July CPI Keeps September Rate Cut in Play

July CPI Keeps September Rate Cut in Play

- After a knee-jerk back up in yields following the CPI report, yields are dipping lower again as traders see the CPI report as not so bad after all. Frankly, CPI came as expected, but investors may have been hoping for more softness. Nevertheless, it should be good enough to keep a rate cut in September firmly on the table (more on CPI below). Currently, the 10yr note is yielding 3.83%, down 1bp on the day while the 2yr is yielding 3.95%, up 2bp on the day.

- July CPI is out and while it met expectations there weren’t any surprises to the downside that maybe the market was hoping for after the docile PPI read yesterday. Overall CPI rose 0.2%, matching expectations but above the -0.1% print from June. The YoY pace did manage to dip a tenth from 3.0% to 2.9%, besting the 3.0% expectation. It’s the lowest YoY rate since March 2021.

- Core CPI rose 0.2% (0.17% unrounded) which matched expectations, but the unrounded number makes it a “low” 0.2% which allowed the YoY pace to decline a tenth from 3.3% to 3.2%, matching expectations. It’s the lowest YoY rate since May 2021. The six- month annualized rate fell to 2.8%, the lowest since March 2021. Declines in airfares (-1.6%), used cars (-2.3%) and hospital services (-1.1%) led the deflation group, while car insurance (+1.2%) and fuel (+0.9) drove the monthly increases.

- Owner’s Equivalent Rent (OER) increased 0.4% (0.36% unrounded) after dipping to 0.3% (0.26% unrounded) in June. The long-awaited trend for OER to slip back to pre-pandemic levels (0.2% – 0.3%) remains elusive but it seems to be settling into a 0.3% to 0.4% level depending on how the rounding works out. Also, after slipping into negative territory the prior two months, core services ex-housing increased 0.21% in July, certainly not steamy, and expecting continuing deflation in this category is asking too much, so on net not a bad story here (see graphs below).

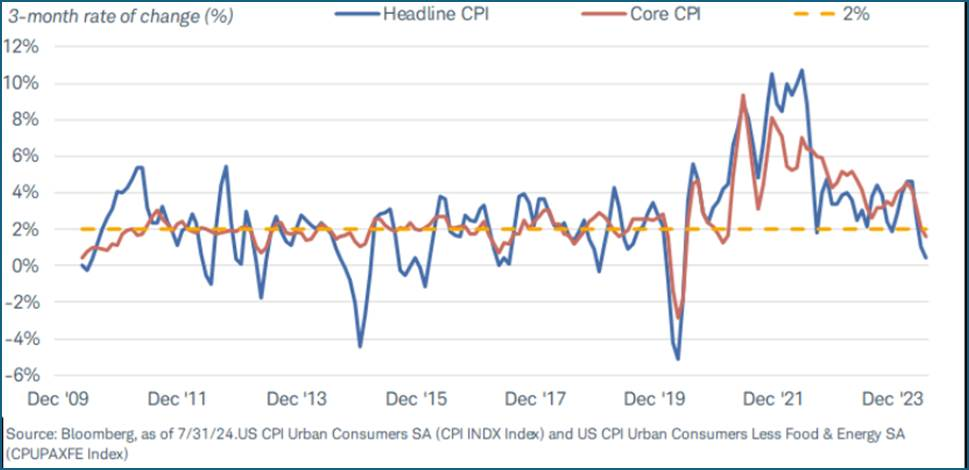

- Overall, this report came mostly as expected and should not impede a rate cut in September. Sadly, we can probably expect Fed speak to continue the refrain of more work to be done. That said, the Fed knows the second half of 2024 was going to be tough to see dramatic YoY improvement. Most second-half 2023 monthly prints are of the 0.2% variety, so when you replace them with the same it’s hard to see major YoY moves lower. That’s why the unrounded numbers get so much attention. Sort of like Olympic scoring where those second and third decimal places can be the difference between gold, silver, or bronze. On a three-month basis annualized, however, both overall and core CPI are under 2% for the first time since 2019. If the Fed is looking for a trend towards the 2% target they may want to look at this graph.

- With CPI and PPI in hand, analysts will be able to provide decent estimates for the end-of-month PCE inflation series. Recall, June core PCE printed 0.2% MoM which kept the YoY pace at 2.6%. It started the year at 2.9% so improvement has been grudging. Early expectations for core PCE are for another 0.2% print. Again, it will come down to those unrounded numbers to determine if that can generate another tenth drop in the YoY rate of 2.6%, but we have a 0.12% rolling off so realistically it looks like core PCE will be stuck at 2.6% for another month.

- Now that we have the latest CPI numbers attention shifts to the all-important consumer and their spending habits in the form of July Retail Sales report tomorrow. As we mentioned on Monday, retail sales are expected to come in below the outsized gains in June (especially ex-auto and Control Group), but still in positive territory which does play into the story of a consumer exercising more caution with discretionary spending. Jobless claims tomorrow will provide another weekly glimpse into the labor market with a similar print from last week (235k expected vs. 233k actual). That steady level of claims would indicate the labor market remains decent and that would be another vote in favor of a 25bp rate cut vs. 50bp.

3-Month Headline and Core CPI Annualized – First Time Under 2% Since 2019

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.