Is a Government Reopening in our Future?

- With seven Dems breaking ranks, and one Independent, the Senate voted 60-40 to advance a short-term funding bill that could potentially reopen the government as soon as this week, but a final Senate vote is still needed and if passed faces an uncertain outcome in the House, so plenty of steps still remain. Even if the government is reopened, say by Friday, returning to a normal report schedule will take more time. Maybe Thanksgiving? Anyway, the DC news has Wall Street in a risk-on mood and that is pressuring Treasury yields higher. Currently, the 10yr Treasury is yielding 4.13%, up 4bps on the day, while the 2yr note yields 3.60%, also up 4bps in early trading.

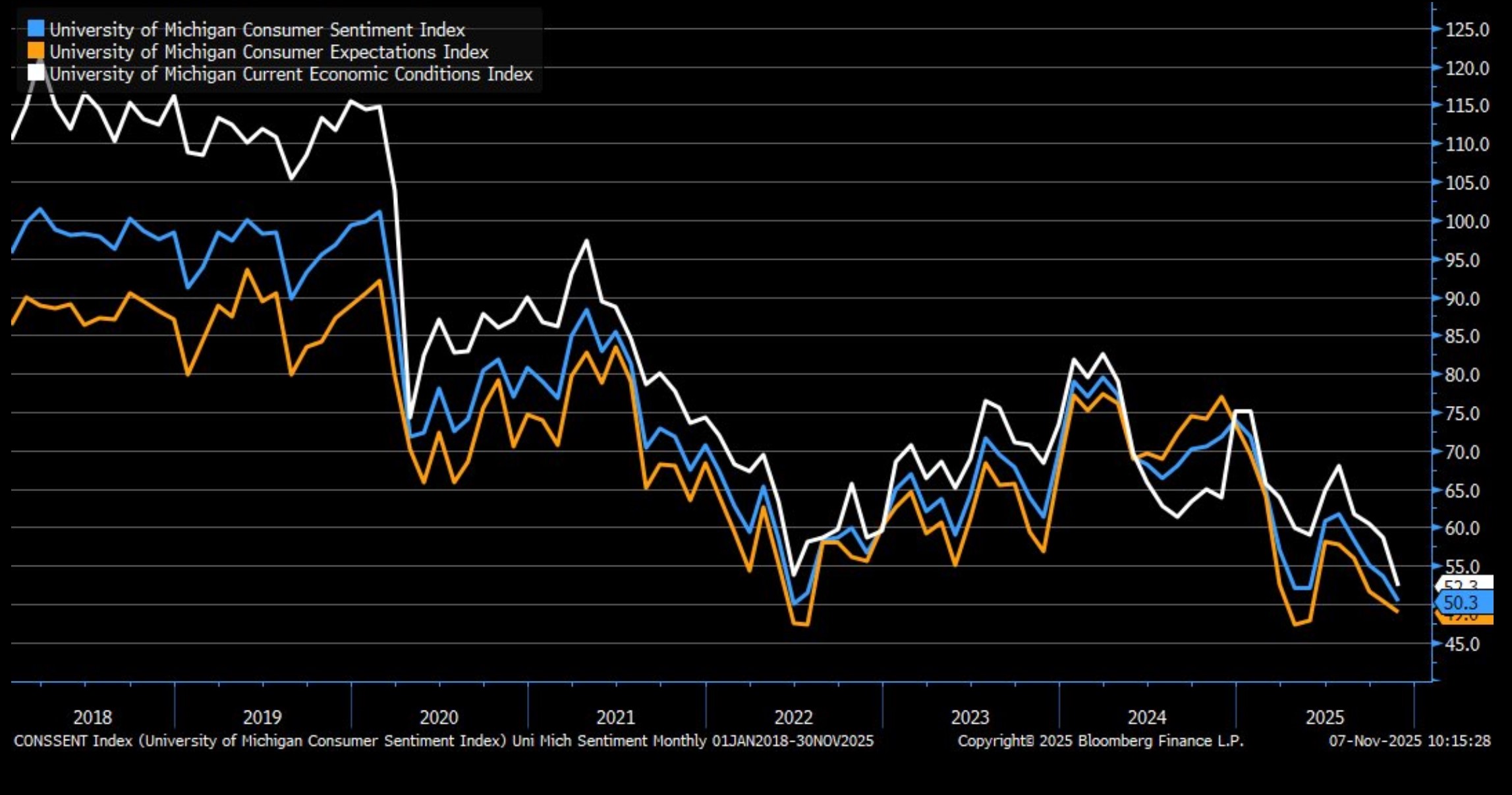

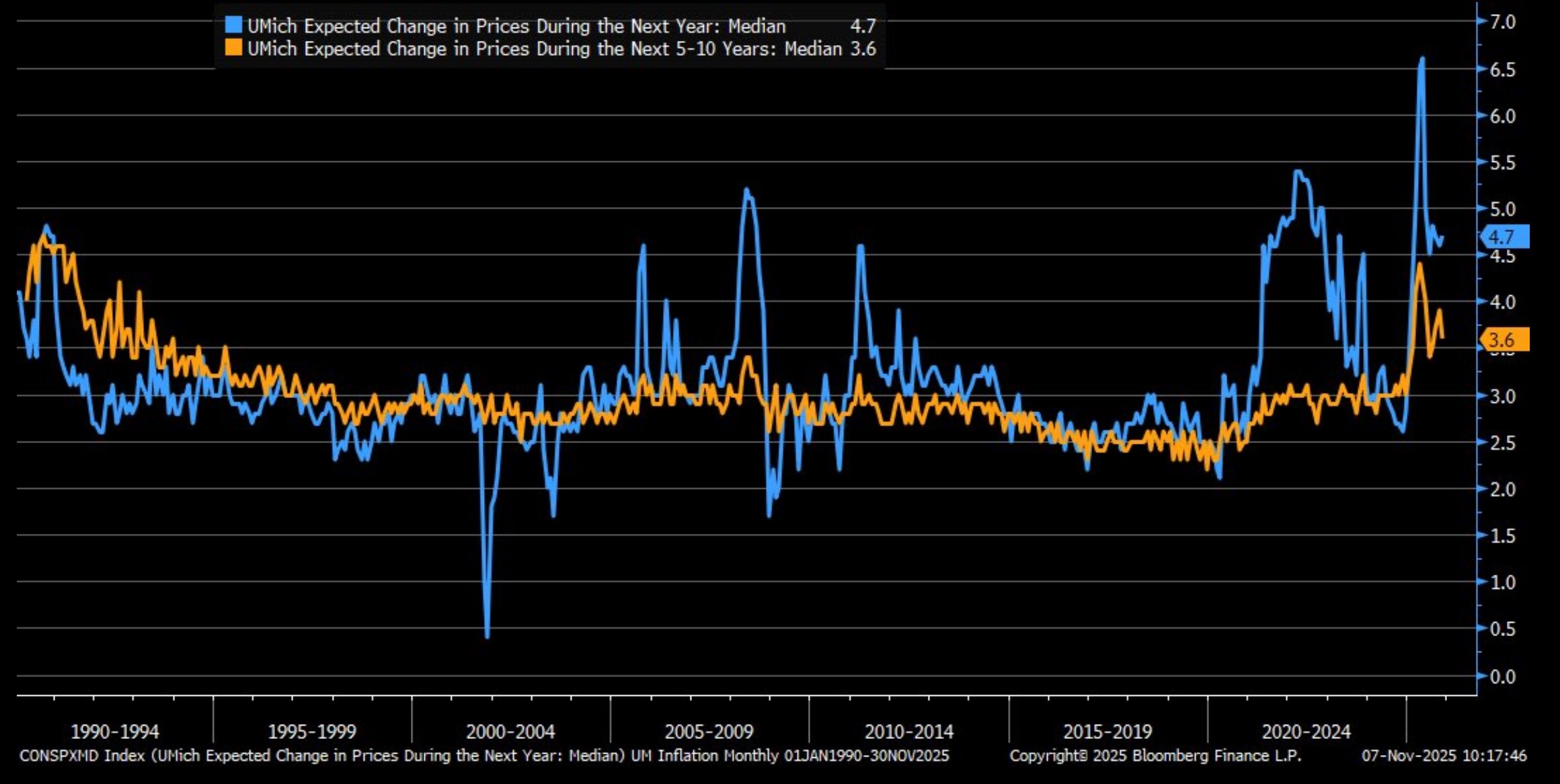

- On Friday, the November Preliminary University of Michigan Sentiment Survey disappointed at 50.3 compared to the 53.0 Bloomberg expectation. This decline from October’s 53.6, brought the index to its lowest level since June 2022. In addition, Current Conditions plunged to a record-low 52.3 (dating back to January 1978) when expectations were for a modest improvement to 59.0 from 58.6 in October. Expectations for the future fell to a 6-month low of 49.0 versus an expected 50.0 and 50.3 in the prior month. Year-ahead inflation expectations ticked up to 4.7% compared to unchanged expectations of 4.6%. In the only bit of good news in the report, the 5-10 year inflation expectation fell to a 3-month low at 3.6% vs. 3.8% expected and 3.9% in October. The results reflect the sour mood the public displayed at last week’s elections.

- The ongoing government shutdown is getting the bulk of the blame for the disagreeable mood of consumers. The report noted that, “With the federal government shutdown dragging on for over a month, consumers are now expressing worries about potential negative consequences for the economy. This month’s decline in sentiment was widespread throughout the population, seen across age, income, and political affiliation. One key exception: consumers with the largest percentage of stock holdings posted a notable 11% increase in sentiment, supported by continued strength in stock markets.”

- Also revealing the sour mood, the share of consumers expecting higher unemployment over the next 12 months jumped to 71% from 64% in October, the highest since May 1980. We’re not sure how many politicians follow this survey, but we would bet a fair share do, or at least their staff, and it will no doubt, along with the election results from last week, spur new momentum towards ending the shutdown, especially with the heavy travel Thanksgiving week looming. Who knows, but this report could have been one piece of the puzzle creating momentum for the Senate breakthrough yesterday. It certainly didn’t hurt.

- Another privately issued sentiment report is due tomorrow with the NFIB Small Business Optimism Survey for October. Given the job losses noted in the ADP report from smaller firms, we’re not expecting an optimistic slant from this group tomorrow. That should only add fuel to the reopening momentum that the Michigan survey provided.

- Away from watching plunging sentiment reports, the Treasury will auction 3yr, 10yr and 30yr bonds this week. The auction of $58 billion in 3yr notes is today followed by $42 billion in 10yr notes on Wednesday, followed by $25 billion in 30yr bonds on Thursday. With stocks struggling more, and Treasuries the repository of some of that former equity money, modest yields will greet auction buyers. We’ll be interested to see how eager they are to purchase at fairly rich levels.

- Finally, another consumer sentiment read. Last Friday, the NY Fed released the October 2025 Survey of Consumer Expectations which showed that households’ inflation expectations decreased at the short-term horizon and remained unchanged at the medium- and longer-term horizons. Unemployment rate and job finding expectations worsened, while job loss expectations slightly improved. Spending and household income growth expectations remained largely unchanged. Perceptions and expectations about credit availability improved, but respondents were somewhat less optimistic about their future household financial situation. The survey was fielded from October 1 through October 31, 2025.

- Median inflation expectations decreased by 0.2 percentage point to 3.2% at the one-year-ahead horizon in October. They were unchanged at the three-year- (3.0%) and five-year-ahead (3.0%) horizons. Median home price growth expectations remained unchanged at 3.0% for the fifth consecutive month. This series has been moving in a narrow range between 3.0% and 3.3% since August 2023.

University of Michigan Sentiment, Expectations, Current Condition all Fall in November

Univ. of Michigan Preliminary November Sentiment Survey – Inflation Expectations

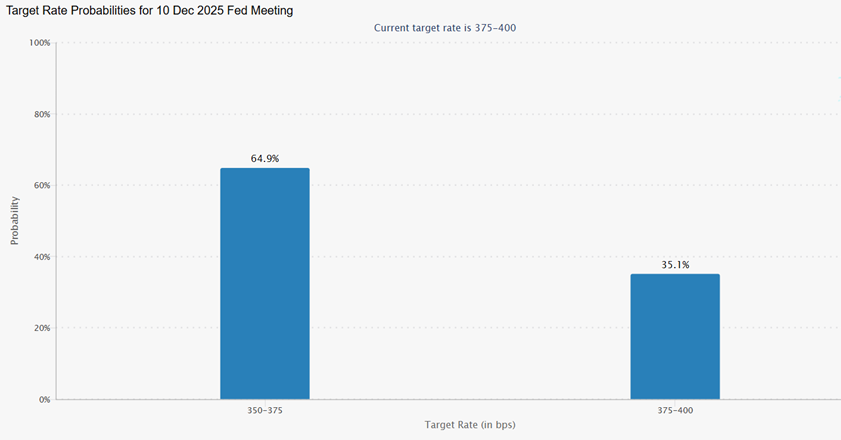

News of a Possible Government Reopening Fails to Materially Move December Rate Cut Odds

Source: CME Group

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.