Investors Brace for FOMC and April Jobs Report

Investors Brace for FOMC and April Jobs Report

- Treasuries are trading in the green this morning, perhaps in recognition that Japanese officials apparently took advantage of a light volume Monday holiday to intervene in the currency market to defend then yen. It declined to 160yen/dollar overnight, then quickly improved to the low 150’s signaling the intervention. That it came and went so quickly provided a bit of a relief trade to Treasuries. Of course, a plethora of April data will come fast this week, including the FOMC meeting on Wednesday and the new information will impact Treasury yields more than intervention relief. Currently, the 10yr note is yielding 4.64%, down 3bps on the day, and the 2yr is yielding 4.99%, down 1bp.

- After finishing up March data with personal income, spending, and inflation data last Friday, this week attention turns to how things went in April. It’s a full slate of first-tier information, headlined by April jobs on Friday. Oh, and don’t forget the FOMC meeting on Wednesday, just to add to the menu offerings.

- As for the FOMC meeting, no rate moves will be made but we do expect to get some details on the tapering process of QT getting started. Expectations are that the $60 billion/month run-off in Treasuries will be reduced to $30 billion with MBS run-off unchanged at $35 billion, (if prepayments are sufficient). Given the inflation disappointment in the first quarter, we expect hawkish commentary from Powell in the press conference. We don’t, however, think he’ll propose possible rate hikes; rather, the higher-for-longer theme will be reiterated with no prospect for rate cuts anytime soon.

- Before the employment numbers on Friday, we’ll get a host of other April data beginning on Wednesday with the ADP Employment Change Report (185k expected vs. 184k in March), JOLTs job openings (8.665mm in March vs. 8.756mm the prior month), ISM Manufacturing (50.1 expected vs. 50.3 in March). On Friday, the ISM Services Index will be released in the wake of April jobs (52.0 expected vs. 51.4 the prior month). As you can tell from the consensus expectations, it looks like April will off little signs of economic slowing.

- As for the all-important jobs report, headline job gains are expected at 250k vs. 303k in March with private payrolls increasing 200k vs. 232k the prior month. The unemployment rate is expected to remain at 3.8% and average hourly earnings are expected to repeat March’s 0.3% MoM increase, with the YoY rate ticking down to 4.0% vs. 4.1% in March. While it’s slowly moving lower, the Fed would like to see that YoY pace move closer to the long-term average of 3.0%. Like the other April data, the jobs expectations show little, if any, signs of slowing which will embolden the Fed to maintain the higher-for-longer rhetoric.

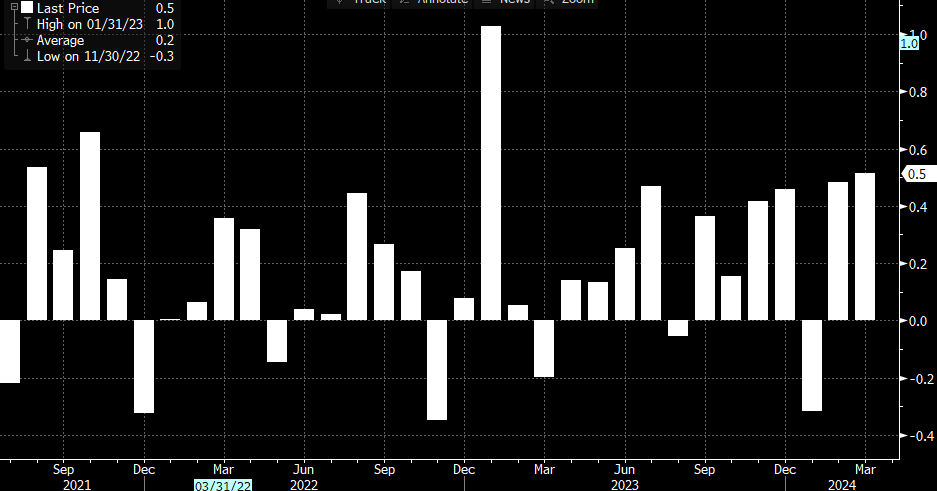

- Given the healthy level of March consumer spending noted in last Friday’s Personal Income and Spending Report, another income report will be released tomorrow with the first quarter Employment Cost Index. This is the most comprehensive look at worker compensation as it includes benefits, and payroll taxes and is a Fed favorite. It has been running around a 1.00% quarterly increase for the past year which is down from the 1.20% – 1.30% quarterly pace in 2022. Annualized, ECI is running just above 4.0% which is aligns to the AHE figures in the jobs report. After a 0.90% increase in the fourth quarter of 2023, first quarter expectations are for a slightly better 1.0% quarterly gain. What this means is that the hefty increases of late 2021 and all of 2022 are trending lower but still probably still uncomfortably high for the Fed.

Above Average Income Gains are Fueling Real Spending (Net of Inflation) Gains

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.