Inflation Week Arrives but a Weak Jobs Market is Stealing the Thunder

- Treasury yields are a tick lower this morning as the soft August jobs report continues to reverberate across the financial landscape. In addition, the BLS is expected to release benchmark revisions to 2024 jobs data on Tuesday with another 600k – 800k in downward revisions expected. Thus, the weak jobs picture could get a little weaker following the BLS update. That will take some of the luster and drama off the inflation reports due later in the week. Currently, the 10yr is yielding 4.07%, down 2bps, while the 2yr is yielding 3.50%, down 1 bp on the day.

- After a weak August jobs report that makes a September rate cut a certainty, Inflation Week arrives with a little less on the line as a result. The inflation numbers will still be a key part of the Fed’s decision-making process, but more so for the magnitude and pace of cuts to come after September. Thus, the inflation data this week will still help to shape the Fed’s updated Dot Plot and Summary of Economic Projections (SEP) at next week’s FOMC meeting, but the inflation numbers won’t derail a cut next week, the weak jobs report cast that in stone.

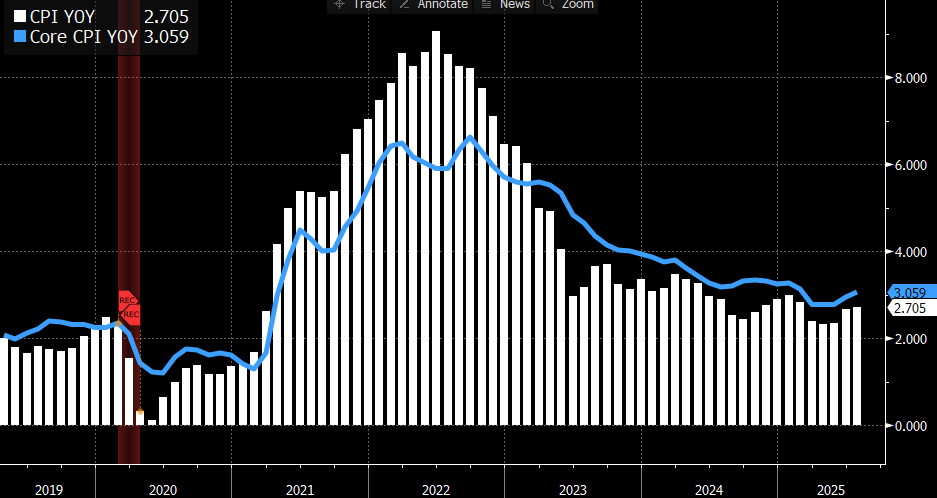

- This is also one of those weird weeks where PPI precedes CPI with PPI on Wednesday and CPI on Thursday. That also works against trying to build some drama over the data. PPI is expected to be up 0.3% MoM as is PPI ex-food and energy, which is not great but certainly better than the 0.9% MoM prints from July. Recall that in July PPI was up 3.7% YoY and 2.8% ex-food and energy. Those YoY numbers aren’t likely to improve despite the slightly cooler monthly prints. What that means is that despite wholesale prices providing something of a tailwind in 2022 and 2023, the gradual climb from disinflation to wholesale inflation has contributed to the challenging retail-level inflation pressures in 2025.

- On Thursday, August CPI is expected to increase 0.3% for the month vs 0.2% in July, with the YoY rate ticking up from 2.7% to 2.8% as low readings from last summer continue to roll off. Meanwhile, core CPI is expected to increase 0.3% MoM vs. 0.3% the prior month, forcing the YoY up from 3.1% to 3.2%. Core services took an unexpected jump in July and that will be watched for any signs of a trend in “piling on” to tariff-inspired price increases even as goods-side inflation was tamer than expected. As mentioned above, even if we get a bit hotter print, a September rate cut will happen, it’s more a matter of whether the pace and magnitude of future cuts will be projected in the updated data coming out of the September 17th FOMC.

- Taking a break from inflation reports, Friday brings us a look at the preliminary University of Michigan Sentiment Survey for September. That report will be interesting from both a sentiment aspect as well as a look at the latest inflation expectations. We’re big on watching what the consumer does and less so what they say but right now they are expecting one-year inflation to be 4.8% and longer-run inflation at 3.5%. Continued upticks in those expectations will not be welcomed at the Fed. They make a big deal about wanting those expectations, particularly the longer-run, “well anchored”. So, the recent drift higher won’t be welcomed as tariff costs and higher wholesale costs continue to bleed into retail-level shelf prices, and that’s as rate cuts are about to begin.

- It’s interesting that in recent comments when Fed officials mention anchoring of inflation expectations, they mention “market-based measures” meaning things like TIPS breakeven rates, which have been docile, and not consumer-level expectations. They’ve had to make that distinction because the consumer sentiment measures have not been “well anchored” of late.

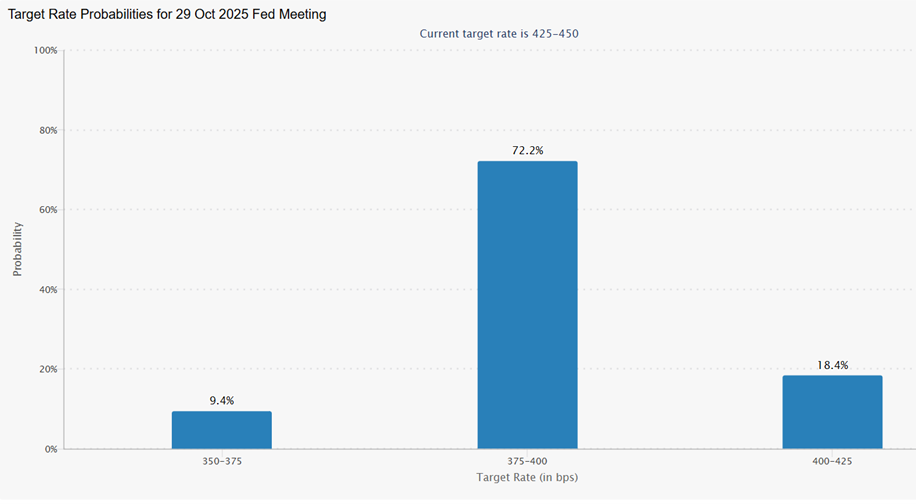

Soft August Jobs Report Now Has Futures Expecting a Second Rate Cut in October

Source: CME Group

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.