Is the Labor Market Finally Starting to Weaken?

Is the Labor Market Finally Starting to Weaken?

- Treasuries open the day with a slight downside bias and that may be the case for a while as the Thanksgiving holiday beckons next week, and first-tier data will be few and far between for the next two weeks (more on that below). Presently, the 10yr Treasury is yielding 4.46%, down 6/32nds in price and the 2yr Treasury is yielding 4.89%, down 3/32nd in price.

- Housing starts and permits for October revealed some resilience in the new home market. Starts in October rose 1.9% to 1.372 million annualized which beat the 1.350 million expected. Permits also beat with 1.487 million annualized vs. 1.450 million expected. The levels were slightly better than September which surprised some given the increase in mortgage rates during the month. When you think about it, however, with the lack of existing home inventory, builders can offer supply along with rate buydowns which likely provides some of the resilience we are seeing in the numbers. Still, in the “it’s all relative” category the level of starts today pales in comparison to the 1.800 million high in April 2022.

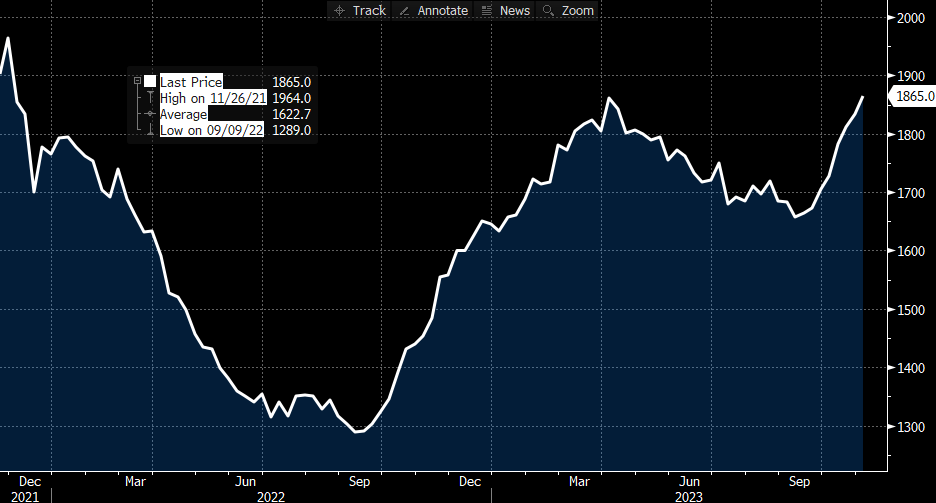

- One of the reports yesterday that caught our eye was the weekly jobless claims series. Weekly claims rose above expectations to 231 thousand vs. 220 thousand expected and 218 thousand the prior week. That was the highest claims total since August 2023. Now that doesn’t spark alarm as it’s still a historically low number of claims. What did catch our attention was the continuing claims series increasing to 1.865 million which was above the 1.843 million expectation and the highest read since November 2021. Again, the total is not historically high, but the increasing trend is unmistakable. That implies workers losing jobs are finding it harder to secure new employment. So, while employers may be reluctant to let workers go, given the modest weekly claims figures, they don’t seem to be as active in the new hire market. Given that the labor market is a lagging indicator it also suggests the cumulative impact of Fed rate hikes is starting to be felt. This is probably another good reason for the Fed to remain in pause position.

- Also helping the pause case were the trio of inflation reports this week, CPI, PPI, and Import/Export prices, all came in cooler than expected. In addition, the one remaining inflation read for October, the Personal Income and Spending Report due on November 30, includes the Fed’s preferred PCE inflation data. The good news there is that much of the PCE series gets its input from the PPI report, so the softer PPI read implies a likely friendly read in the upcoming PCE data. If that comes to pass it’s another reason to believe the Fed is done hiking.

- After the retail sales numbers were posted on Wednesday, the Atlanta Fed’s GDPNow estimate was updated and now sees fourth quarter GDP at 2.2%. While that is well short of the third quarter’s robust 4.9%, it also doesn’t signify an imminent slowing into recession territory. Meanwhile, Fed Funds futures are pricing a rate cut by May 1, 2024. that implies a significant amount of economic slowing as the calendar turns to the new year. The lasted Fed speak, however, while acknowledging the improved inflation outlook, continues to remind that core inflation at 4.0% is still well above the 2% target and higher-for-longer remains the preferred policy path. That seems to be the next battle between the market and the Fed, and so far, the Fed shows no signs of relenting on their higher-for-longer stance. Part of that hardline stance is due to the resilience in the labor market, but is that strength starting to fade? It’s too soon to say yes, but it will be a key focus as we move into 2024.

- Finally, with the Thanksgiving holiday next week and the November jobs report not due until December 8 the next two weeks will be short of first-tier data except for the October personal income and spending numbers at month end. That means trading will likely be a rangebound affair until we move into December and start to see the early November reports like the ISM surveys and the jobs numbers.

Continuing Jobless Claims – Highest Since Nov. 2021

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.