Ho-Hum Fed Meeting Puts an End to a Tumultuous Week

- Was it sell the rumor, buy the fact? After the initial run-up in yields in anticipation of a Trump win, yields are consolidating at lower levels as perhaps a rethink is occurring and an acknowledgement that any change in policy, inflationary or not, will take time to work through the economy. Call it a second half of 2025 thing, not a November one. Currently, the 10yr Treasury is yielding 4.30%, down 5bps on the day, while the 2yr is yielding 4.21%, down 1bp on the day.

- The market was expecting a rather dull FOMC meeting and rate decision and that’s pretty much what was delivered. The Fed did cut 25 bps with the vote being unanimous. Powell did note that even with that cut policy remains in restrictive territory, and reiterated they did not seek additional labor market cooling, which implies to us another 25bps cut in December, absent any real inflation surprises.

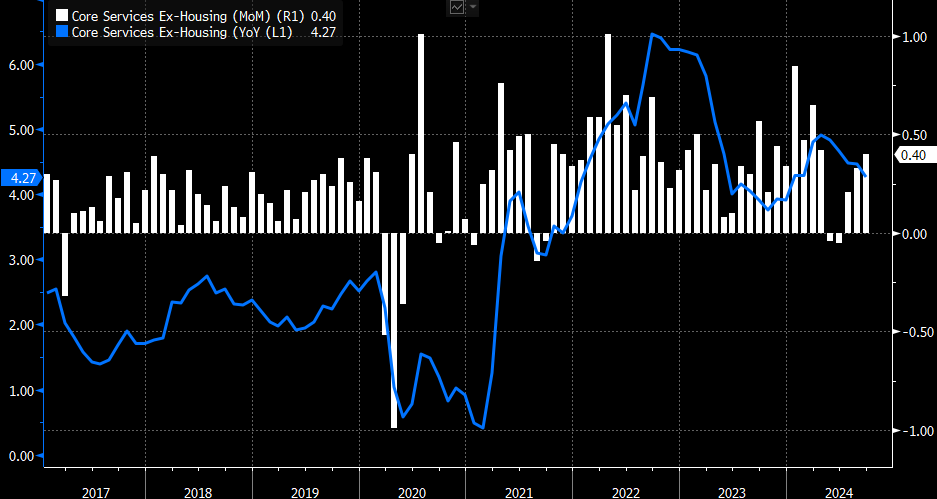

- Speaking inflation, the statement changed the characterization from “greater confidence” in getting to the 2% goal to “made progress.” Perhaps this speaks to some of the back up that we saw in the September inflation numbers, and maybe a nod to the policy uncertainty with a new Administration waiting in the wings. As for the inflation numbers, there was a back-up in the core services ex-housing in September and that marks two consecutive months where it has trended higher (see graph below). That is that “sticky” part of inflation that looked to be coming down earlier in the summer, so possible concern that there is some backsliding.

- Also, the always baffling and lagging Owner’s Equivalent Rent component refuses to definitively roll over and being the largest single piece of CPI at 27% until it does move lower it will create problems getting back to the 2% target.

- Meanwhile, initial jobless claims continue to report muted layoffs and that is good news. That’s been a canary-in-the-coalmine for signaling another leg lower in the labor market and to date it’s not happening. Employers remember the difficulty in staffing after the lockdowns and seem reluctant to let go fulltime, trained workers. When that starts to happen, you’ll know we’ve entered another negative phase in the labor market.

- What’s not so great is the increase the continuing claims numbers. Those increased to 1.892 million vs. 1.873 million estimated and 1.853 million in the prior week. Continuing claims have been steadily increasing which indicates employers are slowing hiring and that’s a trend that will concern the Fed. Just another reason to expect a 25bps cut in December.

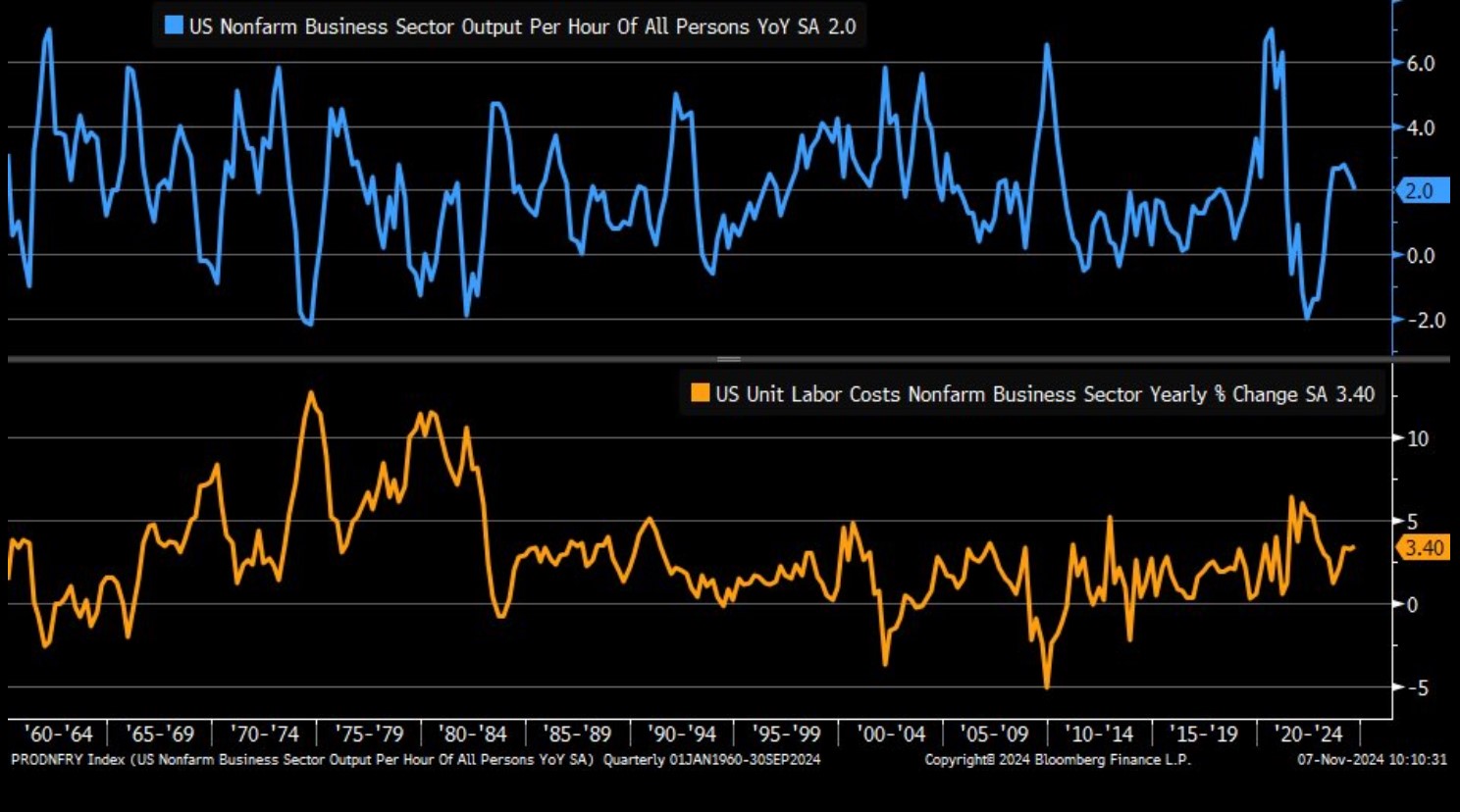

- Finally, yesterday we received the preliminary productivity numbers for the third quarter. They came in at 2.0% compared to a Bloomberg consensus calling for 2.5%. Unit labor costs increased 3.4% YoY. While below expectations the trend has been one of improvement. One way to keep wage gains from becoming too inflationary is to have people working more efficiently. While the increasing adoption of AI may be behind some of it, there’s probably more to it than that but it’s better to see that upward trend in productivity continue.

Core Services Ex-Housing – Trending in the Wrong Direction

Source: Bloomberg

Owner’s Equivalent Rent – Still Above Pre-Pandemic Levels

Source: Bloomberg

Third Quarter Productivity and Unit Labor Costs – Off from Second Quarter Results but not too Bad

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.