January Retail Sales Show Consumer Paused Their Spending Ways

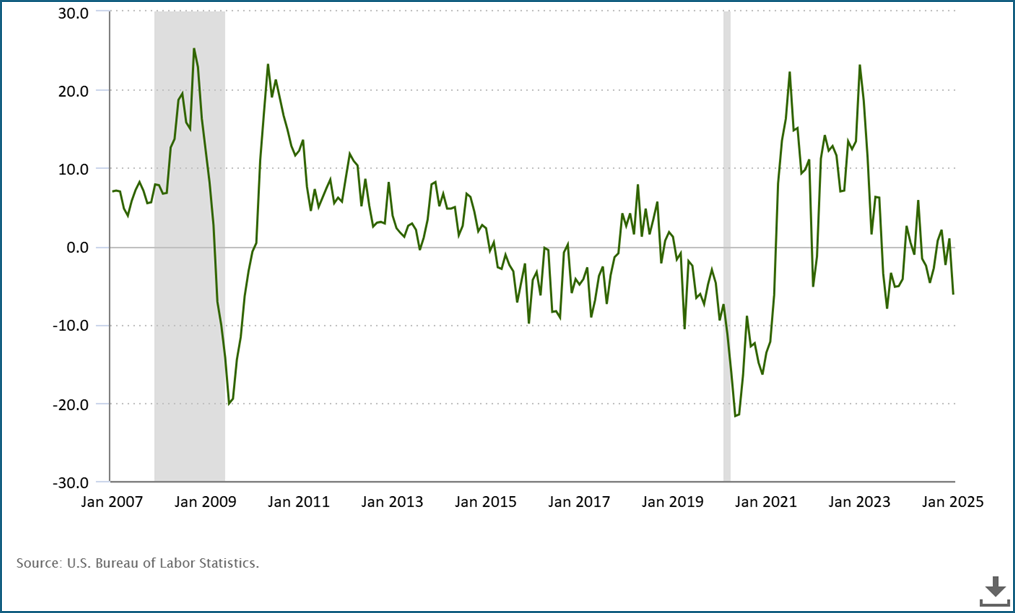

- Treasury yields are lower after disappointing retail sales for January and another inflation input that should lower core PCE estimates. Retail sales posted the largest monthly decrease in a year, and it was broad-based in nature. The weather will be used as a partial excuse, but even the internet sales category, assumed to be safe from the weather, saw a monthly decline. Meanwhile, this morning’s import pricing report saw foreign air fares dropped -12.8%, the largest decline since August 2023, which will feed into PCE later this month. Currently, the 10yr Treasury is yielding 4.48%, down 5bps on the day, while the 2yr is yielding 4.26%, down 5bps on the day.

- Yesterday’s PPI report for January was similar to CPI in that it surprised to the upside vs. expectations, but it came less than the upwardly revised December numbers and the components that feed into PCE were mostly negative which should bode well for a more friendly PCE reading when it comes on February 28th. Those two factors led Treasuries to rally despite the ugly headline reading.

- One issue, however, sticks out regarding PPI that may spell more headwinds for future improvement in CPI. The goods-side of the report led price increases at 0.6% vs. 0.3% in services. That’s the third straight month of outsized advances. One counter to that is the big movers in this category were food and energy, often volatile components that can reverse quickly. However, recall not that long ago wholesale goods prices were consistently declining, or at least dis-inflating, which created a tailwind for lower retail prices over the last couple years. With wholesale goods prices not moving lower that will make improvement at the retail level that much more challenging.

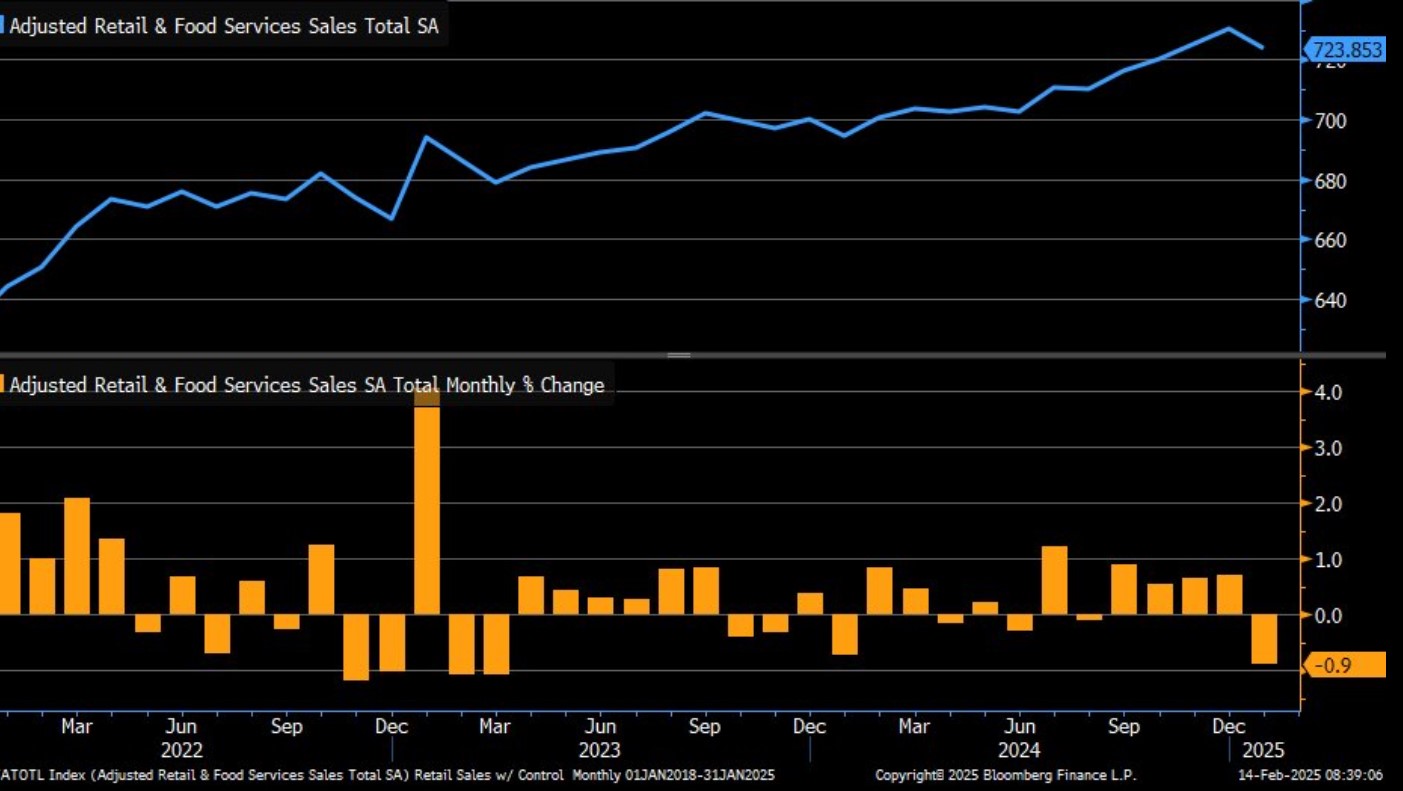

- At least for the US economy, as the consumer goes so goes the economy, and today we received our first look at the consumer in 2025 with the January Retail Sales report and it wasn’t good. Overall sales decreased -0.9%, the biggest drop in a year and much more than the expected -0.2% dip. Taking a bit of the sting off that is December’s results were upwardly revised to 0.7% vs. 0.4% originally reported. Sales ex-autos and gas declined -0.5% vs. an expected 0.3% gain and December’s initial result of 0.3% was revised higher to 0.5%. The Control Group – which feeds into GDP- disappointed at -0.8%, the lowest since March 2023, well below the 0.3% expectation and off from the solid 0.8% in December.

- So, the consumer clearly looks to have taken a breather in January and the question will quickly become was it a single month pause, or the start of something lengthier? The consumer certainly had a lot to contend with during the month and it seems some of those declining confidence numbers signaled a more spending-cautious consumer. Just like in the inflation series the declines were broad-based.10 of the 13 categories saw declines, even the non-store retailer category (think internet sales), which one would assume is immune to the adverse weather excuse. Expect first quarter GDP estimates to get knocked back off this report. Currently, the Atlanta Fed GPPNow model sits at 2.9%. How low will it go after this?

- One caveat that we always throw out with this report is that it’s mostly goods-based, and we know the economy has been driven more by the services-side so that softens the blow a bit. The more comprehensive spending numbers will come on February 28 with the Personal Income and Spending report which includes more service-side spending. In any event, service-side spending would have to really surge to offset this weakness and that’s hard to see at the moment.

- The final inflation report of the week is out and import prices rose 0.3%, just under the 0.4% expected while export prices surged 1.3% vs. 0.3% expected. That’s the greatest increase since May 2022. Imports ex-petroleum rose 0.1% for the third straight month. The YoY numbers were a bit more mixed thanks to the strength in the dollar. Imports YoY increased 1.9% vs. 2.2% in December while exports YoY rose 2.7% vs. 1.8% in December. One item that is included in the month-end PCE inflation series is the international airfare figure which rounds out assumptions for the net foreign travel category in PCE. It fell -12.8%, the largest monthly decrease since August 2023 which should put a bit more downward pressure on the estimates for core PCE. We discuss those numbers below.

- With the inflation information in hand, estimates for the Fed’s preferred inflation gauge, core PCE, are estimated at 0.27% or a “low” 0.3%. That would be a friendly number to the market and the Fed, but the improvement is likely to be grudging, at least early in the year as seasonality usually tends towards hotter inflation prints in the first quarter. The YoY rate, however, should see a nice downward move from 2.8% to 2.6% as a 0.50% print from last year, the highest since August 2022, rolls off. After that, however, base effects become challenging again with a 0.24%, 0.34% and 0.26% rolling off. In fact, monthly prints after January that are 0.2% or higher will not generate any downward move in the YoY rate for most of this year. So, is the Fed really prepared to engage in hand-to-hand combat for the last piece of Inflation Hill from 2.6% to 2.0%?

Retail Sales Slip in January – A One-Month Pause or Something More?

Source: Bloomberg

January PCE Estimates – After PPI but Before Import Price Update

International Airfares YoY Percent Change – Should Help Lower Core PCE Estimate

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.