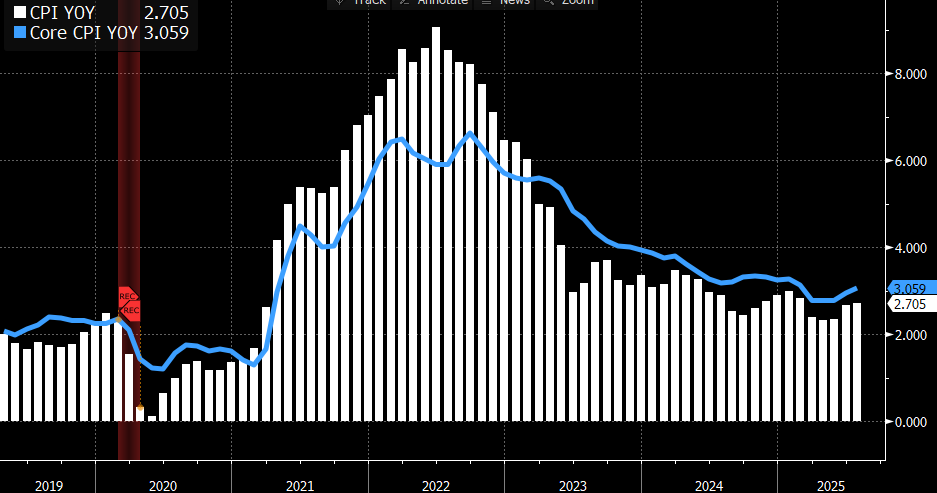

July CPI was OK, but Challenges Abound for Future Improvement

- Treasury yields are drifting lower this morning as rate cut fever takes hold and equity markets are running with that mood as well. The CPI report yesterday was greeted as greenlighting a rate cut in September with futures markets now putting decent odds (>50%) of three cuts by year-end. While we weren’t that enthusiastic about the inflation numbers, we still see two cuts by year-end, but three remains a bridge too far for us at this point. Currently, the 10yr is yielding 4.25%, down 4bps, while the 2yr is yielding 3.69%, also down 4bps on the day.

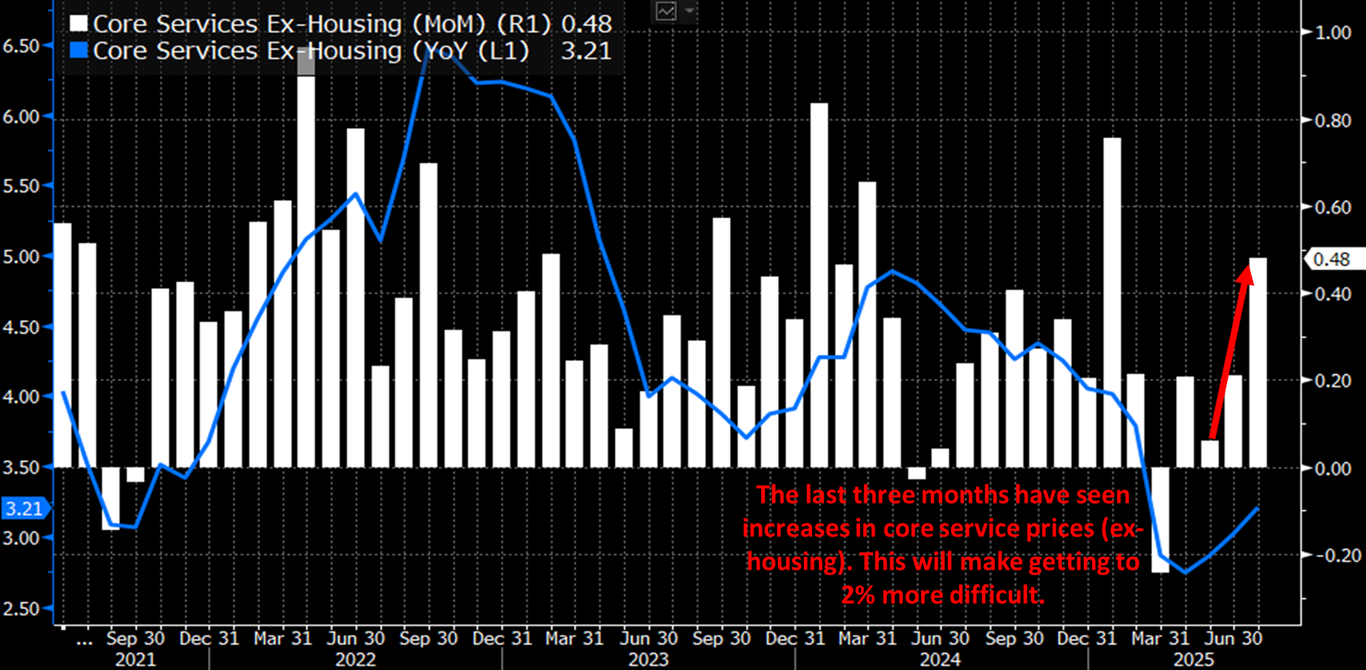

- The July CPI report was greeted as a near on-the-screws report that reportedly greases the skids for a September rate cut. While that rate cut will likely happen, we noted several items in the report that will cause some on the Fed who are not running for Chair-in-Waiting to wring their hands a bit. First, this is the third month of sequentially higher core service ex-housing prices, and the highest since January. Remember, this is the ”sticky” component of inflation that Powell was most focused on while waiting for Owner’s Equivalent Rent to roll over. While those core services were headed lower earlier in the year after that spike in January they are now on an increasingly upward slope since May (see graph below).

- Speaking of OER, it printed at 0.3% (0.28% unrounded) for the fourth month in a row. While this is back within the 0.20% – 0.30% range that prevailed pre-covid it looks like any further improvement in the largest single component of CPI is probably done. That is, don’t expect OER to bail out higher goods and service prices at this point.

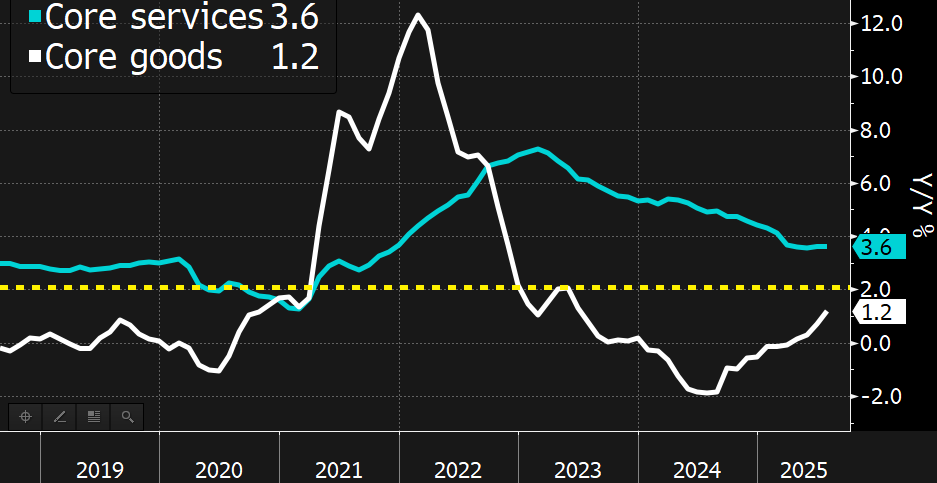

- Speaking of core goods prices, they were in positive territory for the second straight month after deflating over the last year. That deflation bottomed in mid-2024 at -2.0% YoY and in July prices are rising at 1.2% YoY (see graph below). While the latest monthly move is modest it signals that tariff costs are clearly seeping into goods prices and that process is likely to continue in the months ahead as importers and retailers grow more reluctant to absorb higher tariff costs that appear to not be going away. The consumer is likely to see higher goods prices in the months ahead.

- Looking ahead, it’s hard to see where lower prices are going to come from, what with goods prices now lifting and service prices doing the same. While a slowing in consumer demand may dent the hopes of retailers to pass through higher prices, that seems small solace to hope that stagflation may be the out for higher prices. Thus, we see 0.3% core CPI prices set to become the norm over the balance of the year and that means YoY levels in the 3% – 3.6% range.

- Thus, while the report yesterday was close enough to consensus, the July jobs report was decidedly weak enough to keep a September cut as the prohibitive favorite. We still see a second cut by year-end, but a third, which is where some are positioning, seems a stretch given some of the inflationary elements discussed above. It would take a dramatic slowing in the economy to force three cuts but with the Atlanta Fed’s GDPNow model seeing third quarter GDP at 2.5% that doesn’t seem to be in the cards at present.

- July PPI is due tomorrow with prices generally expected to increase 0.2% MoM vs. unchanged readings in June with YoY levels edging higher accordingly. That will provide most of the missing pieces for analysts to calculate the expected PCE inflation levels for July with the consensus for core PCE settling into the, wait for it, 0.3% range. We’re starting to wonder when 3.0% will become the new 2.0% inflation target, perhaps with the new Fed chair?

- Taking a break from inflation, Friday will bring us a fresh look at consumer spending with July Retail Sales. Expectations are that overall sales rose 0.6% matching June. That would be the second straight month of solid headline spending coming after May’s -0.9% drop that was a result of slowing auto sales after a pre-tariff surge earlier in the year. The Control Group-a direct feed into GDP- is seen up +0.4% vs. 0.5% in June. This would put the third quarter on track to follow a nice rebound in the second quarter. If expectations come to pass, it implies an economy that remains rather resilient despite the first quarter stumble and that too would argue against some of the more aggressive rate-cutting scenarios.

While July CPI Generally met Expectations, Further Improvement will be Challenging

Source: Bloomberg

Core Goods Prices Moving Higher While Core Services Has Stopped Trending Lower

Source: Bloomberg

Core Services Ex-Housing Was Improving until June. Are Tariffs Leaking into the Service Side Too?

Source: Bloomberg

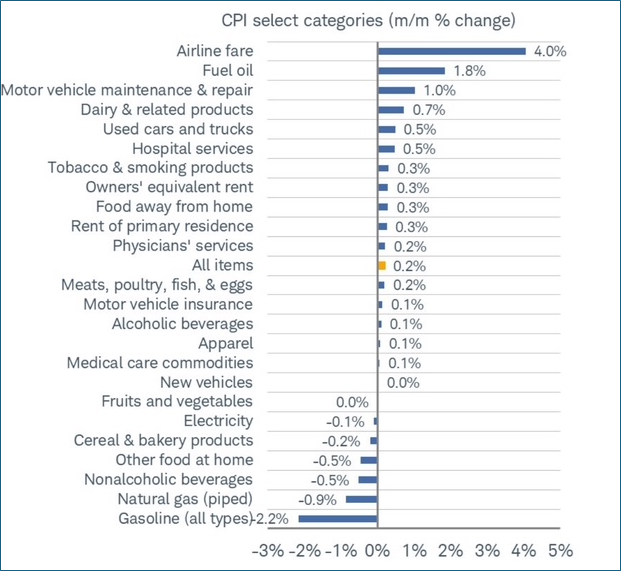

Good Month for the Airlines

Source: BLS

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.