Inflation Progress Appears Stalled in 2024

Inflation Progress Appears Stalled in 2024

- Treasuries are breathing a sigh of relief as the March PCE inflation figures came in close to expectations, and generally in line with February, so the fear of a hot print wasn’t realized. We talk more about today’s numbers below but suffice it to say they show inflation progress stalling and a consumer that continues to spend hot and heavy, especially in the service area, something we’ve noted in our own observations. Currently, the 10yr note is yielding 4.67%, down 3bps on the day, while the 2yr is yielding 4.98%, down 2bps.

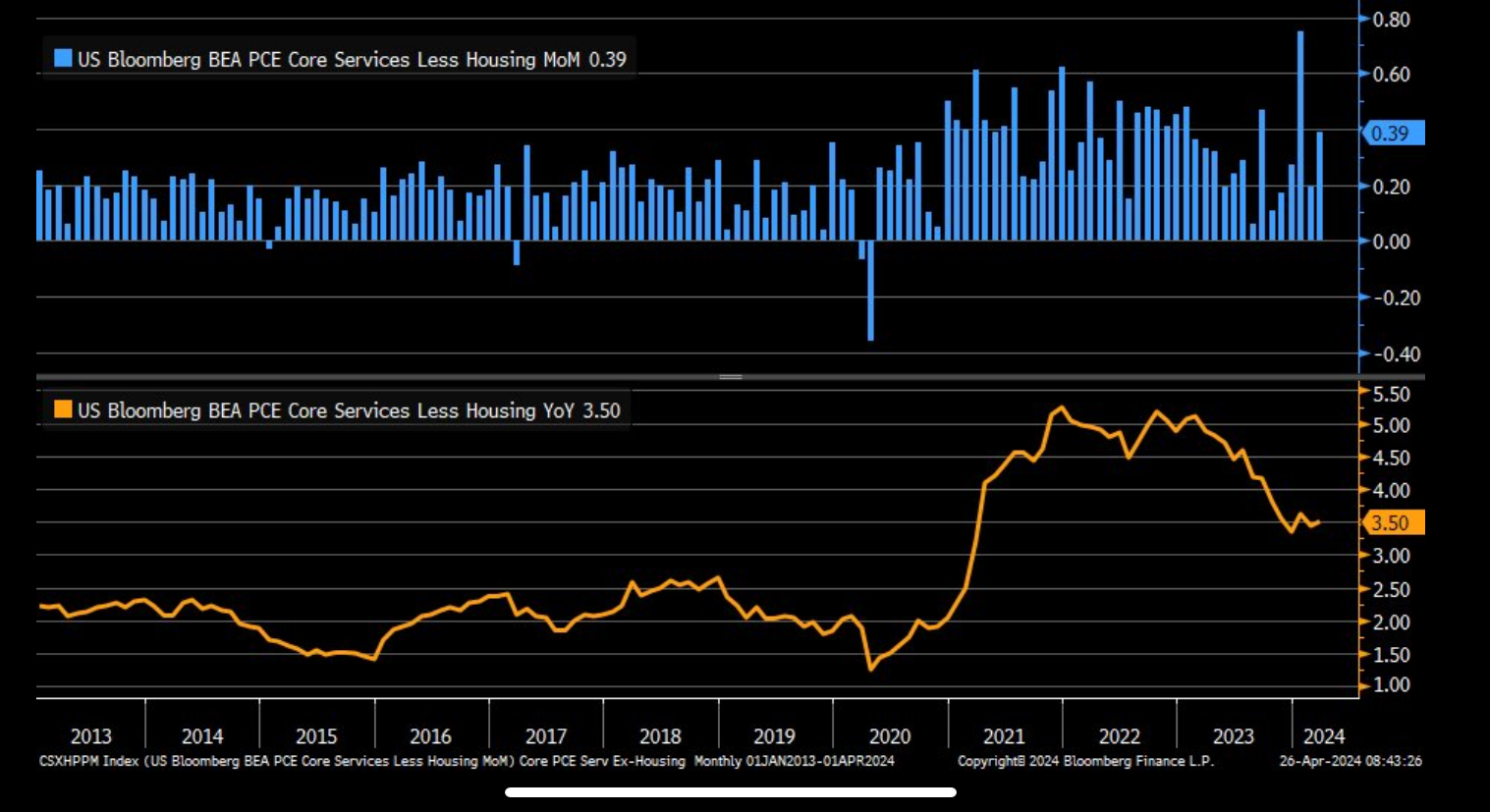

- March core PCE rose 0.3% (0.32% unrounded) matching the nervous expectations and an unrevised 0.3% in February. The YoY rate, however, remained unchanged at 2.8% when 2.7% was expected. The unchanged YoY rate, and the upside surprise in yesterday’s GDP inflation figures, came from an upward revision to January’s core PCE from 0.45% to 0.50% MoM. So, once again, January and all its seasonal issues makes itself known. The so-called Super Core (Core PCE Services ex-housing) came in at 0.39%, higher than the overall core number, and serves as a reminder that most of the stickiness in inflation remains in the service side of the economy, and that doesn’t appear to be changing anytime soon (see graph below).

- Personal income was solid at 0.5%, matching expectations and above the 0.3% gain in February. Personal spending rose a strong 0.8% for the second month in a row and that beat the 0.6% expectation. Real spending (spending net of inflation) rose 0.5% vs. 0.4% in February and 0.3% expected. These solid income and spending numbers certainly refute any stagflation story from yesterday’s GDP numbers.

- In summary, the totality of the numbers reveal inflation progress has clearly stalled in 2024, but not heading materially higher, either. The income and spending numbers remain strong which shows a consumer that is moving ahead without any apparent slowing. That points to a Fed remaining in their higher-for-longer mode with odds of any rate cut this year still focused on the fourth quarter, if they cut at all.

- The initial look at first quarter GDP was released yesterday and headline growth disappointed at 1.6% vs. the Bloomberg consensus of 2.5%. The disappointment, however, can be traced to more one-off, volatile items then a slowdown in consumption. Net exports were a drag as exports slowed while imports surged. In GDP math that subtracts from growth. Also, government spending, particularly Federal spending, was weaker than the fourth quarter and that contributed to the miss as well. Finally, inventory build was less than the fourth quarter which is an extremely volatile segment. There is a category that removes these volatile areas called ‘real final sales to private domestic purchasers’ and that increased 3.1% which is in the range of the past several quarters. Also, the drop in Federal spending will likely reverse as the big fiscal stimulus programs (CHIPs, Infrastructure, IRA) will continue to provide billions in direct investments and tax credits to domestic industries. So, bottom line, we’re not worried with the headline miss but we are bit more concerned with the inflation picture that was painted.

- Core PCE for the quarter (annualized) increased by 3.7% which was three-tenths above the 3.4% expectation and well clear of the 2.0% rate in the fourth quarter. While the hot CPI and PCE reports in January and February have been well chronicled, the miss signals that the sticky inflation story still has more oxygen, and the higher-for-longer rhetoric from the Fed is likely to continue.

- Within the personal consumption category, while it increased a healthy 2.5%, it was less than the 3.3% pace in the fourth quarter, but what was more interesting was that the spending was increasingly concentrated in the services-side vs. goods and that service side has been the stickiest of the inflation components (and we saw that in the March numbers today). So, while growth moderated in the quarter the consumption moved more into the area that has been the most resistant to price moderation. If this trend in service spending continues in the second quarter, and we see no reason to suspect it won’t, it will be another challenge for the Fed to get inflation closer to the 2% benchmark.

Core Services Ex-Housing – The “Sticky” Piece of Inflation

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.