Hot Retail Sales Provided Another Boost to Treasury Yields

- Treasury yields are slightly lower this morning as a mixed message on housing starts and permits have traders waiting for the next big tradeable event. Fed speak may provide a spark with three (Bostic, Kashkari, Waller) set to talk today. All have been rather vocal in their views on policy going forward, so some headlines following the string of stronger data will likely pop up today. Currently, the 10yr Treasury is yielding 4.08%, down 1bp on the day, while the 2yr is yielding 3.95%, down 3bps on the day.

- Advance Retail Sales for September came in stronger than anticipated and that boosted Treasury yields and caused some to rethink a November rate cut. Overall sales rose 0.4% vs. 0.3% expected and 0.1% in August. Similar strength was found across the other categories: sales ex auto and gas (0.7% vs. 0.3% expected and 0.2% the prior month). The so-called Control Group jumped 0.7% vs. 0.3% expected which was the August result as well. Digging through the 13 categories, nine saw monthly gains indicating it was a broad-based move. With this series more goods-based, we think there was a fair amount of pre-hurricane buying, along with stocking up of items before the short-lived dockworkers strike, that helped goose the numbers. The more comprehensive personal spending numbers for September that comes along with the PCE inflation series will provide a more fulsome tell on consumer spending. That report is due October 31.

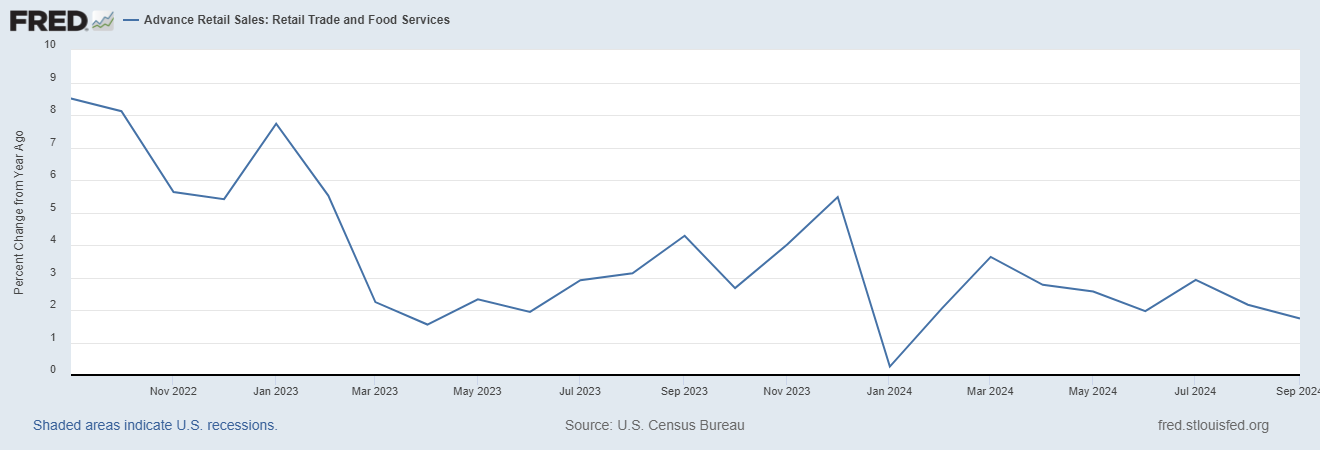

- In any event, the upside surprise in retail sales had the Atlanta Fed update their third quarter GDP estimate from 3.2% to 3.4%. A solid result, for sure, and the solid spending may well be repeated in October with replacement of hurricane-damaged goods providing another impetus for outsized spending. Finally, we’ll add this last point in that while retail sales continue to increase the pace of that increase is slowing, see graph below of the annual change in sales.

- We mentioned Wednesday that the seemingly friendly import/export prices from Wednesday, would be assimilated into estimates for core PCE. The one caveat now is that airline fares soared over 13% (non-seasonally adjusted) and that is a direct feed into core PCE. As of of now, estimates continue to come in around a “high” 0.2% but could easily slip to 0.3%. Certainly not like the more friendly 0.1% (0.13%) print from August. That would be disappointing and make the discussion around a possible rate at the November FOMC meeting a lot more contentious.

- We still expect a 25bps cut as the Fed is seeking to normalize policy, not provide easing to a struggling economy. With the current funds rate clearly in restrictive territory no matter where you believe the neutral rate currently resides, a 25bps cut in November will still have the funds rate in restrictive territory. The hawks will be offering up some opposition no doubt but with both the full employment and price stability mandates in, or near, balance some course correcting closer towards neutral seems a reasonable path.

- Meanwhile, Weekly Initial Jobless Claims fell back to 241 thousand vs. 260 thousand expected which matched the prior week’s result. The claims spike from the prior week wasn’t all about Hurricane Helene but this week’s number did have some curious results. Georgia recorded the highest weekly increase at 3 thousand new claims, while North Carolina and Florida both saw decreases of 2 thousand and 3 thousand, respectively. Perhaps Georgia was a delayed response to Hurricane Helene which did a lot of damage in the south and northeastern parts of the state. Florida will likely see a healthy spike in claims next week as Hurricane Milton hit late Wednesday/early Thursday so filings are probably happening this week. In any event, the storms, the Boeing strike, and labor unrest (dockworkers abbreviated strike), all point to a noisy period for this series after a multi-month run of very little volatility.

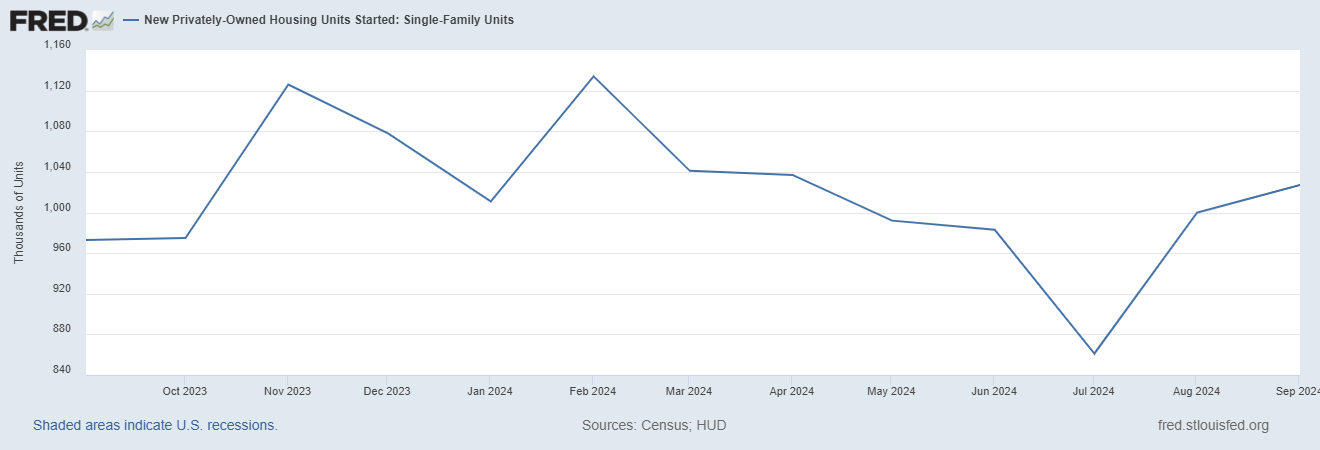

- The only item left for this week was the September Housing Starts and Permits report this morning. Starts fell from 1.361 million annualized to 1.354 million, just above the 1.350 million expected. To be fair, the softening was more in multi-family as single family starts rose slightly from 1.000 million in August to 1.027 million, the highest since April. Permits fell as well to 1.428 million vs, 1.460 million expected, and short of the 1.470 million annualized in August. With yields backing up on the stronger economic and labor numbers this month, mortgage rates are following and that will provide a renewed headwind; thus, the housing market is likely to struggle in the fourth quarter.

Retail Sales Continues to Grow, But the Annual Rate of Growth is Slowing

Weekly Jobless Claims Retreat from Last Week’s Spike but Another Could be Coming Next Week

Single-Family Housing Starts Rose in September but Higher Rates May Stifle Further Improvement

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.