Is Peer Pressure Building at the Fed?

Is Peer Pressure Building at the Fed?

- Treasury yields are lower this morning as disappointing PMI numbers from Europe added to the rate-cutting case on the Continent and it’s putting a little peer pressure on the Fed to join the party. In that regard, former NY Fed President Bill Dudley is adding to that sentiment in a Bloomberg Op-Ed piece calling for rate cuts now. He had been one of the more cautious/hawkish voices, so the sudden turn is interesting, to say the least. Currently, the 10yr note is yielding 4.22%, down 3bp on the day, and the 2yr is yielding 4.40%, down 6bp on the day and the lowest yield since February.

- Despite the peer pressure, the Fed is expected to pass on a rate cut at next week’s FOMC meeting while other central banks are not waiting around. Bank of Canada is expected to cut rates 25bp this week, which would the be their second cut, and China reduced policy rates earlier this week in a bid to support their struggling economy. It’s expected the limited move (10bps) will be followed by more. Add in earlier cuts by the ECB, and Swiss and Sweden central banks, and expectations that Bank of England may cut at its August 1 meeting, the easing trend is clear.

- Before the more consequential reports on second quarter GDP tomorrow and June PCE on Friday, today delivers some early insight into July performance with the preliminary PMI series from S&P Global. The manufacturing sector disappointed with a 49.5 reading vs. 51.6 expected and that dips the sector into contraction territory, albeit just barely. The services PMI, however, rose higher than expected to 56.0 from 55.3 in June and 54.9 expected. That represents healthy expansion in the services sector and that’s no surprise given where the consumer has been focused lately. The decent PMI readings contrast with disappointing European PMIs which certainly accounts, in part, for the divergence in central bank policies.

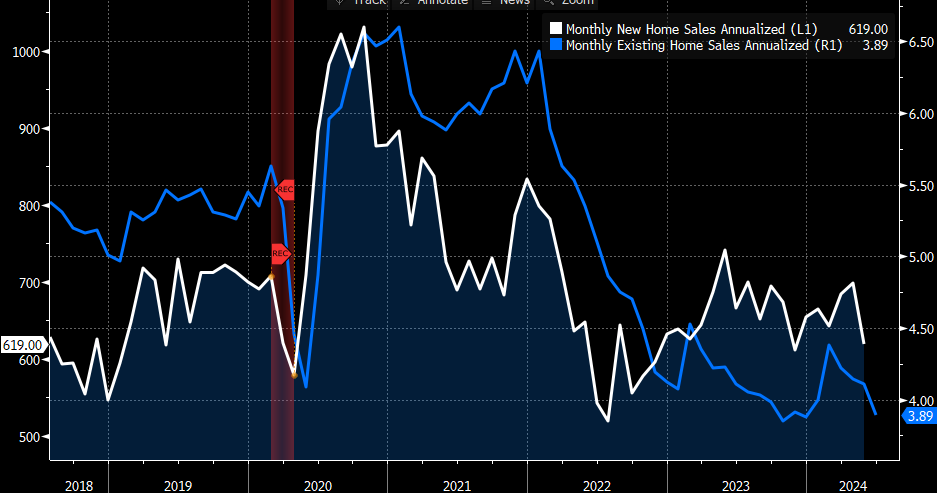

- Later this morning at 10am ET, the New Home Sales report for June will be released with a modest rebound from May with 640 thousand annualized sales expected which would be a 3.4% increase. The disappointing Existing Home Sales report yesterday points to continued struggles in the housing market stemming from a combination of limited supply, high prices, and mortgage rates lingering around the 7% rate.

- One key difference between the two reports is that new home sales are reported as contracts are signed while existing sales are counted when closed so the new home series provides a more real-time look at housing activity. Also, with builders able to buydown mortgage rates to entice borrowers, the new home sales series has held up a bit better, but it has certainly had its share of struggles. For example, the 619 thousand annualized sales in May were the lowest since November.

- The headline economic data this week will be tomorrow’s first look at second quarter GDP and PCE inflation on Friday. Expectations are for GDP to grow 2.0% annualized vs. 1.4% in the first quarter. Personal consumption is expected to increase from 1.5% to 2.0%, once again putting to the sword those that have been predicting the demise of the consumer. The important price index is expected to dip from 3.1% to 2.6% annualized with the core price index dropping to 2.7% vs. 3.7%. These expected declines in inflation reflect the material improvement in the second quarter and if the predictions are correct, will add more evidence supporting a September rate cut.

New and Existing Home Sales – The Struggle is Real

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.