Inflation Week Arrives as a September Rate Cut Looms

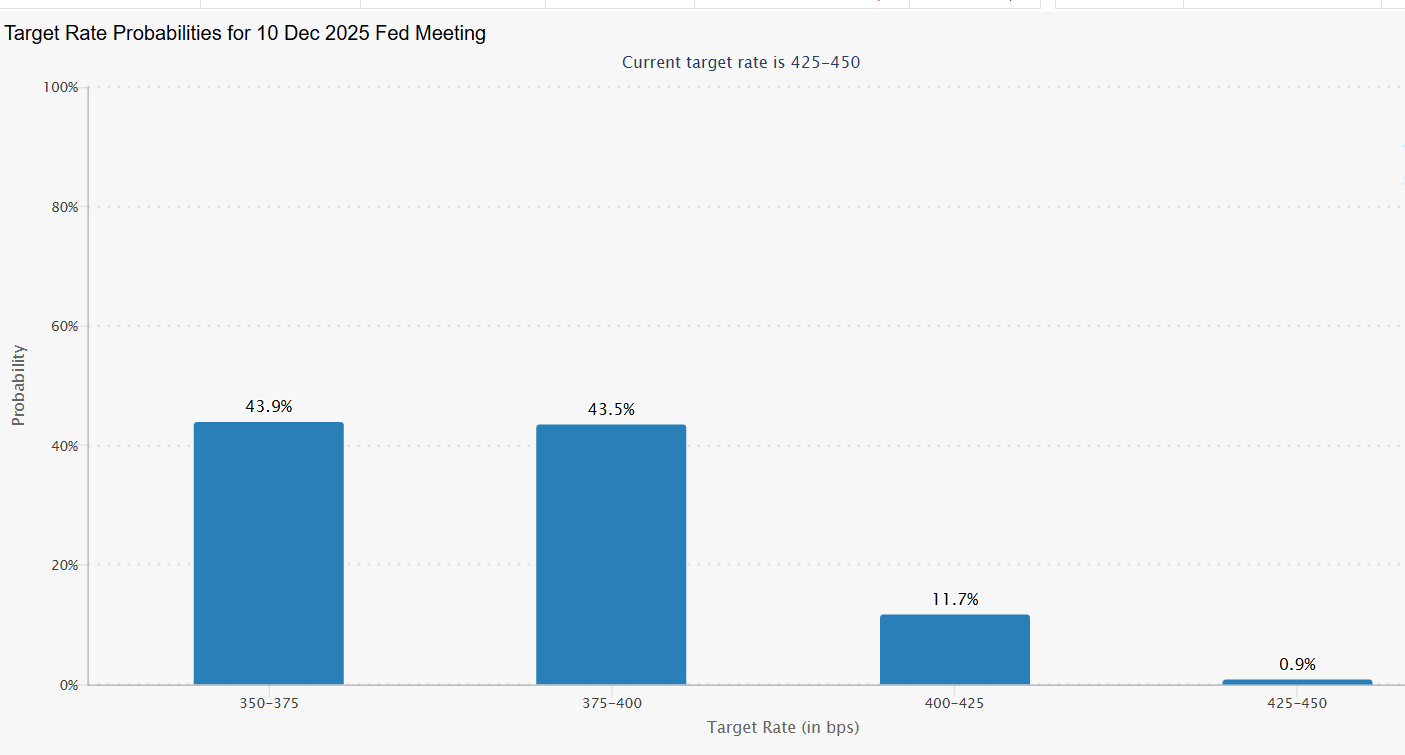

- Treasury yields are a tick or two higher this morning as a modest risk-on mood has Treasuries a bit on the defensive as the week opens. After a rather dull week nearly devoid of data, this week brings the return of Inflation Week with eyes on any additional passthrough of tariff costs, and whether core service inflation, the “sticky” piece, is losing some steam after a string of softer economic and labor market reports. While a September cut appears all but certain, any miss to the high side on inflation will temper some of the hopes for three cuts by year end (see futures outlook below). Currently, the 10yr is yielding 4.27%, down 1bp, while the 2yr is yielding 3.79%, flat on the day.

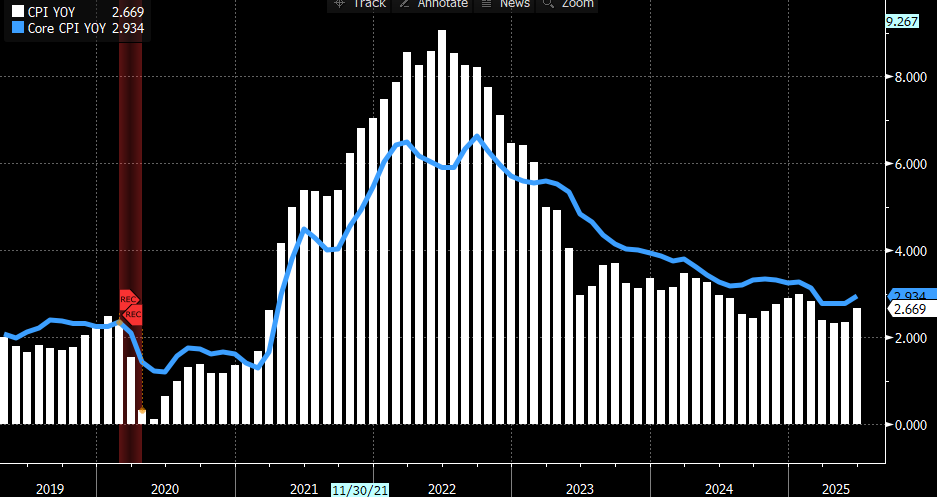

- Inflation Week arrives with all eyes on how much tariff costs are seeping into the data. We still think it’s a bit too early to see dramatic moves, but June data did see core goods prices lift the YoY level positive after being in deflationary territory for much of the last couple years. Will we see more of that in July? That’s the thought, but with still too little overall impact to move the inflation numbers dramatically. It could be a little like watching paint dry. It’s happening but at a glacial pace. Given the weak July jobs report, we think inflation would have to miss significantly to the upside to derail a September rate cut and just don’t see that level of increase coming in tomorrow’s report.

- The July CPI read is expected to show overall inflation rose 0.2% for the month vs 0.3% in June, with the YoY rate ticking up from 2.7% to 2.8% as low readings from last summer roll off. Meanwhile, core CPI is expected to increase 0.3% MoM vs. 0.2% the prior month, forcing the YoY up from 2.9% to 3.0%. If the expectations come to pass, a September rate cut most likely happens, but we expect YoY rates to continue to creep up as unfavorable base effects continue to hamper improvement with 0.2% and 0.3% MoM prints replacing 0.0% and 0.1% prints from last summer. Make no mistake, however, that the increasing evidence of a slowing economy and jobs market may force the Fed’s hand for a second cut before year-end. That’s been our outlook for quite some time, and it remains so today.

- The CPI report will be followed on Thursday by a look at wholesale pricing pressure with July PPI. Recall, part of the reason behind the big drop in retail-level inflation (read: CPI) in 2022 and 2023 was deflation in wholesale prices that was partially passed on in lower retail prices. Wholesale prices are no longer falling and, while the climb earlier in the year has stalled, tariff costs seem likely to begin showing, at least in intermediate inputs, particularly steel and aluminum. Expectations are for MoM increases of 0.2% for the various measures and this compares to flat 0.0% changes in June. That will also work against CPI falling to the Fed’s 2% target.

- Taking a break from inflation, Friday will bring us a fresh look at consumer spending habits in the form of July Retail Sales. Expectations are that overall sales rose a solid +0.5%. That would be the second straight month of solid headline spending (June was 0.6%) coming after May’s -0.9% drop that was a result of slowing auto sales after a pre-tariff surge earlier in the year. Within the details of the release, investors will be focused on the Control Group-a direct feed into GDP- which is seen up +0.5%, matching June’s results. This would put the second quarter in solid shape to improve on the tepid spending of the first quarter when nerves were undoubtedly unsettled from the market’s volatile reaction to the various tariff announcements. Right now, the Atlanta Fed has third quarter GDP at 2.5%, so we’ll see how that gets adjusted following these latest sales numbers.

- Friday also brings the Import and Export Price Indexes and while they will add some to the inflation discussion, tariff costs are not part of the totals so don’t expect to discern any signs of tariff cost bumps because they’re not included. Also, consumer sentiment levels will get attention in the U Mich numbers, in addition to the inflation expectations. The prior two reports saw inflation expectations retreat some from the spike in May, but with tariff talk still very much in the news, any improvement in the 1yr at 4.5% and 5-10yr expectation of 3.4% will likely be marginal. Still, it will remain the metric most eagerly anticipated.

- The Kansas City Fed’s Jackson Hole Symposium at Jackson Hole is scheduled for Aug. 21-23 with the title being, “Labor Markets in Transition: Demographics, Productivity, and Macroeconomic Policy.” Sounds timely, but all eyes will be on Chair Powell’s keynote address on Friday when he could start to lay the groundwork for a September rate cut. He certainly didn’t do that at the last FOMC meeting which came just before the now infamous July jobs report, so we’ll see how his tone shifts in Jackson Hole. The early betting is he does acknowledge the reported weakness and allows a little more dovish tone to surface.

Futures Market Sees About Even Odds of 50bps or 75bps in Cuts by Year-End

CPI and Core CPI Having a Tough Time Lately

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.