ISM Manufacturing Numbers Spell End to the Holiday Week

- Treasury yields are slightly lower in another low-volume overnight session. The only item on the docket today is the December ISM Manufacturing Index at 10am ET (more on that below). The typical rush of reports in the first week of a new month has been pushed into next week due to the New Year holiday mid-week. Currently, the 10yr Treasury is yielding 4.54%, down 4bp on the day, while the 2yr is yielding 4.23%, down 2bp from yesterday’s close.

- At 10am ET, we’ll get the first look at December reports with the ISM Manufacturing Index and further contraction in the sector is the expectation, 48.2 vs. 48.3 in November. The prices paid component, for its inflationary messaging, will get attention along with new orders and employment. 2024 was a tough year for manufacturing and it looks like it will open the new year still trying to get its head above water. With the business-friendly incoming administration, optimism is strong, but that soft data hasn’t yet manifested into a real pick-up in activity. We expect to see it move above 50 (the dividing line between expansion and contraction) in the first quarter.

- That was the message from the S&P Global US Manufacturing PMI final numbers for December. The seasonally adjusted index posted 49.4 in December, down from 49.7 in November but up from the ‘flash’ reading of 48.3. Manufacturing production was down for the fifth successive month, with the rate of contraction the fastest in a year-and-a-half. Lower output generally reflected a drop in new orders. After having neared stabilization in the previous month, new business decreased at a faster pace in December. However, survey respondents generally noted that the incoming administration is expected to help boost demand conditions in the new year. Manufacturers were therefore optimistic that output will increase over the course of 2025.

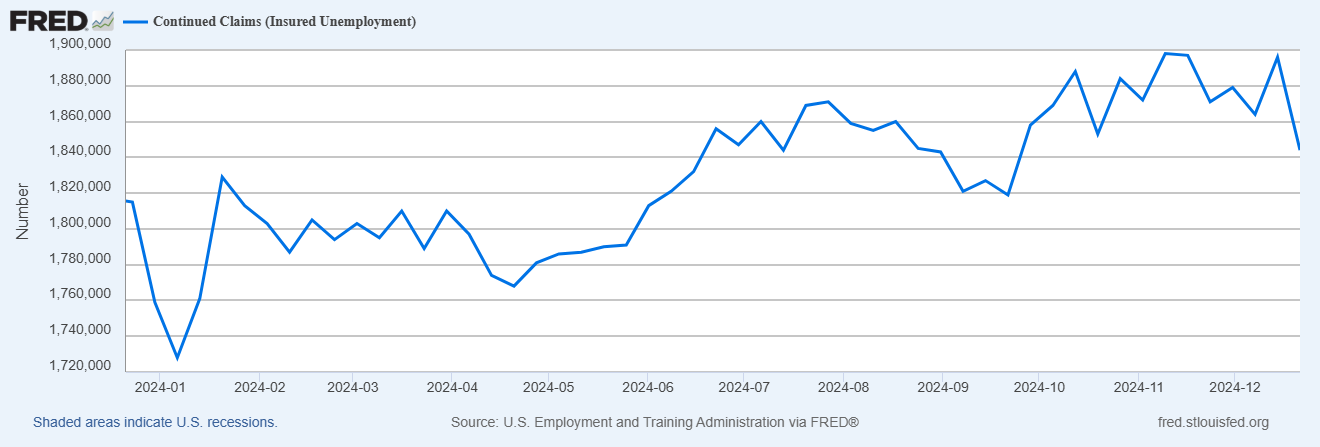

- Meanwhile, initial jobless claims continue to provide a nothing-to-see-here view of the labor market. Initial claims declined by 9 thousand to 211 thousand in the week ending Dec. 28, below the consensus estimate of 221 thousand. At 211 thousand, claims are only slightly higher than 198 thousand in the comparable week in 2023. Continuing jobless claims dropped by 52 thousand to 1.844 million. One caveat to the docile numbers is that holiday weeks can often be noisy despite seasonal adjustments. Bottom line: layoffs continue to be muted, while those looking to find new employment are taking longer to do so, but it’s well below previous periods of economic stress (see graph below).

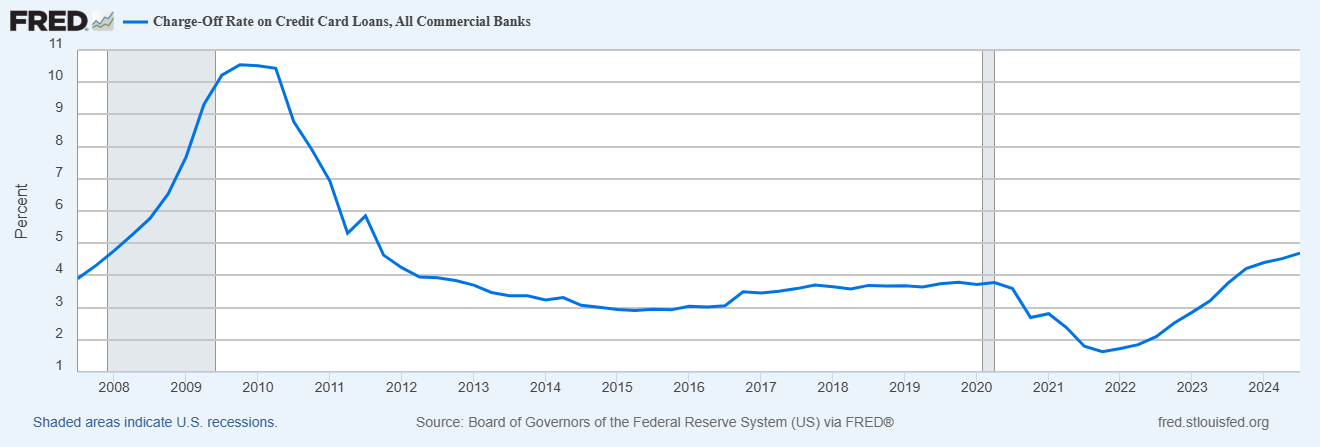

- A recent article from S&P Global noted that third quarter credit card charge-offs reached levels dating back to the Great Financial Crisis in 2008. The trend in the fourth quarter is likely to have worsened. The article stated that the bottom third of consumers were finally succumbing to the effect of higher rates and defaulting in greater numbers, while the more affluent consumers were not feeling the pressure, yet. This could become a leading story in 2025, but one caveat we’ll throw out is the story was using dollar charge-offs, and while the amounts today are approaching levels of 2008, as a percentage of outstanding credit card debt it remains well below GFC levels (see graph below). Nevertheless, this could become more of story and slow consumption in 2025.

- The first Friday of a new month usually brings the latest jobs report but given the holiday, the BLS is delaying the release until next Friday (Jan. 10). Expectations are for a solid report with 153 thousand new jobs and the unemployment rate remaining unchanged at 4.2%. If that comes to pass it will provide more cover for the Fed to pause in January as they are widely expected to do.

- The first fly-in-the-ointment as far as the 2025 economy goes could be the upcoming negotiations between dockworkers and the US Maritime Association (a consortium of large shippers). Negotiations are set to start Jan. 7 with a deadline of the 15th. Those in the know expect an agreement to be reached, but if not, it would shutter most ports on the eastern seaboard and Gulf Coast. As a precautionary measure, some shippers are already diverting some cargo to unaffected ports, but again the feeling is that a deal will be reached.

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.