Inflation Week Arrives

Inflation Week Arrives

- Treasuries open Inflation Week in the green as investors look ahead to PPI numbers tomorrow followed by the headlining CPI Report on Wednesday. Obviously, investors are hoping for signs of cooling after the string of hot inflation numbers in the first quarter. Currently, the 10yr note is yielding 4.47%, up 7/32nds in price, and the 2yr is yielding 4.83%, up 2/32nds in price.

- It’s hard to overstate the importance of Wednesday’s April CPI Report. If it comes in hot odds of even a single rate cut this year could suffer. The hope, though, is after the softish read from the April jobs report and some secondary employment indicators that April’s inflation data could print as expected or even lower, breaking the hot streak in 2024. In that regard, core CPI is expected to increase 0.3% vs. the 0.4% prints that have been the standard so far this year. The YoY pace is expected to dip to 3.6% vs. 3.8%. Meanwhile, the overall CPI rate is expected to print another 0.4% for a third straight month bringing the YoY pace to 3.4% from 3.5%. The bottom line is no great lessening in inflation pressure is expected and the second half of 2024 will see more challenging base effects which will make YoY improvement more difficult.

- Before CPI on Wednesday tomorrow brings April PPI and the potential signals it carries for the Fed’s preferred PCE inflation numbers due later this month. Expectations are for similar results to March. Final demand PPI is expected to increase 0.3% vs. 0.2% in March with the YoY pace increasing to 2.2% vs. 2.1% in March. That would be the highest YoY rate in nearly a year. Other measures, such as ex-food and energy, ex-food energy, and trade are all expected to match March’s 0.2% MoM prints. The overall message from PPI is that the disinflationary story from last year appears to have played out and that will make hitting the Fed’s 2% target more challenging. This is one of the inflation tailwinds from the second half of 2023 that are turning into headwinds so far in 2024.

- Away from inflation numbers, Wednesday also brings April Retail Sales. Recall, last month surprised to the upside and that strength was also evident in the broader Personal Income and Spending Report. For April, sales are expected to increase 0.4% vs. 0.7% in March while sales ex-autos and gas are expected to increase a scant 0.1% vs. 1.0% in March. The Control Group, which is a direct GDP feed, is also expected to slow to 0.1% vs. 1.1% prior. If the softish expectations are met it will be another report that is picking up hints of slowing. We’ve had the April jobs report, ISMs, and JOLTs all point to some slowing, and a similar performance by consumers in the retail sales area would add to the case that second quarter growth could struggle to match the pedestrian first quarter results. The latest Bloomberg consensus for the second quarter GDP is 1.7%, not to dissimilar to the first quarter’s 1.6% result.

- One report we’ll be interested in is today’s New York Fed 1yr inflation expectation. It takes on a little more importance after the uptick in inflation expectations picked up in Friday’s University of Michigan Sentiment Survey. The 1yr ahead forecast rose from 3.2% to 3.5% while the 5-10yr expectation ticked up to 3.1% vs. 3.0% prior. The Fed’s March report had inflation expectations at 3.0% which has been the trend in 2024. The Fed obviously wants these expectations to trend lower, or at least not move higher, lest they become a self-fulfilling prophecy.

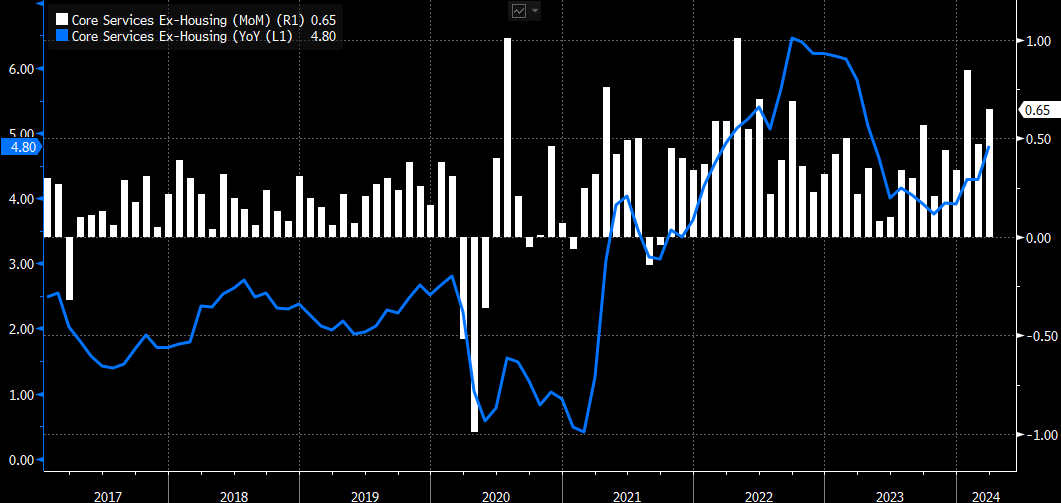

Core Services Ex-Housing (MoM & YoY) – Perhaps Slowing Job Growth and Wage Gains Will Moderate Recent Price Spikes?

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.