It’s Fed Day but Don’t Expect many Fireworks

- After a pause yesterday, Treasury yields are edging lower this morning, but with little conviction, as the market awaits the Fed’s rate decision later this afternoon, and equities continue to regroup after the DeepSeek-inspired Monday selloff. Currently, the 10yr Treasury is yielding 4.52%, down 3bps on the day, while the 2yr is yielding 4.19% down 1bp on the day.

- This afternoon brings us the FOMC’s rate decision and Powell press conference. As meetings go, this will probably be one of marking time until more is known about an array of current unknowns. First, the Fed is widely expected to pause. Second, given the uncertainty with the Trump administration’s policies on a host of fiscal issues, namely tariffs, deportations, and tax cut extensions, it seems easy for the Fed to say too many unknowns so we’re not offering much in the way of forward guidance. Third, add in the fact that the first quarter last year saw a sizeable uptick in inflation and the Fed is probably wise to sit on their hands to see if 2025 plays out the same. Thus, we don’t expect much in the way of concrete guidance.

- We suspect this will be more a placeholder meeting until March 19th when the Fed will have the January and February inflation reports, not to mention the employment reports as well. And with the job market expected to hold up in the interim there is really nothing that is pushing the Fed to act sooner rather than later, especially with the high degree of unknowns. As we mentioned on Monday, the greatest intrigue may well be when Powell is asked about Trump’s comments that he knows interest rates better than the Fed. Powell will most likely bat away such questions, but the body language will be scrupulously examined.

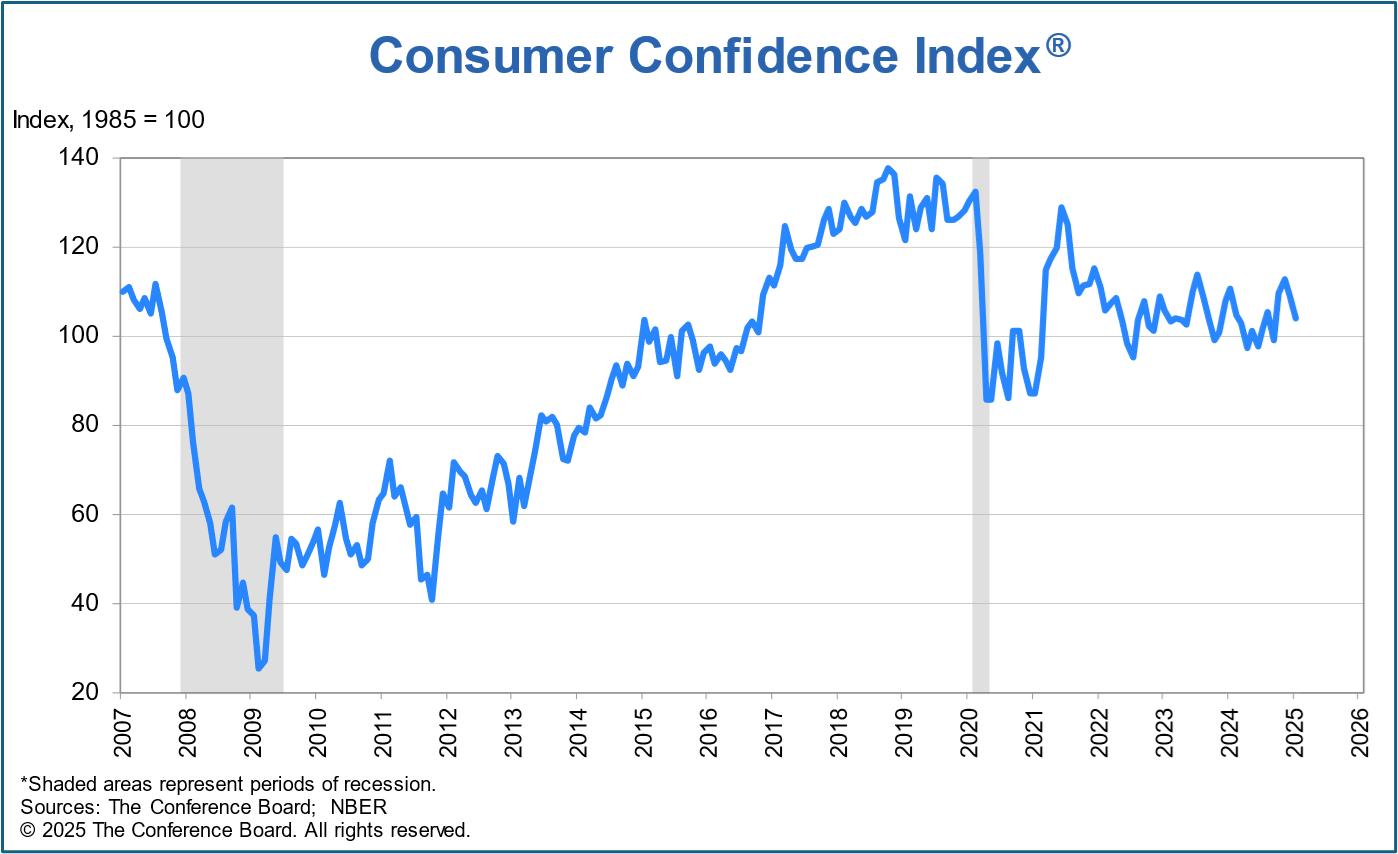

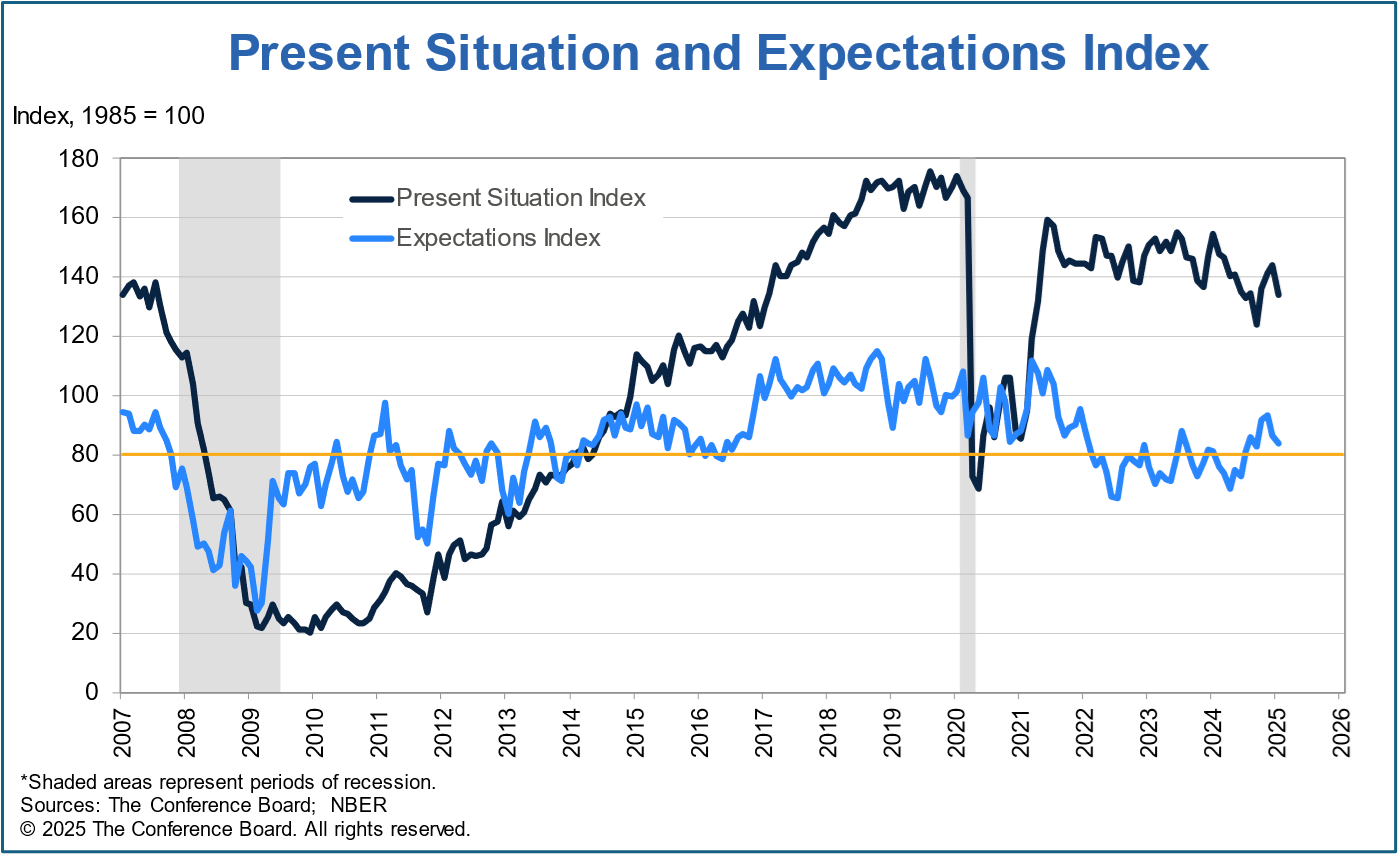

- Yesterday’s Conference Board Consumer Confidence report found consumers not quite as upbeat in January as they were in December. Confidence, present situation, and expectations all ticked down and the labor differential (jobs plentiful – jobs hard to get) moved decidedly lower, indicating jobs are getting harder to find. That broke a three-month string of jobs being more plentiful after a long downtrend for much of 2024. If that continues it could signal a bit rougher time in the job market, making the Fed a little less comfortable in waiting until June for a rate cut.

- Also yesterday, the preliminary Durable Goods Orders report for December painted a clear picture of the struggles at Boeing while the wider goods economy seems to be doing ok. Headline orders were down -2.2% vs. 0.6% expected, and the November reading was adjusted lower from -1.2% to -2.0%, again mostly attributable to Boeing. Ex-transportation, orders improved to up 0.3%, matching expectations, and better than the -0.2% dip in November. Orders ex-air and defense, a proxy for business spending, were up 0.5% vs. 0.3% expected and a strong upward revision from 0.4% to 0.9% in November. That upward revision could boost estimates for fourth quarter GDP which currently stand at 2.7%. The Atlanta Fed’s GDPNow model was adjusted for the first time in a week from 3.0% to 3.2% following the report.

- Given all the talk of tariffs lately, it’s timely that we did get the latest report on the goods trade balance for December. The goods trade balance deficit came in at $122.1 billion vs. $105.0 billion expected and $103.5 billion in November. The gap to a higher deficit was driven by both sides of the equation: greater imports and less exports. Goods imports surged $10.8 billion to $289.6 billion, while exports fell $7.8 billion to $167.5 billion. Some front-running of possible tariffs seems to be at play here in the spike in imports. Nevertheless, it wouldn’t be at all surprising to find Trump highlighting the report as it pertains to the trade deficit and the need, in his eyes, for wide-ranging tariffs. Never a dull moment.

- Housekeeping Note: I will be away this afternoon for a medical appointment so the usual FOMC recap will not be forthcoming. Fortunately, I think the meeting and press conference will be a nothing burger, so perhaps not much will be missed.

Consumer Confidence Takes a Modest Step Back in January

Consumer’s Present Situation and Expectations Retreat Modestly in January

After Three Straight Months of Improvement in Jobs Plentiful, it Takes a Step Back in January

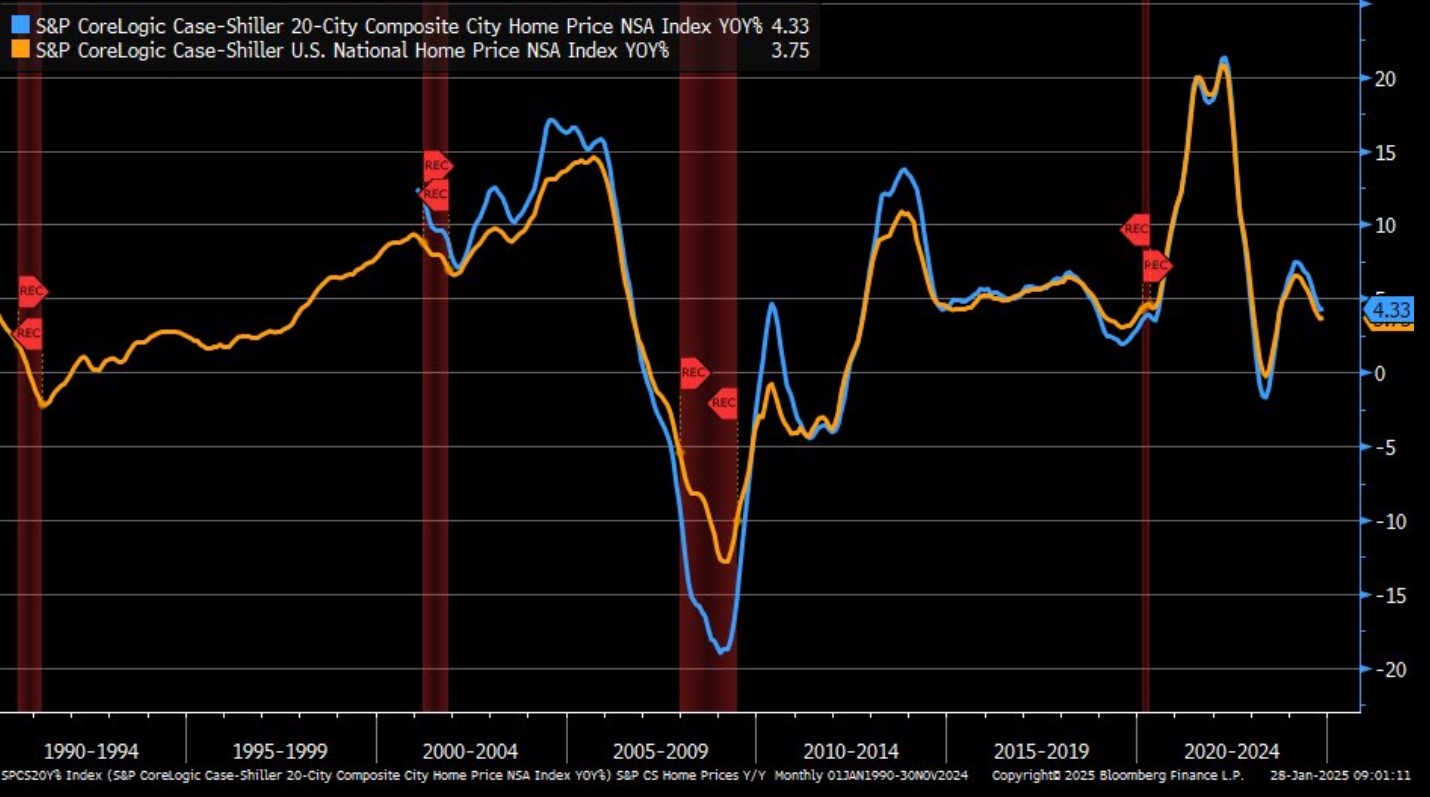

S&P CoreLogic Case-Shiller Home Price Appreciation (YoY) Slowing Again as High Rates and Affordability Hit Demand Source: Bloomberg

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.