Inflation Week Opens and Substantial Improvement Appears Daunting

Inflation Week Opens and Substantial Improvement Appears Daunting

- With the worst of geopolitical fears not being realized over the weekend, Treasuries find themselves on the back foot as trading opens for the week that will be headlined by the March CPI numbers on Wednesday. Currently, the 10yr is yielding 4.43%, down 6/32nds in price while the 2yr is yielding 4.77%, down 1/32nd on the day. Still, that’s the highest 2yr yield since November which reflects the shrinking odds of a June rate cut.

- Outside of geopolitical events transpiring – especially the current tensions between Iran and Israel – the focus this week will be the latest inflation data. The headline report comes Wednesday in the form of March CPI. After a jobs report last Friday that showed surprising strength in top line job growth, but with a more friendly read on wage gains (4.1% YoY down from 4.3% prior and the lowest since June 2021), that still sent bond yields higher, and that tone has carried over in early trading.

- As for CPI details, expectations are for a 0.3% MoM gain in overall inflation vs. 0.4% prior. Due to challenging base effects ( 0.1% from March 2023 rolls off the annual calculations), the YoY rate is expected to increase from 3.2% to 3.4%. Like the overall rate, core CPI (ex-food and energy) is expected to increase 0.3% vs. 0.4% prior, but in this case the core YoY rate is expected to edge lower from 3.8% to 3.7%. That would be the lowest since April 2021, but still a long way from 2.0%. On a positive note, the next two months we’ll see a 0.5% and 0.4% roll off so if we can print 0.3%, or lower, the YoY rate should move closer to 3.0%. After that, three straight 0.2% monthly prints roll off which will make any improvement in the YoY rate much more challenging.

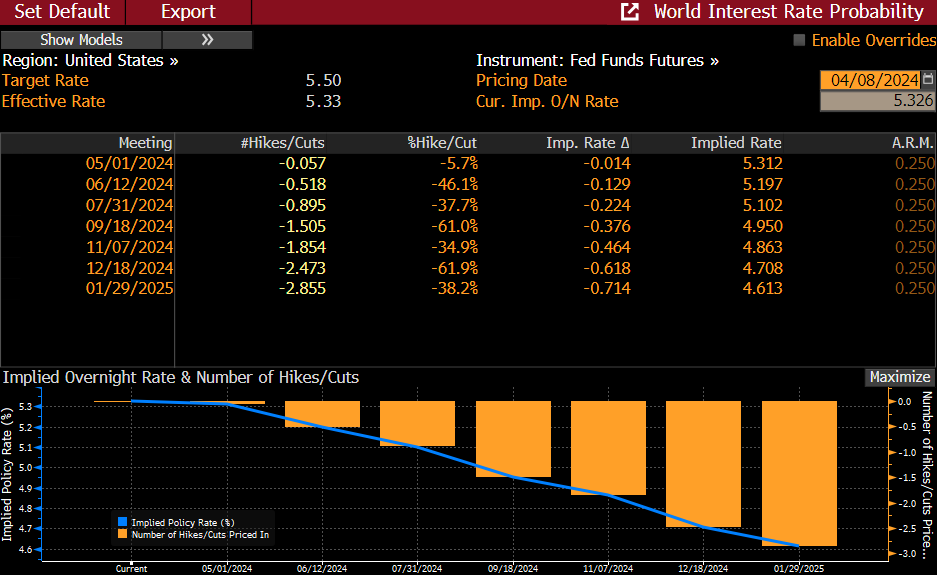

- The risk in the CPI numbers is rather asymmetric. Any soft read on inflation will have to be confirmed by the April and May numbers before the Fed considers a possible June rate cut. Meanwhile, a hot report further dashes the notion that January and February were anomalies, and that will further reduce odds of a June rate cut, which are already teetering (see the latest futures indications below).

- On Thursday, March PPI numbers will be released and while cooler MoM reads are expected, challenging base effects will force YoY rates higher as deflationary numbers roll off from last year. Final demand PPI is expected to increase 0.3% vs. 0.6% prior, while ex-food and energy is expected to increase 0.2% vs. 0.3% prior. On a YoY bases, final demand is expected to tick up from 1.6% to 2.2%, ex-food and energy to 2.3% vs. 2.0% prior. The wholesale deflationary impulse from last year appears over. That deflationary trend contributed to PPI leading CPI lower in 2023 and that trend appears will come to an end this year. That’s another challenging aspect to inflation improvement this year.

- With the goods-side deflationary story at an end, and with oil and other commodities lifting higher on the combination of geopolitical concerns and improving global demand, it makes it more important for the services side to begin easing. The February PCE numbers were encouraging in that regard, so the core services ex-housing number in CPI will be a focus for inflation-watchers on Wednesday.

- It all smacks to us that the so-called last mile on inflation from 3% to 2% will be a tough one. Given the present tightness in policy, the Fed could deliver a token 25bps cut in a few months, but to follow that with more implies continued improvement in inflation which could be a daunting proposition as we sit here today.

Fed Funds Futures – Rate Cutting Odds Continue to Drift Lower

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.