It may be Jobs Week, but it’s Tariff Tuesday too

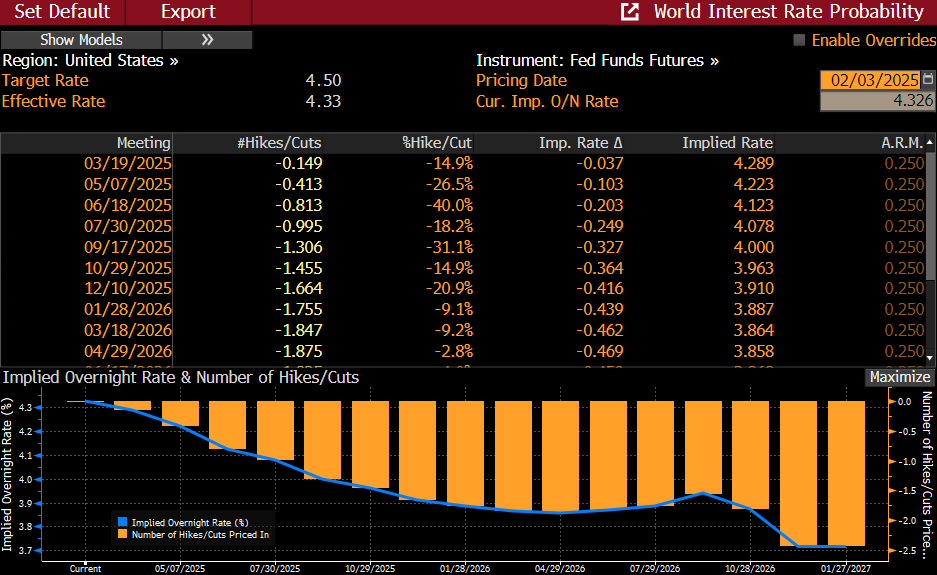

- Expect a week of volatile trading as tariff policies are implemented, and likely revised, and if that isn’t enough to stir the anxiety pot, this is jobs week which adds first-tier data to the volatile brew. The initial reaction to the weekend tariff news is to dent equities and provoke a minimal flight-to-safety trade on the longer end. The shorter end is weighed down by thoughts the inflationary impact of tariffs will reduce odds of multiple rate-cuts this year. Currently, the 10yr Treasury is yielding 4.50%, down 4bps on the day, while the 2yr is yielding 4.24%, up 4bps on the day, as multiple rate-cut odds are reduced.

- It is jobs week what with the Big Daddy BLS Nonfarm Payrolls report on Friday, but before then we get the latest read on Job Openings and Quits Rate with the December JOLTS survey. Also, the pair of ISM surveys will note overall sector strength, or lack thereof, in manufacturing and services but it will also include employment trends in both sectors. And don’t forget the ADP Employment Change report on Wednesday. Overall, the employment numbers are expected to be decent to solid but off the strong December report.

- It should also be noted that this month’s employment report will include Census Bureau population revisions for 2024 that will be dropped into the Household Survey for January. Expectations are that population and labor force will increase by 3 million people, mostly immigrants. The BLS doesn’t revise historical Household Survey data so the pop in January’s numbers may cause some confusion at first but ultimately after the revision it will bring the survey into better alignment with the Establishment Survey which often diverged during 2024. It shouldn’t impact the unemployment rate but expect the Labor Force Participation Rate to increase about a tenth.

- All of that, however, will take a backseat this week to the tariff plans rolled out by the administration over the weekend. Let me first say I align with the Wall Street Journal’s sentiments in viewing this as the “Dumbest Trade War in History.” Be that as it may, a 25% tariff on most goods in Canada, except energy at 10%, coupled with 25% levies on practically all Mexican goods and 10% on Chinese goods will have first-order inflationary impacts, not to mention potential product shortages. One a possibly positive note, talks are expected to be held between Mexico, Canada. and the US today to attempt some maneuvering/negotiation to delay or at least hold out the prospect for a near-term resolution. We mentioned previously that 2025 is the year where the Fed’s somewhat boring measured and telegraphed approach gives way to the mercurial While House and the daily dose of fiscal policy proposals that will be a feature of the new administration.

- If these tariff salvos go the way of Trump 1.0, it’s akin to throwing a hand grenade under the tent, panic ensues, and the administration claims some negotiating victory and defuses the explosive. Will Trump 2.0 follow the same script? We’re about to find out. Meanwhile, the EU seems to be on deck, so this issue is not likely to go away anytime soon. So, the equity market reaction, quite rightly, will remain volatile and eventually, if the tariffs are implemented for any length of time, it will filter into higher prices and lower growth, not a great combination.

- Also, the fentanyl and immigration rationale, in my view, are red herrings. Trump continues to incorrectly conflate trade deficits as “subsidizing” the country in question. It should be noted, we receive something of value for that deficit spending. It’s hardly “subsidizing.” When you consider Canada has just over 10% of the US population it’s hard to see how we could ever have a trade surplus given that disparity.

- Meanwhile, Musk and his DOGE colleagues have been given access by the new Treasury Secretary Scott Bessent to the Treasury’s payments data base. So, his 20-somenthing computer whiz kids now have your banking and SSA information, not to mention details on every payment made by the Treasury. So, Congress may control the purse strings, nominally, but it seems payments will now have to pass muster with Musk and company.

- Moving back to the mundane tasks of reviewing economic releases, this morning the ISM Manufacturing survey is expected to show some improvement but still in contractionary territory, albeit just barely at 49..9 vs. 49.2. The shift in the employment index will be viewed as one of the early clues

The Job Openings and Labor Market Survey for December will be released tomorrow and that is expected to see another dip in openings from 8.098 million to 8.000 million. The Quits Rate and Layoff Rates will be viewed as well as they have been loitering around or below pre-pandemic levels.

Futures Still see June/July Rate Cut but only Another 15bps by Year End as Tariff/Inflation Worries Hang over Rate Cut Odds

Source: Bloomberg

January ISMs Due This Week – Slight Improvement Expected

Source: Bloomberg

JOLTS Quits Rate Has Been Stuck Below Pre-Pandemic Levels Indicating Low Worker Confidence in Finding a Better Job

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.