January PCE Inflation Cooler Than CPI While Spending Slows Too

- Treasury yields are moving lower on a Personal Income and Spending Report for January that noted softer spending and better-behaved inflation vs. the CPI report. That and uncertainty surrounding tariffs and economic growth are making for fertile trading for Treasuries as we await the weekend and whatever headlines may await us there. Currently, the 10yr Treasury is yielding 4.25%, down 4bps on the day, while the 2yr is yielding 4.04%, also down 4dbps on the day.

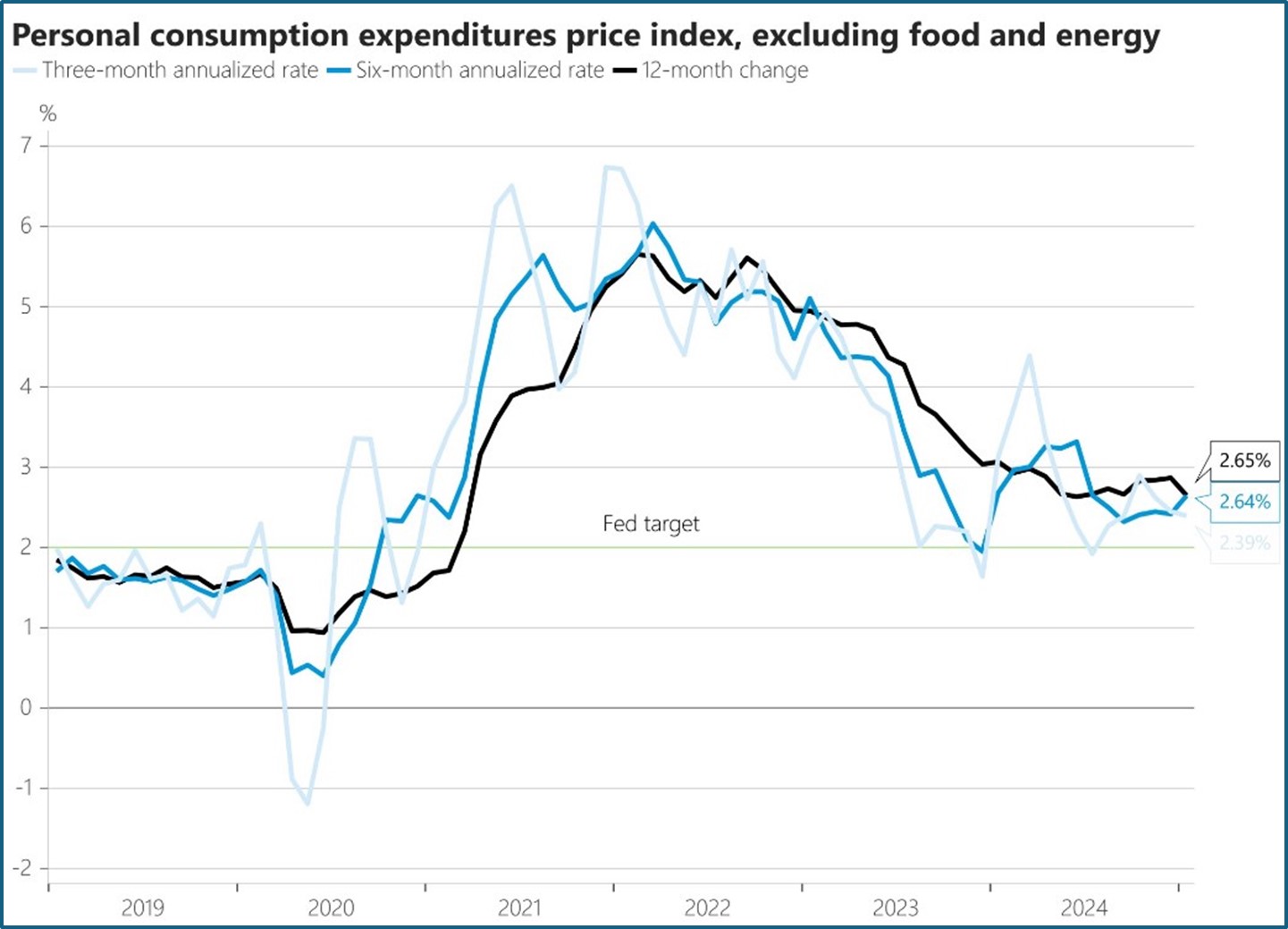

- Today we received the Fed’s preferred inflation gauge, PCE, in the Personal Income and Spending report for January. Overall PCE was up 0.3% in January (0.33% unrounded), matching expectations and the December result. That sent the YoY rate from 2.6% to 2.5%. Core PCE increased from 0.2% in December to 0.3% (0.28% unrounded), as expected, while the YoY rate dipped from 2.9% to 2.6% as an ugly 0.5% monthly print from last January rolled off the calculations. The so-called super core (core services ex-housing) increased 0.22% which is Fed friendly. Recall, the CPI version had this at a much steamier 0.71% (a lower shelter weighting in PCE is the primary difference). So, while the increase in core inflation was expected, it wasn’t as steamy as CPI, but the Fed may be faced with a stubborn inflation picture while economic growth becomes an increasing concern. If first quarter inflation runs hot like last year, the Fed will be squirming a bit while watching the labor market hoping the assumed strength remains while waiting on cooler seasonal inflation numbers in the spring and summer.

- The question is does the Fed have the luxury of waiting with DOGE wildly swinging the job hatchet in D.C., and the constant stream of tariff talk negatively impacting consumer confidence along the way? We tend to think the uncertainty of near daily tariff threats and job cut announcements will cause corporate planners to pause large capex plans and thus, growth may be more at risk over the coming months forcing the Fed’s hand perhaps sooner than they would otherwise like.

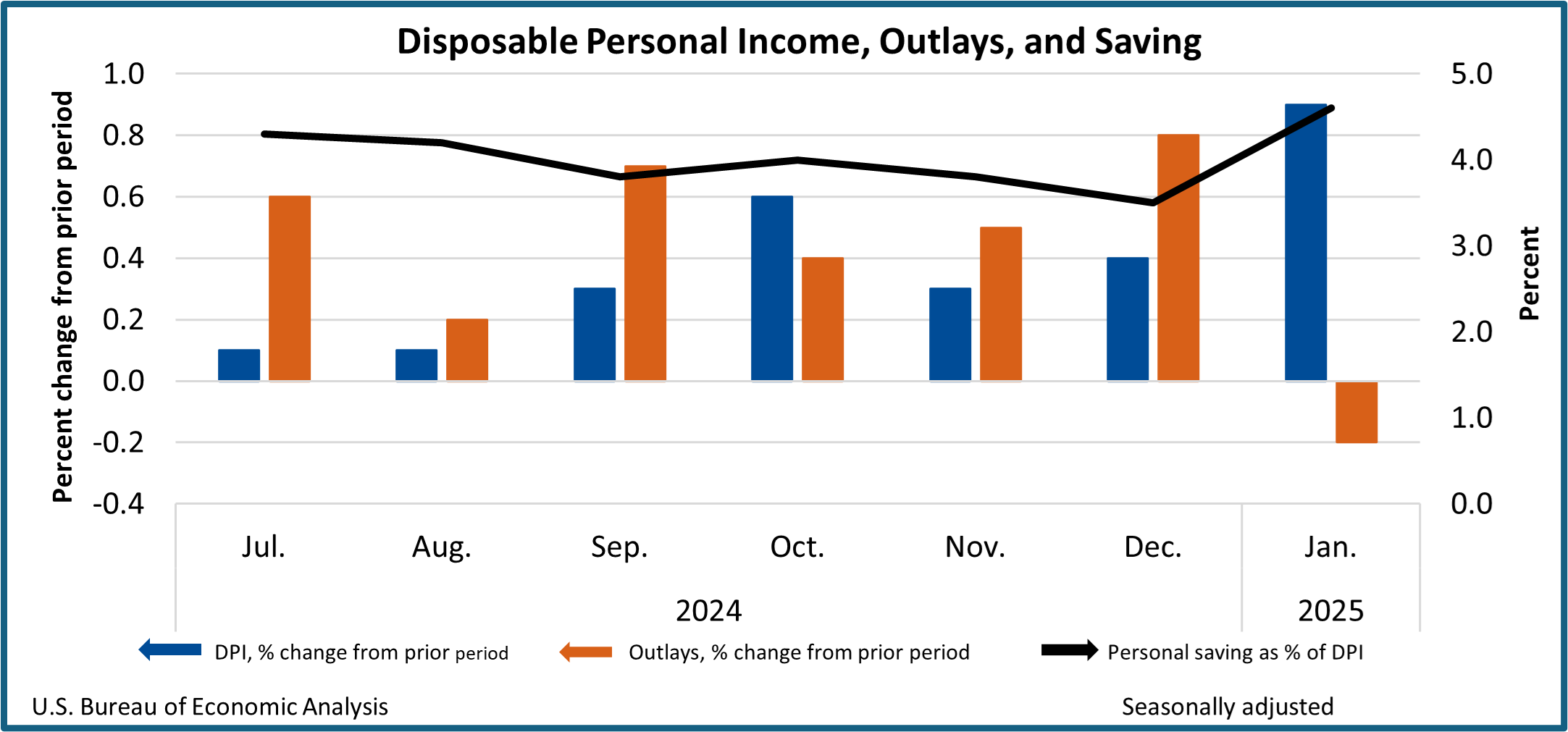

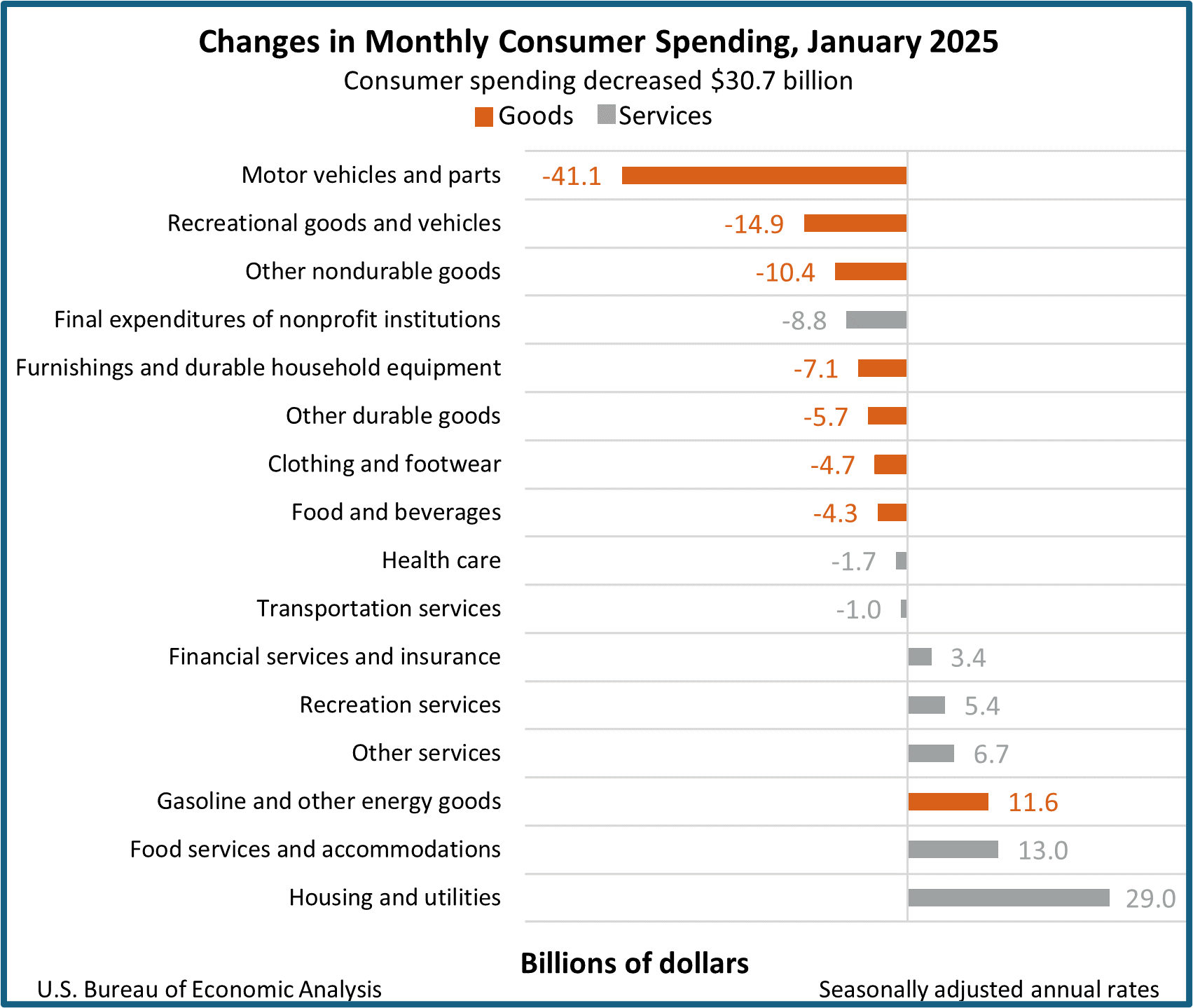

- Back to today’s PCE report, it also found personal income rose 0.9%, much higher than the 0.4% expectation, and more than twice December’s 0.4% print. It’s the highest income gain in a year. It was driven mostly by one-off items like realized stock gains, dividend income, SSA COLA adjustment, and increased farm income. Meanwhile, personal spending decreased -0.2% vs. 0.7% in December, short of the 0.2% expected and the smallest spending since Feb. 2021. Real spending, adjusted for inflation, fell -0.5% vs. -0.1% expected and well below the 0.4% real spending in December. It’s the softest real spending since Feb. 2021.

- It should be noted there was a one-time settlement made by a “foreign pharmaceutical firm” to US households of $26.4 billion that in the math reduced spending by that amount. Zeroing that out, spending declined by -0.12%, not quite as ugly as the -0.2% reported figure, but still weak. The soft spending confirms the weakness seen in last week’s Retail Sales Report and is even more concerning as today’s numbers are more comprehensive, capturing more service-side spending. It will add to concerns the consumer is becoming more discerning regarding their spending habits. While one month doesn’t establish a trend, when you combine it with flagging confidence and a softer services side it will give the Fed some indigestion over whether they have the time to wait on inflation to dip closer to 2.0%.

- Speaking of GDP, the second estimate of fourth quarter GDP was unchanged at 2.3%, as expected. It should be noted the above 2% result was largely the result of the consumer so any softening will have analysts marking down their first quarter GDP numbers. Currently, the Atlanta Fed’s GDPNow model is at 2.3% but it will be updated later this morning for the first time in a week. We suspect it will be revised lower; the question is how low?

- A softening labor market is one of the prerequisites for a possible June rate cut, and the latest weekly jobless claims report did finally show an uptick in layoffs. Weekly claims increased from 220 thousand to 242 thousand, the highest since October 2024. It brings the 4-week moving average up to 224 thousand, an increase of 8 thousand from the week before. Meanwhile, continuing claims fell from 1.867 million to 1.862 million. Federal workers are grouped in a separate insurance program and saw claims increase to 614 vs. 337 a year ago, so no big upsurge yet. In summary, the report isn’t flashing yellow yet, but the 22 thousand increase in weekly claims definitely warrants continued scrutiny.

- Finally, the preliminary read on durable goods orders for January was a mixed bag. New orders increased $8.7 billion or 3.1% and followed a 1.8% December decrease. Excluding transportation, however, new orders were virtually unchanged. Capital goods orders ex-defense and air (a proxy for business investment) were up a solid 0.8%, but shipments of those same goods were off -0.3% vs. 0.5% in December.

Core YoY Rate Drops to 2.6% from 2.9%, as Expected Source: BEA

Source: BEA

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.