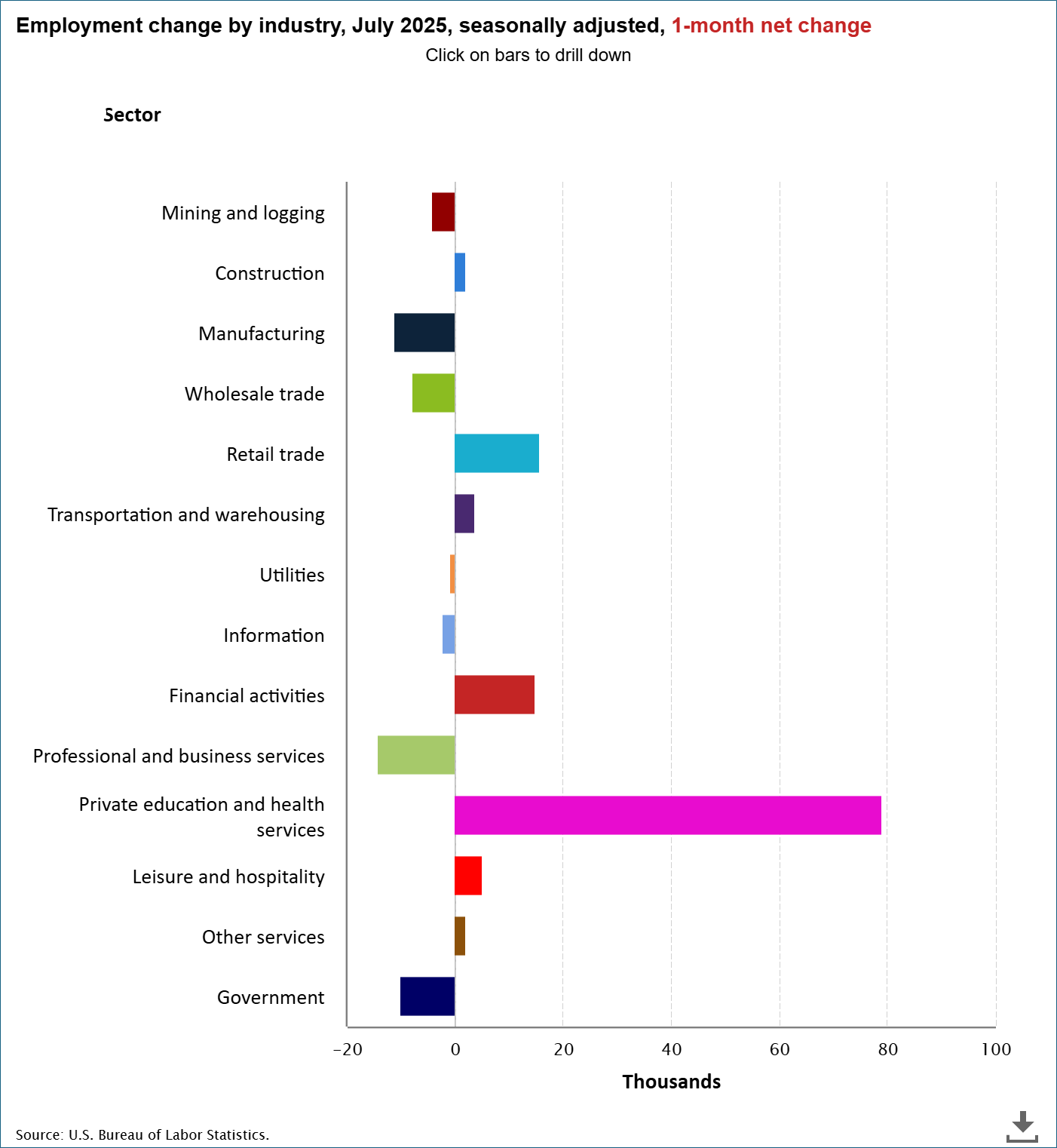

- Job gains were strongest in healthcare/social assistance, a perennially strong category, (73k). Other categories showing decent gains were retail trade (16k) and financial activities (15k). Missing from that list, leisure and hospitality which gained only 5 thousand jobs when it typically is a leading category. This is an indication that consumers are retreating from the heavy discretionary spending of last year. Job losses were concentrated in professional/business services (-14k), manufacturing (-11k), and government (-10) (see chart below).

- With the decrease in the labor force, the Labor Force Participation Rate dipped a tenth to 62.2%, missing the unchanged expectation. The dip in July has the rate at the lowest since November 2022. With deportations continuing, and legal immigration slowing, the labor force participation rate seems destined to move lower. The labor force rate was 62.7% a year ago and has shrunk for three months in a row, typically not what you see in a growing economy. Watch this metric in the months ahead. Another one that uses a wider lens, so to speak, is the employment to population ratio and that is shrinking as well. It started the year at 60.1% and sits at 59.6%. Again, not a good sign for a growing economy.

- Average Hourly Earnings rose 0.3% MoM, matching expectations and above the June gain of 0.2%. The year-over-year pace ticked higher to 3.9%, from 3.7%beating the 3.8% expectation. Average weekly hours worked rose a tenth to 34.3 hours, also beating expectations.

- The July jobs report disappointed across several fronts, first headline job gains were minimal, and downward revisions only added to the sense that the labor market is practically dead in the water. What’s more, the unemployment rate barely missed ticking up two-tenths to 4.3%, that’s where the Fed expects it to be at year-end, not mid-year. Private payroll growth is almost at a standstill, and the labor force continues to shrink. The only bright spot in the report is that wages and hours worked both increased in July, although the gains were modest. Bottom line: the hiring machine has slowed to a near standstill and the labor force continues to shrink. Those are not the ingredients for a robust economy. Layoffs, however, remain muted, which is moderating the downside risk for now. This report won’t prompt an inter-meeting ease, but Powell will probably use the upcoming Jackson Hole central bank symposium to tee-up a September rate cut where odds now stand at 83%.

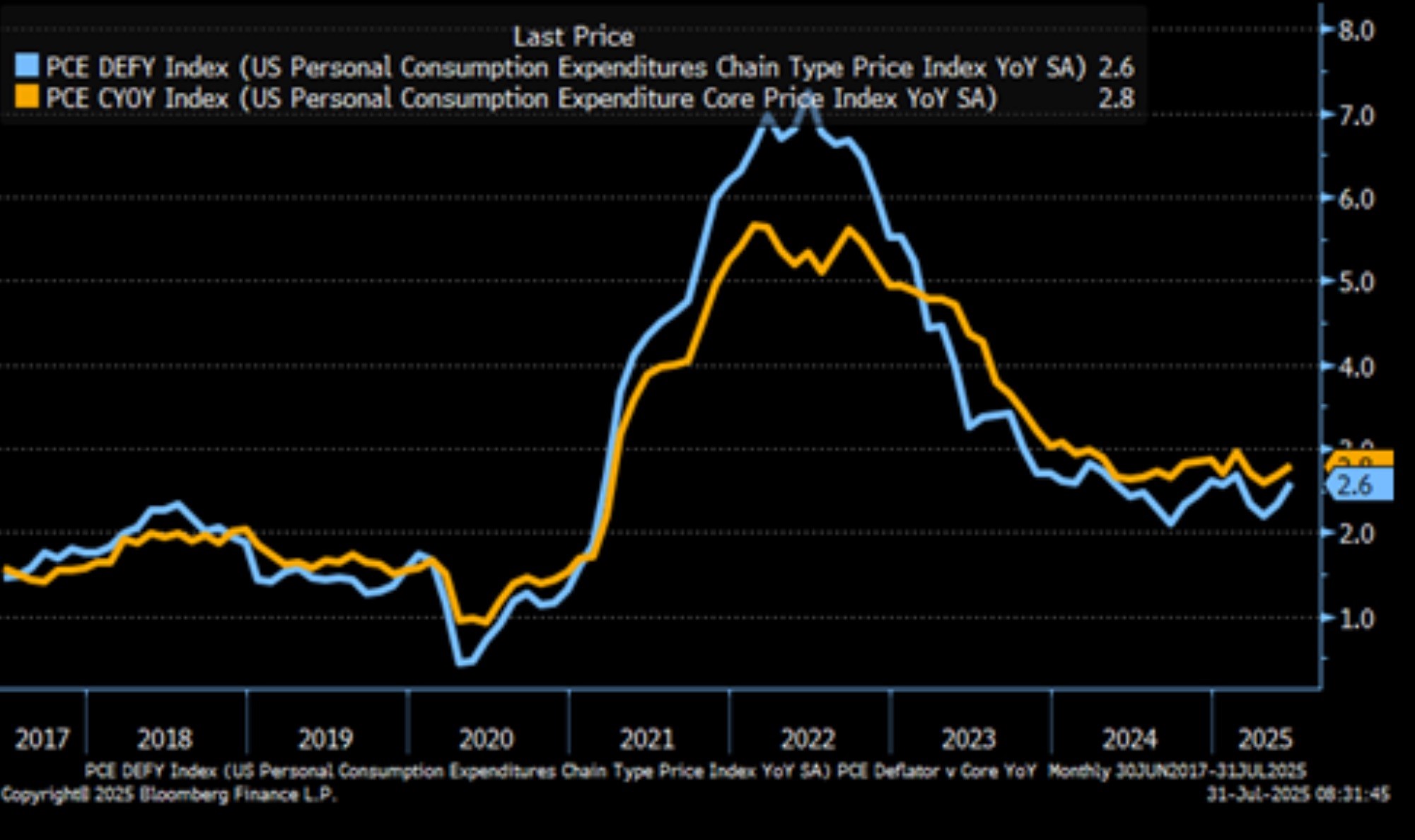

- Shifting gears, the June Personal Income and Spending Report was released yesterday with the Fed’s preferred inflation gauge which ran a bit hotter than expected, especially with prior month revisions. Core PCE rose 0.3% (0.256% unrounded) which matched estimates but above May’s 0.2% print. This is the largest monthly core PCE gain since February’s 0.476%. In addition, May was revised up to 0.213% from 0.179% and April revised up to 0.180% from 0.136%. YoY core was unchanged at 2.8% but that was after an upward revision too from 2.7% originally. In addition, goods inflation increased 0.6% YoY from 0.1% in May and reversed a deflationary trend prior to the recent tariff policy change. Service side inflation continues to run steady at 3.5% YoY.

- Personal income increased 0.3% vs. 0.2% expected while personal spending disappointed at 0.3% vs 0.4% expected and 0.0% in May. Real spending (net of inflation) inched higher at 0.1% MoM matching expectations. The slowdown in spending is particularly concerning as it was also evident in 2nd quarter GDP with Sales to Final Domestic Purchasers (which includes consumer and private corporate spending) rose only 1.2% vs. 1.9% in 1Q25. It was the lowest print since Q422. In addition, the June spending gains were concentrated in necessity items like housing and healthcare with discretionary items such as recreational activities and autos showing the largest decline in spending. This indicates consumers are becoming much more discerning about their spending.

After Sizeable Revisions, Nonfarm Payroll Growth Significantly Slows

Labor Force Participation Rate Continues to Fall to Multi-Year Low

PCE Inflation, both Overall and Core, at 0.3% MoM – Notice the Trend

PCE Inflation YoY – Starting to Creep Higher

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.