Inflation and Retail Sales Headline this Week’s New Information

Inflation and Retail Sales Headline this Week’s New Information

- Treasury yields are waffling around unchanged this morning as the lack of a weekend catalyst has allowed the dust to continue to settle from the volatility of early last week. This week provides plenty of new inputs for Fed policy as inflation data will be followed by retail sales. Meanwhile, last Saturday hawkish Fed Governor Michelle Bowman stuck to her hawkish tendencies noting that inflation remained “uncomfortably high.” Those comments are seen as on brand so it has done little to Impact trading, but it does indicate that a rate cut decision in September, and certainly 50bps, may not be a unanimous affair. Currently, the 10yr note is yielding 3.95%, up 1bp on the day while the 2yr is yielding 4.07%, also up 1bp on the day.

- While last week was sparse with new data points, this week leads with inflation numbers for July and then finishes with a look at the labor market and consumer in the form of weekly jobless claims and July retail sales, both on Thursday.

- This month, PPI leads CPI with its release tomorrow and CPI on Wednesday. In general, PPI is expected to be a bit softer than the spicier numbers in June. Final Demand is expected up 0.2% matching June while Final Demand Ex Food & Energy is expected at 0.2% vs. 0.4% in June. Final Demand YoY is expected to ease from 2.6% to 2.3% while Ex-Food & Energy is expected to ease down to 2.7%YoY vs. 3.0%. During the downturn in inflation readings from the 8% highs of 2022, PPI has been leading CPI lower, but it looks like the disinflation impulse from wholesale prices over the past two years has about played itself out, which will force CPI to look elsewhere for continuing improvement.

- Speaking of CPI, Wednesday’s July release is expected to see headline inflation increase 0.2% MoM vs. -0.1% in June, while the YoY pace is expected to be unchanged at 3.0%. Core CPI (ex-food & energy) is expected to also be up 0.2% MoM vs. 0.1% in June with the YoY pace dipping from 3.3% to 3.2%. June saw Owners Equivalent Rent finally slip to pre-pandemic levels increasing 0.3% MoM vs. 0.4% in June. While that one-tenth dip may not look impressive, at 27% of CPI it’s the single largest input in the basket so small moves make big waves. Also, core services printed negative for a second straight month as the previous stickiness of that segment seems to be easing as labor market momentum slows and as the consumer becomes more discerning with purchases.

- With CPI and PPI in hand, analysts will be able to provide decent estimates for the end-of-month PCE inflation series. Recall, June core PCE printed 0.2% MoM which kept the YoY pace at 2.6%. It started the year at 2.9%, so improvement has been grudging and, as we’ve mentioned before, base effects in the second half of 2024 will make further dips in YoY rates tough if monthly prints remain around 0.]2%.

- The attention then shifts from inflation to the labor market and consumption with weekly jobless claims and retail sales. Jobless claims are expected to be close to last week’s downtick in claims with continuing claims expected to be 1.870 million vs. 1.875 million the prior week. If that comes to pass, it will provide additional soothing of frayed nerves generated off the pop in claims the previous week and the soft July jobs report. Retail sales are expected to be below the outsized gains in June (especially ex-auto and Control Group), but still in positive territory which does play into the more discerning consumer story.

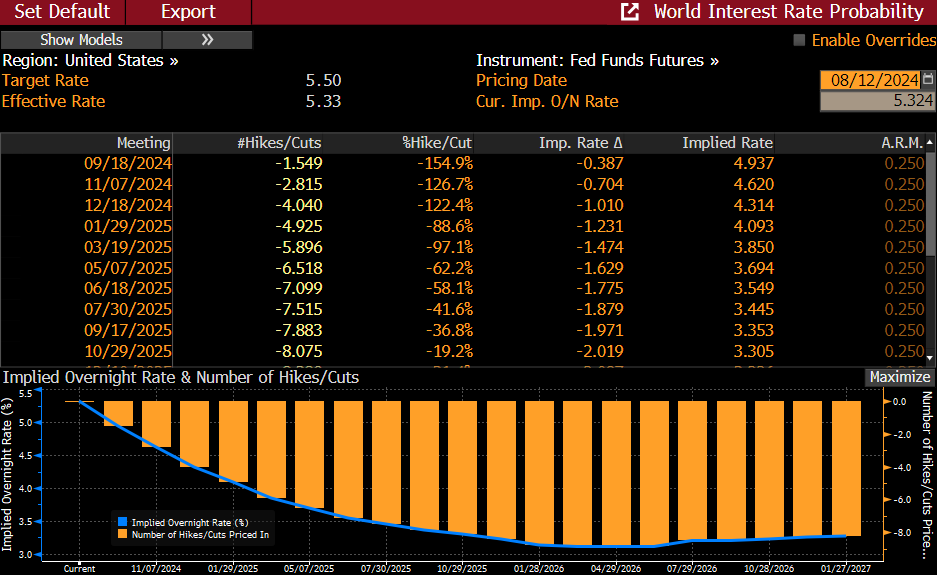

- Our thought is that if the inflation numbers don’t surprise to the upside by an appreciable margin (say 0.4% or better), rate cuts in September are a given, with the 25 to 50bps decision coming down to labor market conditions and the state of the consumer. Call it the revenge of the full employment mandate that has had to sit on the sidelines for two years as the Fed focused on the price stability/inflation mandate. So, of the reports this week, the more influential for the Fed’s September rate decision will come more from the labor market indicators (jobless claims) and consumer spending numbers (retail sales). The futures market sees 38bps in rate cuts at the September meeting, implying a lean towards a 50bps cut but not quite all the way there, yet (see table below). This week’s numbers will certainly help to add more clarity to those odds.

Futures Market Sees 39bp September Rate Cut Implying a Lean Towards 50bp

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.