Job Numbers and Fed Speak on Tap

- Treasuries open the week a touch higher in yield even as equities look to open modestly lower. With the calendar turning to June we’ll get the usual onslaught of updated economic reports leading up to the Friday employment report and in between Fed speak will provide some headlines with Chairman Powell on tap this afternoon. Currently, the 10yr is yielding 4.44%, up 2bps on the day, while the 2yr is yielding 3.93%, up 1bp in early trading.

- The first week of the month is here, and with it a bevy of updates to economic activity in May, highlighted by the Nonfarm Payroll Report on Friday. That one is expected to see payrolls increase by 130 thousand with the unemployment rate sticking at 4.2%. While that’s down from the 200 thousand level job gains, it would still be good enough to keep the Fed in their patient pause approach.

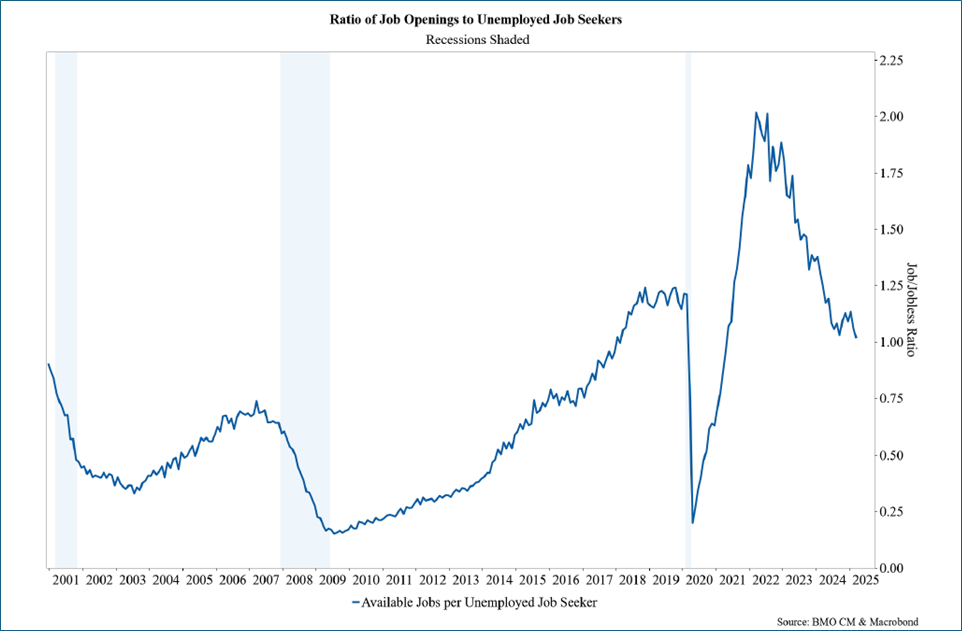

- The Job Openings and Labor Turnover Survey tomorrow is also expected to reflect continued cooling in labor market conditions but not raise alarm bells either. Job openings are expected to dip from 7.19 million in March to 7.08 million in April. That would keep the job openings to jobless ratio near the 1.02 level which is a far cry from the labor market tightness in 2022 when the ratio peaked at 2 job openings for every unemployed person.

- This morning the ISM Manufacturing Survey will be released with the consensus estimate expected to edge up from 48.7 to 49.5. That would indicate some improvement in the sector but still below the 50 dividing line of expanding vs. contracting. The other metrics of employment, prices paid, and new orders will provide a picture of overall activity in the sector along with any price pressures emerging from the tariff bruhaha.

- It’s not all about numbers this week as we’ll also get some Fed Speak with Chair Powell providing the opening remarks at the Fed’s International Finance Divisions annual conference. It will be a scripted address with no Q&A, but we suspect the message will be one of continued patience in the face of uncertainty and expected tariff pricing pressure.

- Speaking of tariff pricing pressure, Fed Governor Christopher Waller was in Korea overnight and provided his latest view on the path to rate cuts this year. The major points from his address centered around the potential inflation impact of tariffs being transitory (he admitted playing with fire by using that term), and the resulting effect on monetary policy. He did make pains to say that he is taking more credence in market-based measures of inflation rather than the various consumer surveys that have revealed much higher expectations vs. what the market-based measures are indicating. He pointed out that market-based measures are from professionals with “skin in the game” as providing a more accurate view.

- Waller went on to point out that some of the sentiment surveys most recently were indicating 1yr inflation expectations near 7%, which is at odds with the market-based measures like TIPS rates and the general level of Treasury interest rates. While those rates have ticked higher of late, the moves are far below what the consumer survey inflation expectations would imply. He also stressed the point that if consumers really did believe inflation was about to ramp higher that the Quits Rate (from the JOLTS report) would move higher as workers look for higher paying jobs. Also, workers would ask for higher wage gains to keep pace with the expected inflation surge but that is not happening. In fact, given the dropping job openings level and the subdued Quits Rate, workers are more concerned with keeping their jobs rather than asking for a 7% wage bump. Absent a surge in wages, Waller sees little chance of those inflation expectations becoming reality. Thus, he still sees a path to rate cuts later this year as long as tariff levels settle in the 10% to 20% range and not the higher levels initially introduced.

- Finally, another reminder that I sat down with Joe Keating from our Wealth Department last week for a chat on the economy. With all the crosscurrents impacting the economy it’s a must listen. Follow the link here to listen to our 30-minute conversation.

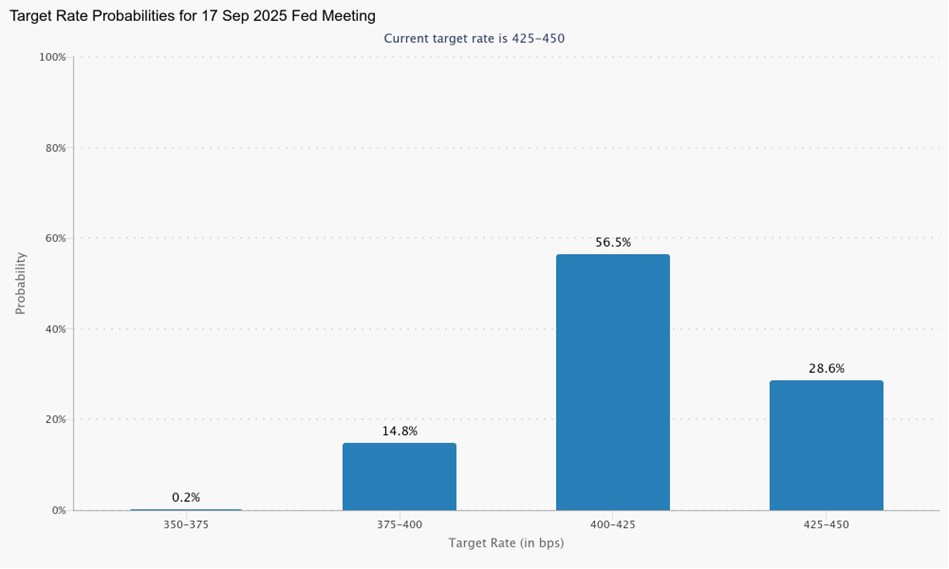

Futures Still See September as First Rate Cut

Job Openings to Unemployed Continues to Drift Lower Indicating a Cooling Labor Market

ISM Manufacturing for May Continued to Drift Lower Missing Expected Improvement

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.