Jobs Report and Personnel Fallout to Continue this Week

- Treasury yields continue to drift lower in the wake of the weak jobs report and the personnel changes that are coming. The data flow slows considerably this week opening centerstage for DC theatrics to keep markets focused on work instead of the waning days of summer. As mentioned, economic releases will be few, but following the FOMC meeting Fed members will be able to voice their thoughts on the latest jobs numbers, not to mention the slightly hotter PCE figures. Currently, the 10yr Treasury is yielding 4.20%, down 2bps on the day, while the 2yr note yields 3.67%, down 4bps in early trading.

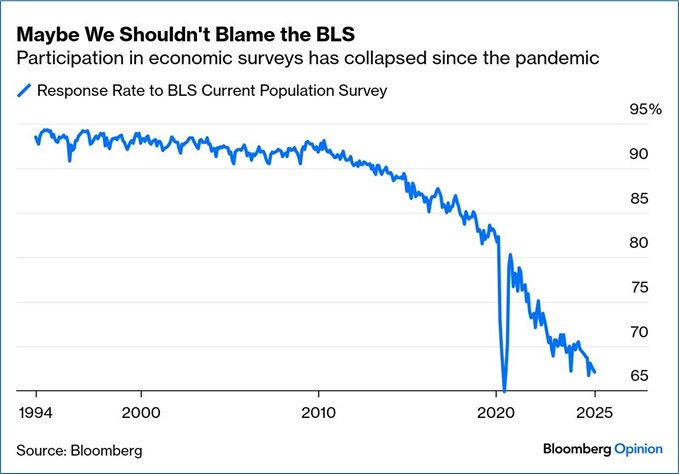

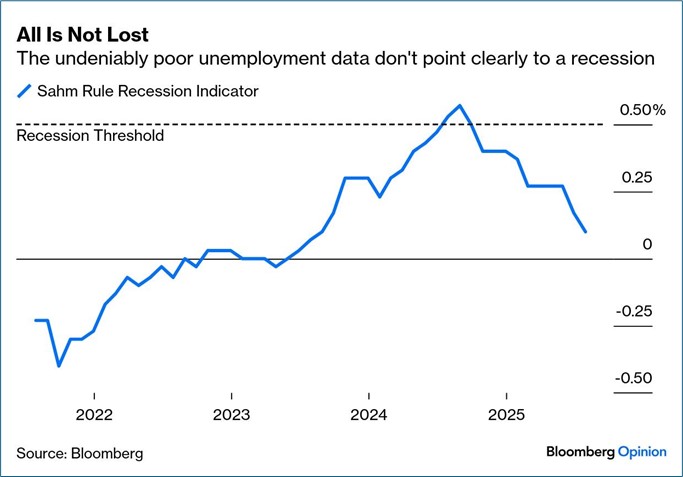

- We can expect some continuing fallout from Friday’s weak employment report and Trump’s subsequent reaction in demanding the firing of the head of BLS, a Biden appointee. While the jobs report was decidedly weak, the firing of BLS officials could send a chill throughout markets. If investors start to doubt the veracity of data being presented due to political reasons it will create more uncertainty and volatility to a market that’s only recently started to look past the tariff issue.

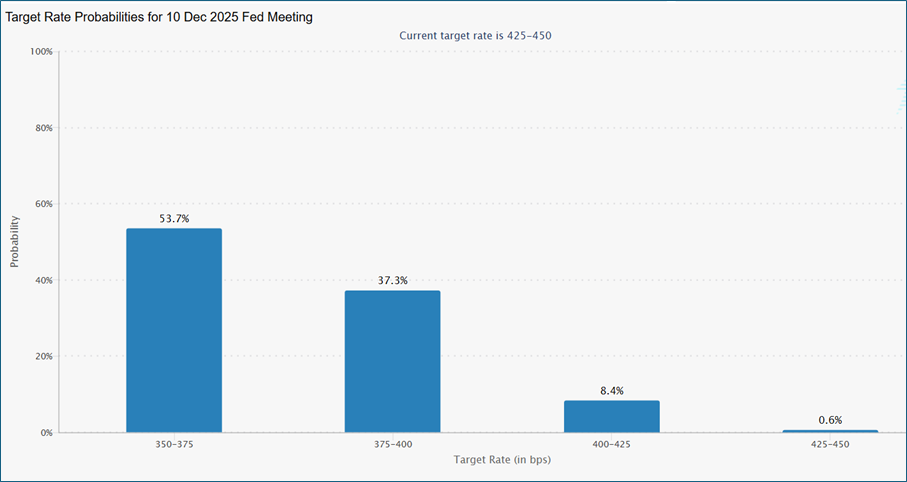

- In other government related news, Fed Governor Adriana Kugler has announced her resignation effective August 8th in order to return to her previous career as a professor at Georgetown University. She was appointed by then President Biden in 2022 to fill a vacant term and leaves slightly short of the 2026 expiration. President Trump will now have an opportunity to add a second governor to the Federal Reserve Board, assuming Chair Powell retires following the end of his term as Chair in May next year (his governor’s term doesn’t expire until January 2028). While this is an issue that won’t develop overnight it does point to a Board that could be quite different by mid-2026 than it looks now. Trump said a decision on a new Fed governor will come this week, which could very well be his pick for the new chair in waiting. That’s one reason futures market now sees better than 50% odds of 75bps in cuts by year-end (see graph below).

- While last week was full of first-tier data, this week that information flow slows, which is probably a good thing given the scope of new information received last week, not to mention the personnel machinations.

- Part of that information came after the jobs report which sucked all the oxygen out of the markets before the weekend. First, the August ISM Manufacturing Survey disappointed and added to the slowing economy theme. The headline index declined from 49.0 to 48.0 which was below the 49.5 estimate. In addition, the employment sub-index declined from 45.0 to 43.4, well short of the 46.8 expectation. The New Orders metric came in at 47.1 vs. 46.4 in June but short of the 48.6 forecast. Finally, in one bit of slightly better news, the Prices Paid index retreated from 69.7 to 64.8 and well below the 70.0 expectation. So, pricing pressure remains high but eased a bit from the prior month. In a look at the comments, they were almost exclusively bemoaning the uncertainty created by the tariff issue and repeated changes in policy which makes planning and budgeting frustratingly difficult. Unfortunately, that issue doesn’t look like it will be going away anytime soon.

- Also released Friday after the jobs report was the final University of Michigan Sentiment Survey for July. In it, consumer sentiment was nearly unchanged at 61.7 vs. 61.8 while inflation expectations ticked a bit lower from the preliminary estimates. The 1 Year inflation expectation was nearly unchanged at 4.5% vs. 4.4% in the preliminary report while longer-term inflation expectations dipped from 3.6% to 3.4%. At least the Fed can say as they sit on the policy rate so far in 2025 that inflation expectations remain “well anchored.”

- The biggest reports this week will be the ISM Services Index for July and the first look at 2nd quarter Productivity, both due tomorrow. The Services Index is expected to increase slightly from 50.8 to 51.5 while productivity is also expected to improve from the 1st quarter’s disappointing -1.5% dip to 2.5% for the second quarter. Improving productivity lowers unit labor costs which will limit inflationary pressures, and anything that improves inflation will be welcome news.

Futures Market Now Sees Better than 50% Odds of 75bps in Cuts by Year-End

Source: CME

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.