Is the Consumer Showing More Distress Signs?

- Treasury yields are sharply unchanged in quiet Friday morning trading. With not much on the data docket today – S&P Global Preliminary February PMIs are it – any volatility will have to come from White House announcements, of which they are quite prolific. Currently, the 10yr Treasury is yielding 4.50%, unchanged on the day, while the 2yr is yielding 4.27%, also unchanged on the day.

- Initial jobless claims for the week ending February 15 increased by 5 thousand to a seasonally adjusted 219 thousand vs. 215 thousand expected. The previous week’s level was revised up a thousand to 214 thousand. The four-week moving average decreased by a thousand to 215.25 thousand. Insured continuing claims increased by 24 thousand to 1.869 million vs. 1.868 expected and 1.850 million the prior week.

- You may be asking, but what about those Federal employees being cut in the DOGE cost-cutting effort? Well, Federal employees are not included in the state claims data. Their claims are filed separately under the unemployment compensation for federal employees (UCFE) program, and the data is reported with a one-week lag. Expect that report to get a little more attention in the following weeks.

- The minutes from the Jan. 30th FOMC meeting contained a bit more than just patiently waiting to recommence rate cuts. Minutes from the meeting reveal that officials discussed the possibility of slowing or pausing the reduction of the central bank’s balance sheet due to uncertainties surrounding U.S. Treasury debt issuance and the borrowing cap. Fed policymakers cited the potential for significant swings in reserve balances over the coming months as the debt ceiling negotiations play out. Apparently, some banks are parking reserves as a safe-haven play, but if the debt ceiling negotiations are resolved successfully much of those reserves could leave. Thus, officials monitoring such levels are cautious about continuing with portfolio run-off.

- Fed officials in charge of the “plumbing” at the Fed are wary of the risk that bank reserves could become too scarce. Such a scenario stands to roil US funding markets and increases the threat of boosting borrowing costs as markets struggle to find buyers for new government debt issued to fund the swelling budget deficit.

- The minutes also discussed the possibility of adjusting purchases in the portfolio to align the duration with the outstanding stock of public debt. Right now, the Fed’s portfolio, as it is being allowed to shrink via maturities, is about three years longer in duration than the public debt. So, they would need to purchase shorter duration issues to move the overall duration closer to the public debt duration. Combine that with Secretary Bessent reiterating yesterday that Treasury is not planning on increasing longer duration supply and the Treasury market promptly rallied.

- While this week has been devoid of much new data, later this morning (9:45am ET) we will get the preliminary S&P Global US PMI series for February. The manufacturing series is expected edge higher from 51.2 to 51.3 while the services sector is expected to increase as well from 52.9 to 53.0. That should send the composite reading up from 52.7 to 53.3.

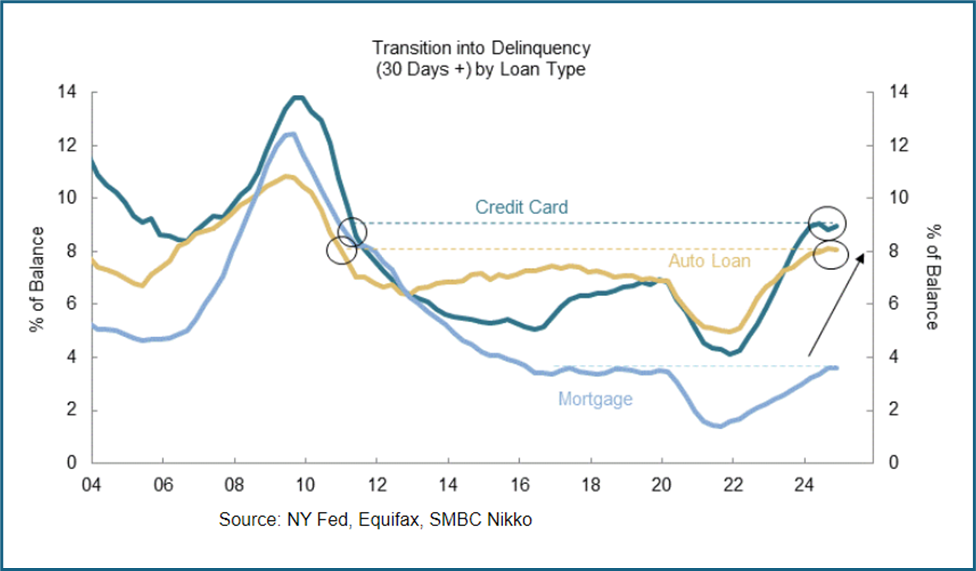

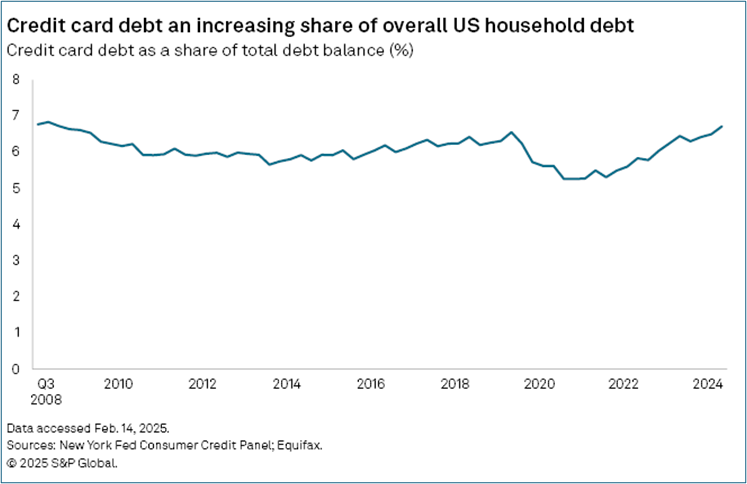

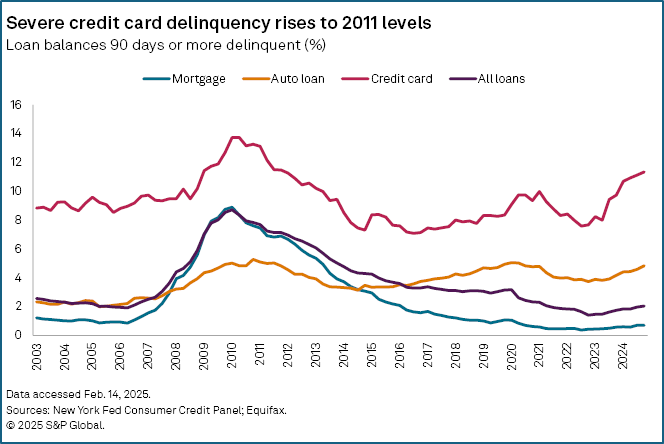

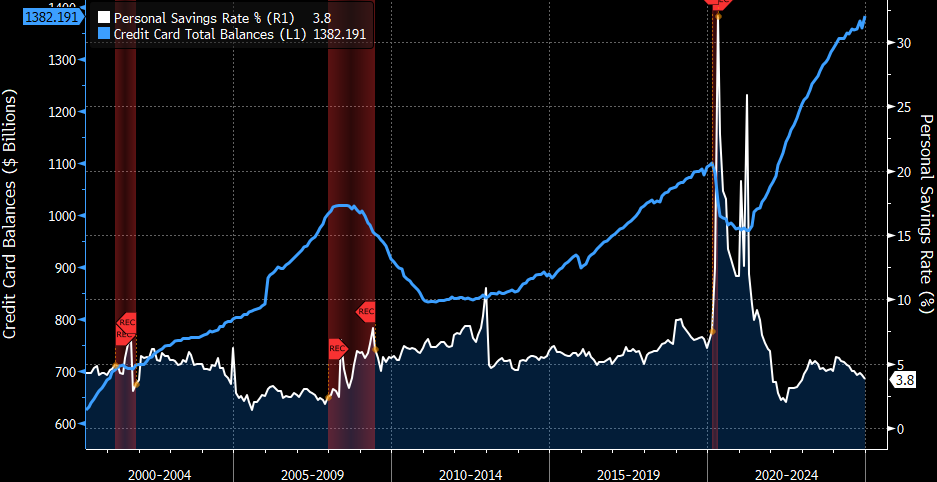

- Finally, with Wal-Mart’s warning yesterday of potentially softer sales we wanted look at the consumer’s debt situation, both balance and delinquency trends. Both are not doing so well. Now, many an analyst has predicted the demise of the consumer only to end up with egg on the face so we’re not going there, yet. But we did want to present these series of graphs for your review and let you begin to decide.

As Savings Grow Scarce, Consumption is Funded More and More with Credit Cards

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.