Inflation Week Awaits Investors

- Treasury yields are edging higher this morning as some of the post-jobs report rally is reversed, and inflation reports loom on the horizon. The quick fall of the Assad Regime in Syria adds to the geo-political risk in a region already full of it, but so far there hasn’t been a flight-to-safety rally in Treasuries. That Fed has gone into the Cone of Silence prior to next week’s FOMC meeting so that clears the stage for the inflation reports and geo-political machinations to dominate trading this week. Currently, the 10yr Treasury is yielding 4.18%, up 2bps on the day, while the 2yr is yielding 4.12%, up 1bp from Friday’s close.

- It’s Inflation Week with CPI due Wednesday, PPI on Thursday, and Import/Export Prices on Friday. After that troika, analysts will have a good idea of what core PCE will be when released Dec. 20.

- With the November jobs report behind us, the uptick in the unemployment rate and drop in the Labor Force Participation Rate have kept a rate cut next week the prohibitive call with 87% odds of a cut (see table below). Odds then drop in January to 29% implying a pause and we’re onboard with the consensus outlook as well.

- The employment report was a tale of two surveys. The Establishment Survey was solid with an impressive rebound in new jobs, albeit goosed some by returning strikers and storm rebound, and impressive wage gains. Meanwhile, the Household Survey painted a less optimistic picture. It reported job losses instead of gains and a reduction in the labor force. That led to the uptick in the unemployment rate and the downtick in the Labor Force Participation Rate. The Household Survey gets questioned at times due to its smaller sample size and sometimes ambiguous answers to survey questions, but we’ll just note it was the Establishment Survey’s job growth numbers that were revised lower by 800 thousand for the year as additional hard data was included. It’s something that will no doubt be discussed at the FOMC meeting next week.

- With that backdrop it would have to take a steamy CPI report to derail a cut. Expectations are for core CPI to print 0.3% MoM (0.27% unrounded) with the YoY rate stable at 3.3%. A 0.4% print, or higher, could derail a cut so it’s still not a done deal. The usual suspects to a higher print, Owner’s Equivalent Rent (OER) and core services ex-housing will be key here. The long-awaited rollover in OER has been frustratingly uneven and with the services side of the economy still shouldering the economic load, core services ex-housing carries the risk of a disappointingly hot print. That said, we are comfortable with the consensus call for a 0.3% MoM rate.

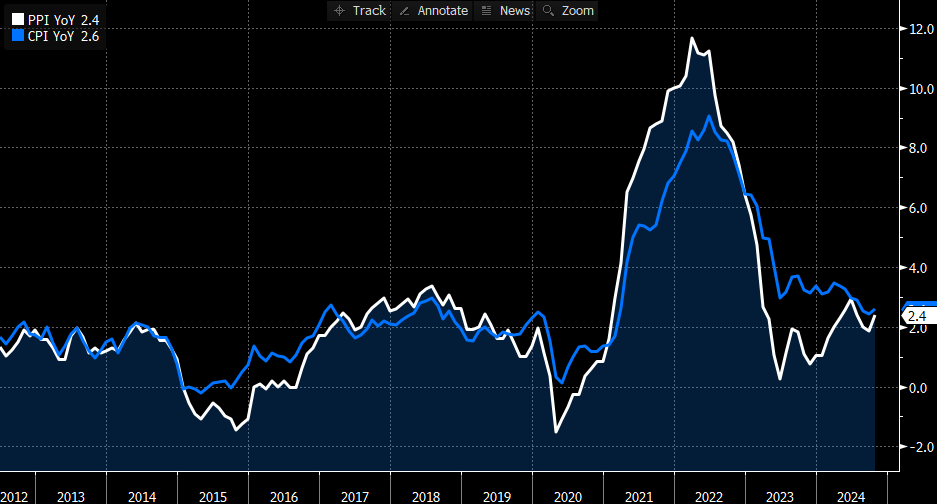

- PPI follows on Thursday with 0.3% MoM gains expected with the YoY rate on Final demand ticking higher from 2.4% to 2.6%. We’ve mentioned before the tailwinds from mid-2022 through mid-2023 when wholesale prices were dropping rapidly has ended with prices grinding higher since mid-2023. That pass through from wholesale to retail will be another headwind for CPI to cover that last mile to the 2% target.

- Geo-political uncertainty increased again over the weekend with the rapid fall of the Assad Regime in Syria. Rebels moved quickly across the country reaching the capital of Damascus faster than most analysts anticipated. Part of the reason was Assad’s protector, Russia, didn’t offer up much resistance which highlights the damage the Russian army has suffered in Ukraine. It is either not interested or incapable of continuing to prop up Assad militarily. What happens next in Syria with Assad’s departure is anyone’s guess, but the power vacuum will bring uncertainty to a region already rife with it. So far, only the oil market appears to be reacting with higher prices.

Odds for a December Rate Cut at 87%, Then a Pause in January

Wholesale Prices Continue to Edge Higher Which Will Be Another Headwind for Further CPI Improvement Source: Bloomberg

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.