January Jobs Much Stronger Than Expected, but Questions Remain

January Jobs Report Much Stronger Than Expected

- Nonfarm payroll gains came in much better than expected with 353 thousand new jobs vs. 185 thousand expected and 333 thousand in December (revised higher from an initial 216 thousand). Private sector jobs increased by 317 thousand vs. 165 thousand expected and 278 thousand in December (revised higher from an initial 164 thousand). Revisions have been trending to the downside in 2023 but that reversed in January with 126 thousand jobs added from the prior two months. Head-scratching results to say the least.

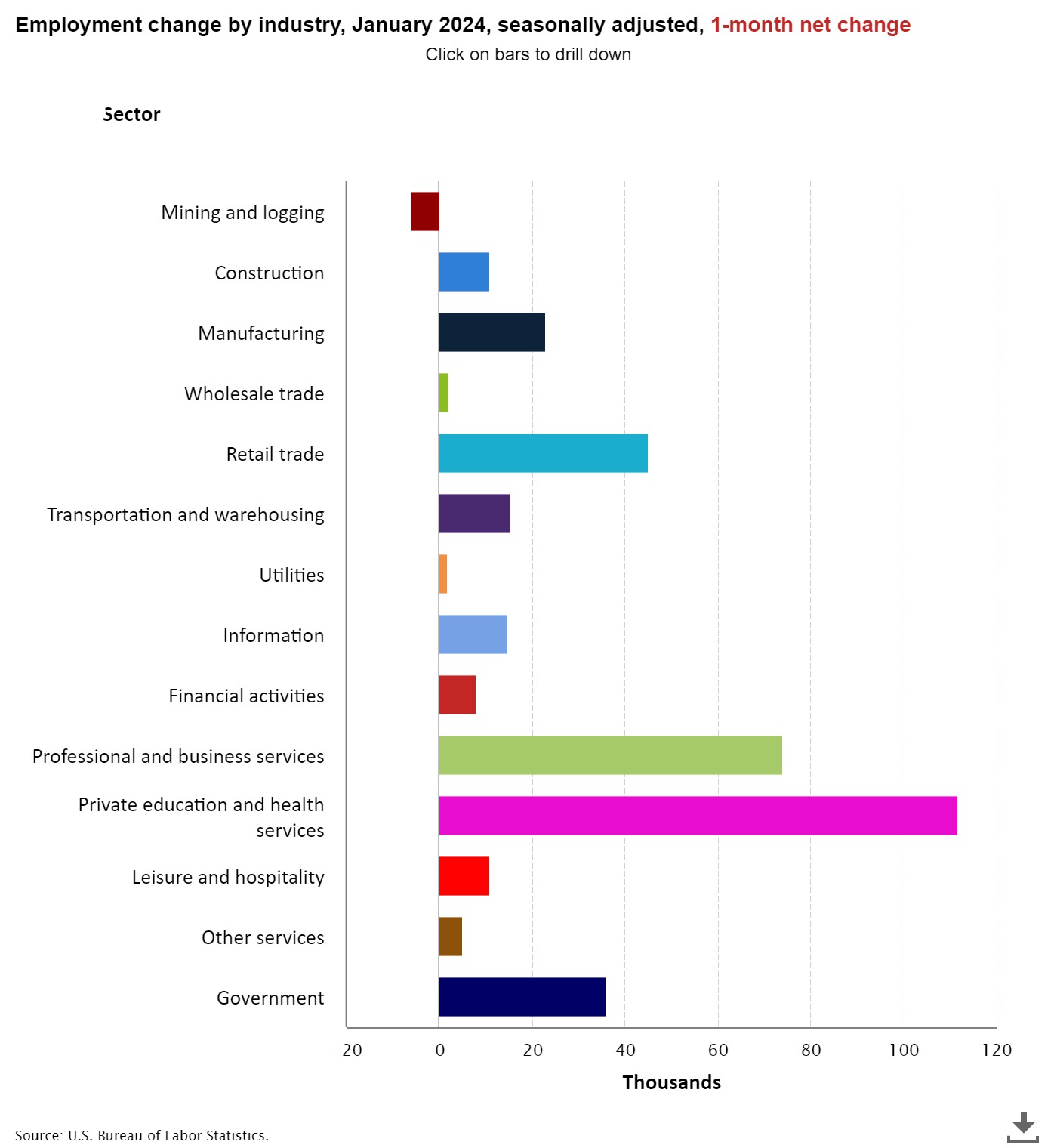

- Job gains were notable in healthcare (100k), professional and business services (74k), government sector (36k), and retail trade (45k). In a sign of the breadth of job gains, the only segment that experienced job losses in the month was mining (-6k).

- Wage gains followed a strong December with even stronger gains in January with a MoM gain of 0.6% vs. 0.3% expected and 0.4% in December. In addition, the year-over-year pace increased to 4.5% vs. 4.1% in December and 4.1% expected. Average weekly hours, however, decreased from 34.4 hours to 34.1 hours, missing the 34.3 expectation. The 34.1 hours represents a new cycle low. Weekly hours peaked at 35.0 a year ago.

- Nevertheless, the solid wage gains will bolster the Fed’s higher-for-longer theme, and put to rest any thoughts of a March rate cut. Ideally, the Fed wants that YoY number to drift to around 3.5% to reduce the wage-push inflation potential, so certainly anything above 4% will harden their higher-for-longer stance, but the dip in hours worked does signal some easing in labor demand which is curious given the gain in overall jobs.

- The unemployment rate remained at 3.7% which is under the 3.8% expected as the Household Survey reported a decrease of 144 thousand in the ranks of the unemployed but also a decrease of 175 thousand in the labor force (the denominator in the unemployment rate calculation). That’s two months in a row with a decline in the labor force, which is curious too given the job and wage gains reported.

- The decrease in the unemployed and labor force led to the Labor Force Participation Rate remaining unchanged at 62.5% which is just under the 62.6% expectation. The participation rate a decade prior to the pandemic averaged 63.3% while the average over the past year has been 62.6%.

- All-in-all, surprising strength on the topline number and in the wage gains that belies some other recent reporting such as ADP and the Employment Cost Index. The Establishment Survey underwent an annual benchmarking process in January and the Household Survey updated population figures so those adjustments are probably influencing some of the surprising results we are seeing. Also, January can be a notoriously tricky month with annual pay increases showing up in the monthly wage gains so some seasonal factors may also be at play here. The large revisions of late and the ongoing disparity between the two surveys gives one pause about exactly how strong the month was, but regardless it certainly pushes out any thoughts of rate cuts to May or later.

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.