Investors Await Expected Fed Pause

Investors Await Expected Fed Pause

- Treasury prices are higher this morning as investors await the Fed’s rate decision and Powell press conference at 2pm ET. With a pause expected Treasury prices are also being aided by the Treasury’s auction size announcement this morning came in slightly less than anticipated (more on that below). Presently, the 10yr note is yielding 4.87%, up 15/32nds in price, while the 2yr is yielding 5.06%, 2/32nds in price.

- Earlier this morning, ADP saw private sector jobs increase 113 thousand in October which was below the 150 thousand expected, but better than September’s disappointing 89 thousand, which was the lowest since January 2021. While the ADP report has been a poor predictor of the BLS numbers the Friday expectation for private sector jobs is for an increase of 148 thousand vs. 263 thousand in September. Could it be that the anticipated slowing in the labor market is nearly upon us? Meanwhile, annual pay increases for the month were 5.7% for job stayers and 8.4% for job changers. Both pay increases continue a downward trend that has been in place for a year. While still high compared to BLS-reported wage gains, the ADP gains are the lowest since mid-2021.

- Also, the US Treasury announced this morning that next week’s auctions of coupon-bearing Treasuries will be slightly less than most dealers had expected. The Treasury will sell $112 billion of securities at its quarterly refunding auctions next week. The maturities include 3-year ($48 billion vs. $42 billion in August), 10-year ($40 billion vs. $38 billion), and 30-year ($24 billion vs. $23 billion) bonds. Dealers had expected $114 billion, which would have been the same size as the August refunding auctions. The slightly lower issuance announcement has lent an early bid to Treasuries. They also announced that they anticipate one more increase in auction size at the February refunding, which is also helping the Treasury bid this morning.

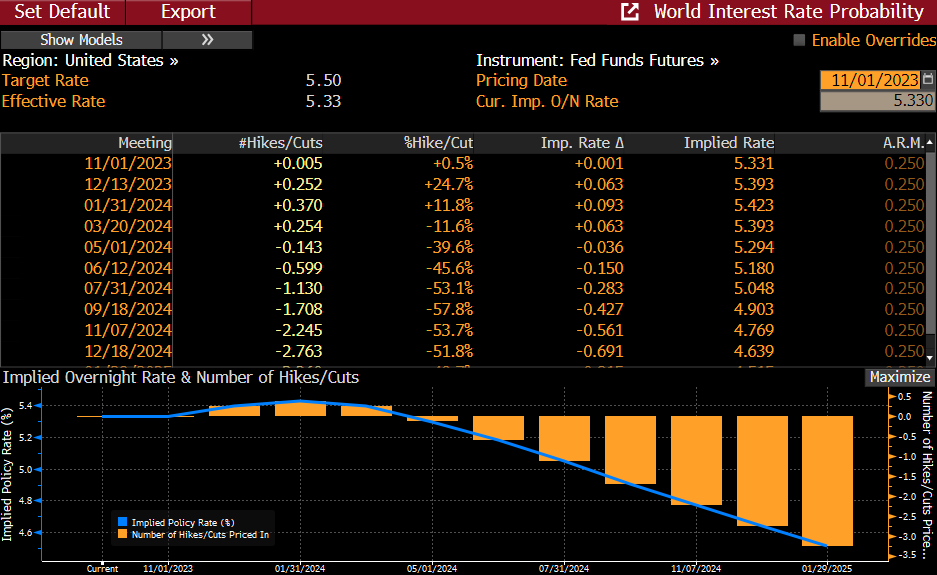

- The Fed is widely expected to pause its rate-hiking at this afternoon’s FOMC rate decision, but Powell will likely keep a potential rate hike on the table, and persist in the hawkish tone, lest the market rally too much in anticipation of a pivot while inflation remains well above the 2% target. The Fed no doubt likes the tightening in financial conditions that has resulted from both the increase in longer-term yields and the recent struggles in equities, yesterday’s rally withstanding. The December meeting is on the 13th and current rate-hiking odds stand just under 25%. That will obviously get adjusted after Powell’s comments today and the employment numbers on Friday. We’ll be back this afternoon with a summary of the FOMC rate decision.

- Away from the Fed meeting, more first tier data is due with the ISM Manufacturing Survey at 10am ET today with an unchanged reading of 49.0 expected. The services survey is due Friday and is expected to remain in expansionary territory at 53.0 vs. 53.6 in September. As has been the case lately, the prices paid index for both surveys will be eyed for any clues on the direction of cost/inflation.

Agency Indications — FNMA / FHLMC Callable Rates

| Maturity (yrs) | 2 Year | 3 Year | 4 Year | 5 Year | 10 Year | 15 Year |

| 0.25 | 5.92 | 5.81 | 5.86 | 5.96 | 6.28 | 6.74 |

| 0.50 | 5.90 | 5.78 | 5.80 | 5.85 | 6.14 | 6.63 |

| 1.00 | 5.90 | 5.75 | 5.77 | 5.81 | 6.05 | 6.50 |

| 2.00 | – | 5.73 | 5.71 | 5.73 | 5.93 | NA |

| 3.00 | – | – | – | 5.68 | 5.86 | NA |

| 4.00 | – | – | – | – | 5.82 | NA |

| 5.00 | – | – | – | – | 5.78 | NA |

| 10.00 | – | – | – | – | – | NA |

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.