Inflation Data Keeps Treasuries Under Pressure

Inflation Data Keeps Treasuries Under Pressure

- Treasury yields are moving higher as investors absorb all the inflation data this week that has tended to be on the hot side. That has investors revisiting odds of a June rate cut which a week ago were more than 60%, but now it’s closer to a coin-toss. Other than the University of Michigan Sentiment Survey later this morning, and its inflation expectations, there is not much of consequence before the FOMC meeting next Tuesday/Wednesday. Presently, the 10yr Treasury is yielding 4.31%, near the top end of the recent 4.10% to 4.33% range. Meanwhile, the 2yr Treasury is yielding 4.72%, near the high yield for 2024 as odds of a June rate cut fall.

- Yesterday’s February PPI report followed CPI with another hotter-than-expected read on inflation, but there were some encouraging signs in the report nonetheless. First, energy accounted for more than two-thirds of the headline gain of 0.6% which was double the 0.3% expectation. Hot, right? Well, again the bulk of the gain came from higher energy prices. That led to the goods-side increasing 1.2% while the services side moved up a more modest 0.3%. Is the stickiness of service-side inflation starting to ease? That would be big as the Fed waits on core services inflation to start turn lower.

- Also, energy drove the majority of the headline gain. That won’t be included in core PCE so we stand the chance for a decent core PCE inflation numbers due later this month. Based on PPI, some analysts are penciling in a 0.3% to 0.4% core PCE reading. Obviously, the market would much prefer the lower figure.

- PPI ex-food and energy rose 0.3% which did exceed the 0.2% expectation, but it represented a sequential decline from January’s 0.5% gain. The same can be said for PPI ex-food, energy and trade which rose 0.4% vs. 0.3% expected but better than January’s 0.6%.

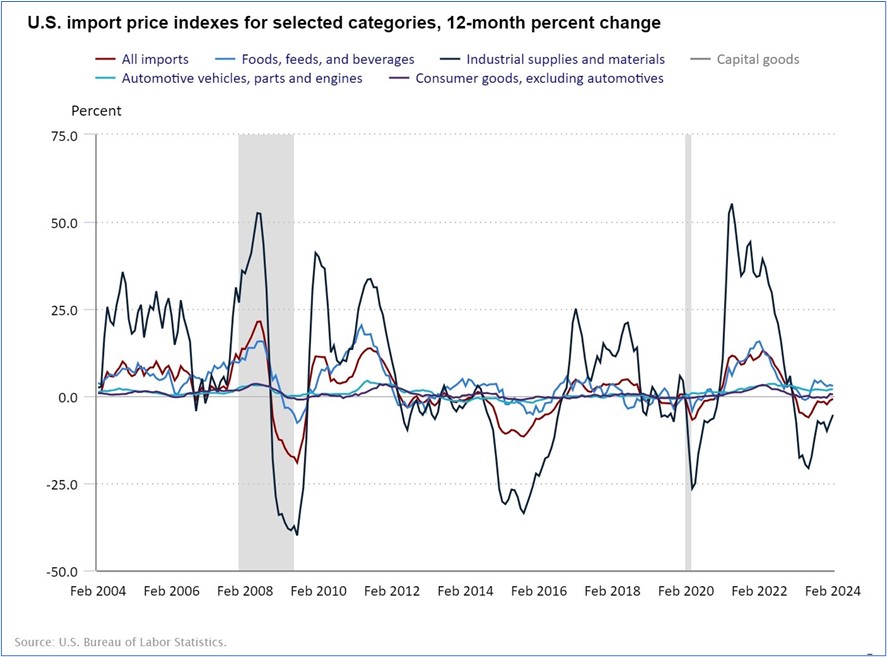

- A third inflation report is out this morning with the February Import and Export prices. Import prices increased 0.3%, matching expectations while import prices less petroleum rose 0.2% vs. -0.2% expected but it does compare favorably to January’s 0.7% increase. On a YoY basis, import prices were down -0.8%, as expected, while in January YoY prices were down -1.3%. So, some slight increases in import prices of late which is gradually clawing back the deflation over the past year. Meanwhile, export prices rose 0.8%, double the 0.4% expectation but less than the 0.9% increase in January. On a YoY basis, export prices have declined -1.8% vs. -2.4% expected which was also the pace in January. Much like imports, export prices are edging higher which is eating into the deflation that was the trend last year. That modest increase in prices from a sector that was previously deflating will incrementally add inflationary pressure going forward.

- Meanwhile, retail sales for February managed a modest rebound after January’s weather-influenced disappointment but sales fell short of expectations. Overall sales rose 0.6% vs. 0.8% expected while January was revised lower from -0.8% to -1.1%. Ex autos and gas sales were up 0.3%, matching expectations, and ahead of January’s poor -0.8% (which was revised lower from -0.5%. So, is this the beginning of the much anticipated consumer slowdown? Maybe so, but remember this was the pattern from last year. The consumer retrenched after the holidays only to come roaring back in the summer and fall.

- Interestingly, the latest Fed Beige Book, that will be part of next week’s FOMC meeting, found consumers becoming more discerning, especially with discretionary spending. Also, it was reported that more businesses are experiencing increasing consumer pushback on price hikes. Are we seeing the discernment and pushback in reduced sales, or is it just a pause like last year? We got burned in 2023 predicting the demise of the consumer, so we’re not ready to declare them down for the count just yet. In addition, TSA boarding statistics continue to show increased boardings vs. last year (only 2 days out of 74 with lower boardings), and many spring break venues are reporting strong attendance. So, put me down in the pause that refreshes category for now.

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.