Investors Look to October CPI and Retail Sales This Week

Investors Look to October CPI and Retail Sales This Week

- Early Treasury gains flipped to losses as investor angst over last week’s poorly received auctions and upcoming inflation reads weigh on trader sentiment. October CPI numbers are due tomorrow and while not likely to shift the consensus from pause to hike may reveal enough “stickiness” to keep the higher-for-longer theme on solid footing (more on that below). Presently, the 10yr Treasury is yielding 4.69 down 10/32nds in price and the 2yr Treasury is yielding 5.08%, down 1/32nd in price.

- While last week was light on economic data this one picks up the pace led by October CPI due tomorrow. Headline CPI is expected to be up 0.1% vs. 0.4% in September as decreasing energy costs flow into the results. Given a healthy 0.5% MoM figure from last year rolling off the YoY pace is expected to dip from 3.7% to 3.3%. The core rate, however, is expected to increase 0.3% for the third straight month with the YoY pace unchanged at 4.1%. If that comes to pass it will keep the prospects for another rate hike on the table and energize the higher-for-longer theme. If the report surprises to the upside odds of a December rate hike will increase from the current 14% but moving above 50% will be a big ask.

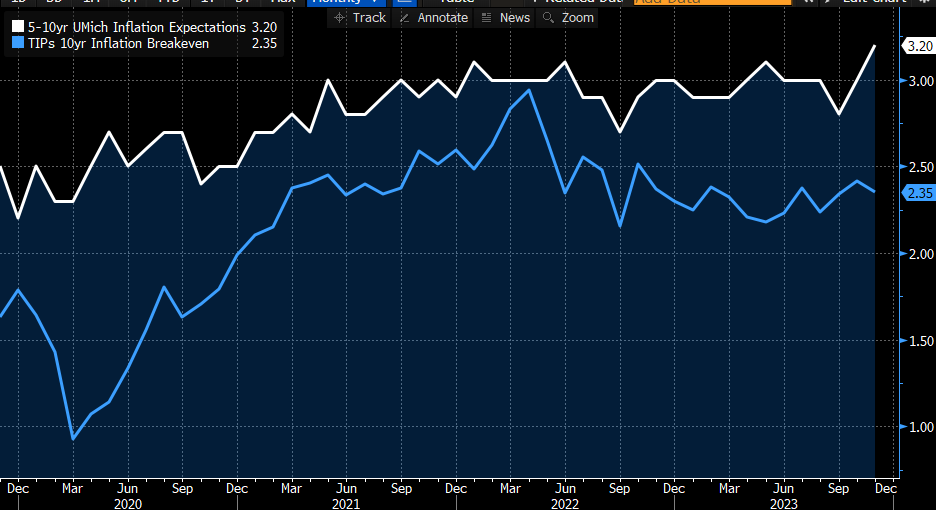

- One of the reports we did receive last week, the preliminary November University of Michigan Sentiment Survey, surprised to the upside with its inflation expectations. Both the 1yr and 5-10yr inflation expectations came in above forecasts with the 1yr at 4.4% vs. 4.0% expected while the 5-10yr hit the highest level since 2011 at 3.2% vs. 3.0% expected. This is not what the Fed wants as they try to keep inflation expectations “well anchored” lest they become self-fulfilling. However, market expectations as measured by TIPS inflation breakeven rates remain more sanguine (see graph below). It will be interesting to see how much that disparity gets mentioned with the bevy of Fed speakers that are tap this week. Given the recent decline in gas and energy prices, along with other commodities, the Fed may be inclined to side with the market’s expectations for now.

- The other big report this week will be October retail sales due on Wednesday. Sales are expected to be soft with the overall down -0.3% vs. 0.7% in September while sales ex autos and gas are expected to be up 0.2% vs. 0.6% the prior month. The sales metric that is a direct feed into GDP is expected to soften from September’s 0.6% print to 0.2%. So, the consumer looks to have taken a bit of a breather in October after finishing the third quarter in a strong spending mood. The question the market and the Fed will be asking is if the expected softening in October is a one-off or the start of a trend where the consumer turns cautious. It’s been a fools errand this year to predict the demise of the consumer but with job and wage growth slowing, and savings continuing to be drawn down, it does warrant scrutiny.

- Other releases of note this week will be PPI on Wednesday, with modest softening expected, and the same on Thursday with October import and export prices. Housing starts and building permits for October are due on Friday with some easing in activity expected which is not surprising given the run-up in mortgage rates during the month.

Finally, we’d be remiss if we didn’t mention the upcoming Friday deadline for a federal budget deal. There’s nothing evident at this point that points to a deal in the works but expect some form of kick-the-can continuing resolution to emerge in the coming days that may survive a bi-partisan vote in the House. Of course, with the last deal having cost then Speaker McCarthy his job current Speaker Johnson will have to thread a tight needle to avoid the same fate. So far, the market is not paying it much mind, but that will change if we get closer to Friday and a deal remains out of reach.

Univ. of Michigan 5-10yr Inflation Expectation Spikes While TIPs 10yr Inflation Breakeven Remains Quiet

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.