Inflation Week Arrives

- Talks between the US and China open today in London on the tariff issue so once again the market will have those headlines to chew on as the week opens, and swirling in the background are the weekend deportation protests in LA. One wonders as the summer progresses and temperatures and tempers get more heated where this eventually goes. Still, we have inflation numbers this week to try and distract from those events and the market is rather calm as we open the week. Currently, the 10yr is yielding 4.51%, up less than a basis point on the day, while the 2yr is yielding 4.03%, down 1bp on the day.

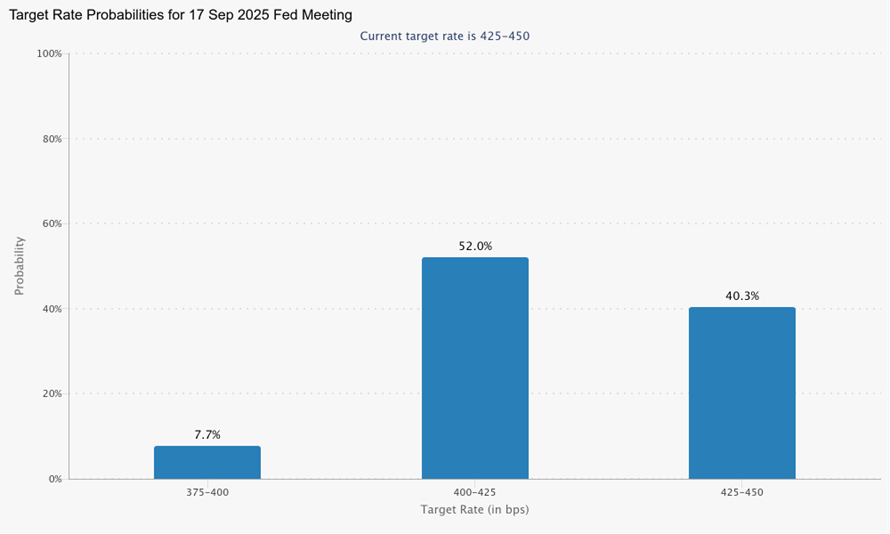

- Inflation week arrives but not with the usual anticipation and angst. While Friday’s latest jobs report wasn’t great, it was good enough to dash thoughts of a summer rate cut, so that dims some of the luster from the inflation numbers expected this week. In addition, the market is waiting on evidence of tariffs impacting the results but if it doesn’t happen in May the expectation is that eventually it will. Thus, even stellar reports on inflation will be greeted with a “yea well, just wait” response. Still, with the market now eying September as a first possible rate cut date, docile inflation readings will go a long way in keeping that hope alive. The trouble is we’re not holding great inflation cards at the moment.

- For example, let’s consider Wednesday’s May CPI read. Expectations are that overall inflation rose 0.2% for the month, matching April, but with the YoY rate ticking up from 2.3% to 2.5% as an unchanged reading from last year rolls off. Meanwhile, core CPI is expected to increase 0.3% MoM vs. 0.2% the prior month (and 0.1% the month before that), forcing the YoY up from 2.8% to 2.9%.

- As we mentioned last month, with the hotter first quarter 2024 numbers out of the calculations, achieving further improvement in the YoY rate towards the Fed’s 2.0% goal will be exceedingly difficult, and that’s before the potential tariff impact. That’s part of the reason in their March forecast, the Fed saw little if any improvement in inflation towards the 2% target this year, and that’s probably still a safe bet.

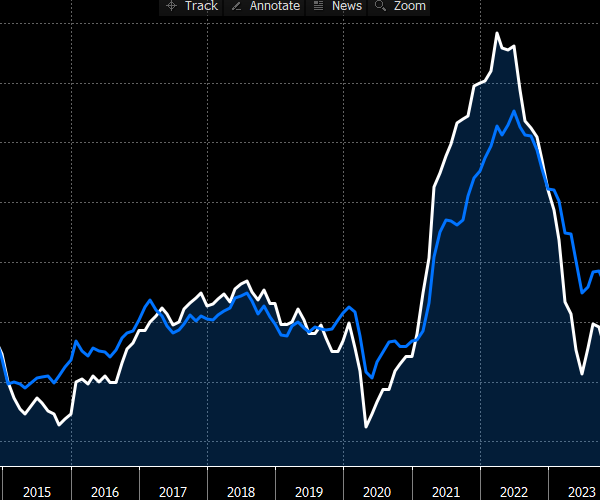

- The CPI report will be followed on Thursday by a look at wholesale pricing pressure with May PPI. Recall, part of the reason behind the big drop in retail-level inflation (read: CPI) in 2022 and 2023 was deflation in wholesale prices that was partially passed on in lower retail prices. Wholesale prices are no longer falling and, in fact, have been climbing in fits and starts for several months (see graph below). One has to think the tariff impact will find its way into these numbers as well, particularly steel and aluminum, which are intermediate level inputs in much of PPI world. That will also work to keep CPI from falling to that 2% Fed target.

- The week will finish with the “getting more interesting” Initial Jobless Claims on Thursday, and the preliminary look at the latest University of Michigan Sentiment Survey. Jobless claims saw the largest print last week since October with continuing claims holding above 1.9 million. Will the trend in both series continue higher, indicating a real-time look at slowing labor momentum?

- Also, while consumer sentiment levels will get some attention in the U Mich numbers, the real attention-getter lately has been the inflation expectations ramping higher, aided by a huge partisan split in those expectations. That behavior has taken some of the signal strength away from the report but it’s becoming a parlor game of sorts to lay odds on how high those inflation expectations can go, especially with the tariff matter still front and center.

- Away from data, the Fed has gone into radio silence prior to next week’s FOMC meeting which is expected to be yet another pass, but with refreshed economic projections and a dot plot the market will have a better understanding of the Fed’s expectations for rates through this year and into next. However, that’s next week’s business and a long summer week in between awaits.

Futures Focus on September Meeting as Next Rate Cut Date

Source: CME

PPI Deflation Had Helped Lower CPI but that Tailwind Seems Over – Especially When Steel and Aluminum Tariffs Hit

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.