January Jobs Report – Annual Benchmark Revisions Make for a Cloudy View

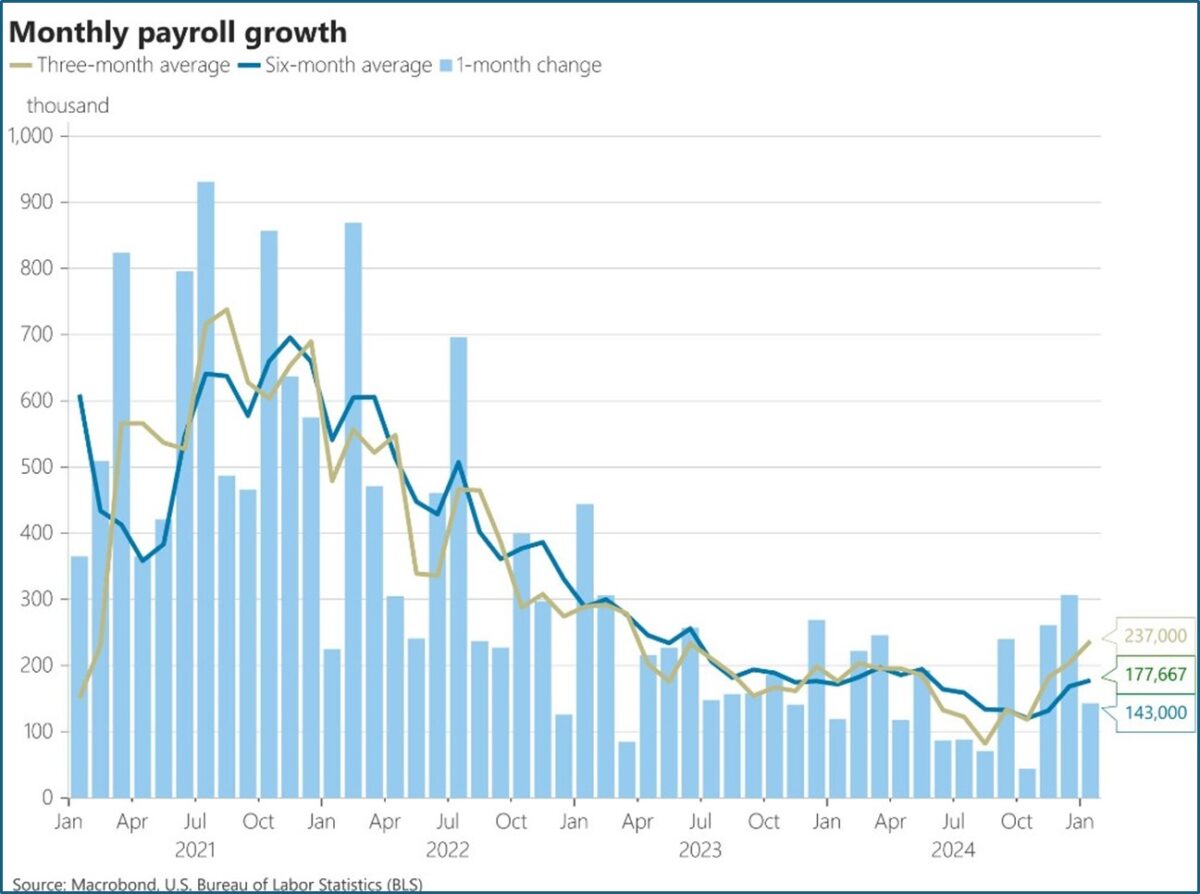

- January nonfarm payrolls rose 143 thousand, missing the 175 thousand expectation and 307 thousand in December (revised up from an initial 256 thousand). November was revised up by 49 thousand jobs bringing the two-month revision to 100 thousand. Private sector job growth was modest at 111 thousand which was off the 273 thousand in December and behind ADP’s 183 thousand reported earlier this week. It needs to be noted that numerous benchmark revisions for 2024 are hitting in January and that will cloud some of the results from today’s report.

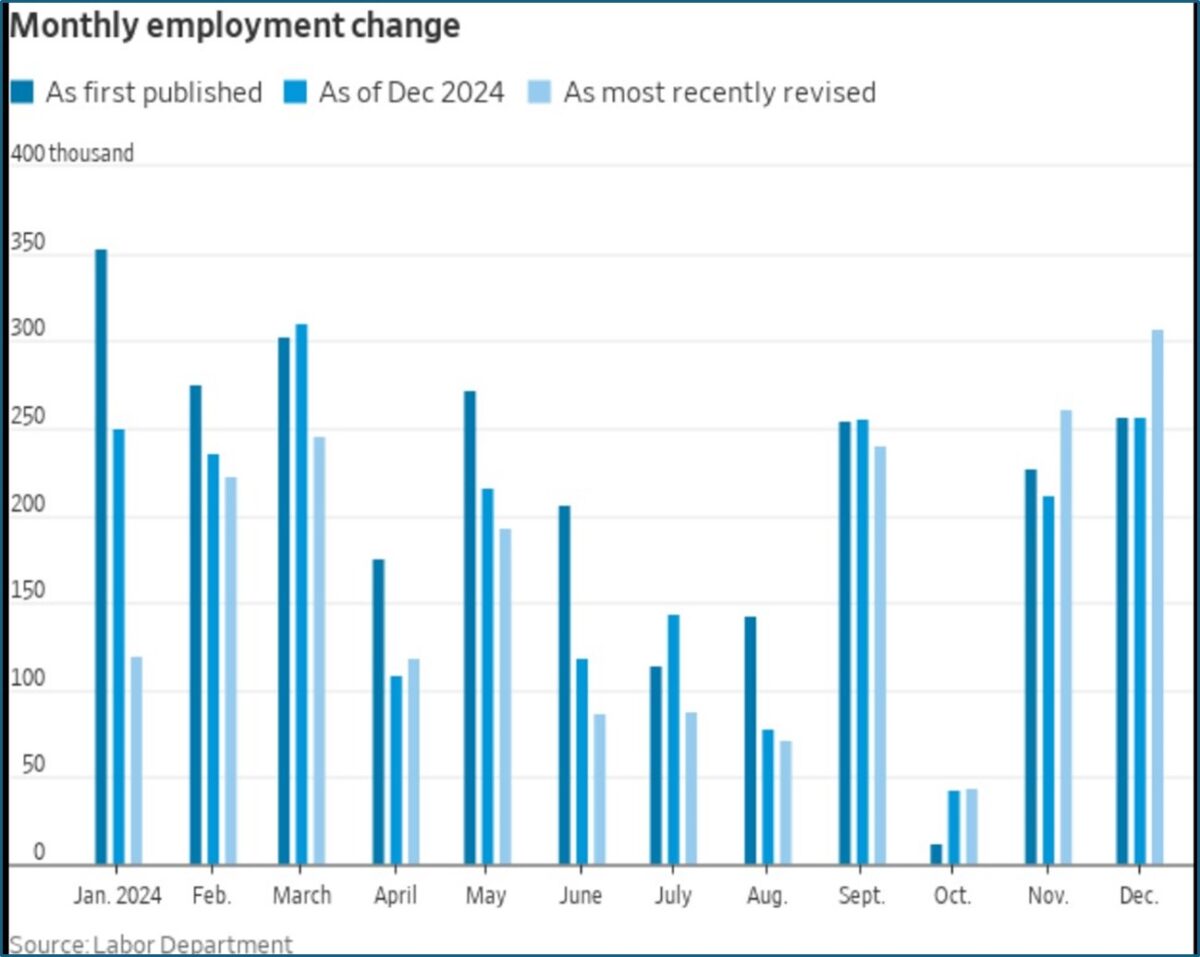

- The Establishment Survey (which reports the headline job number and wage numbers) was revised downward from two sources: (1) the birth-death model overstating business creation along with (2) updated state unemployment records that in total resulted in a downward adjustment of job gains of 610 thousand for 2024. Those adjustments are spread pro-rata across the prior twelve months. Meanwhile, the Census Bureau adjusted upward 2024 population totals by 2.9 million people. However, instead of spreading that adjustment across the affected months, it’s wholly reflected in January’s Household Survey numbers, which obviously leads to some eye-popping results. Going forward, only the birth-death model will impact 2025 as far as the original release is concerned. It’s expected to be adjusted downward given the 2024 overstatement. For instance, for all of 2024 the model estimated 1.2 million jobs created, or about 100 thousand a month. It’s estimated that for 2025, the model will be in the 900 thousand range, or 75 thousand per month. Confused yet?

- The Household Survey, which is smaller in size than the Establishment Survey, and then extrapolated across population totals, generates the unemployment rate, labor force participation rate, etc.. After accounting for the annual adjustment, the survey reported 234 thousand new jobs while also reporting a 142 decrease in unemployed persons. Total unemployed, however, increased from 6.149 million a year ago to 6.849 million now. The survey also reported a 91 thousand increase in the labor force, after accounting for the annual adjustment. With the simultaneous downward move in unemployed and increase in the labor force the unemployment rate decreased from 4.1% (4.086% unrounded) to 4.0% (4.011% unrounded), beating the 4.1% expectation.

- Job gains were strongest in healthcare/social assistance, a perennially strong category, (66k), retail trade (34k), and government (32k). One has to ask with the new administration how long will government continue to add jobs? Job losses were concentrated in the temporary help category (-12k), and car and parts manufacturing (-10k). It’s easy to see the strength in service sector hiring vs. the goods side of the economy and that is what we’ve been seeing across a host of reports with services really carrying the economy. There was some slippage in the ISM Services Index for January, while ISM Manufacturing, for the first time in two years, moved back to expansionary territory. So far, however, that’s not reflected in the job gains but expect some shifting to occur in the months ahead.

- Average Hourly Earnings rose 0.5% (0.476% unrounded) MoM, beating the 0.3% expectation, and the December gain of 0.3% (0.253% unrounded). The year-over-year pace rose two tenths to 4.1%, beating the 3.8% expectation and December’s 3.9%. Average weekly hours dipped a tenth for a second straight month to 34.1 hours, missing the 34.3 expectation. A tenth of an hour may not sound like much but with 163 million full-time workers each tenth of an hour is just over $1 billion in lost wages. That dip in hours worked offsets some of the pick-up in MoM earnings putting it more in line with the 0.3% level that had been the average of late.

- With the increase in the labor force after the population adjustment, the Labor Force Participation Rate increased a tenth to 62.6%, beating the 62.5%expectation which is where it has been for much of the last year. For instance, it was 62.5% a year ago, so the upward population adjustment finally bumped it out of that level.

- The January’s jobs report was expected to soften after the stronger-than-expected December report and that’s what happened. However, with the one-time adjustments in both surveys it creates plenty of noise around today’s report. The upward move in wages offsets some of the headline weakness but the dip in weekly hours takes some of the shine off that as well. Taking a step back, if we’re going to continue to see sizeable downward revisions to the Establishment Survey, along with big annual adjustments to the Household Survey, it takes away plenty of the signal value from the initial release of these reports. Overall, no imminent distress was noted, and that will keep the Fed on pause for the foreseeable future. In addition, other labor-related reports show little, if any, weakening. That said, the downward revisions for 2024 make clear the labor market strength the Fed thought they had to work with is not quite that much and that will make them a little more sensitive to future signs of weakening if and when that happens.

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.