Goldilocks Inflation Report Greets the Fed

Goldilocks Inflation Report Greets the Fed

- A Goldilocks inflation report has Treasuries rallying as it puts a September rate cut back on the table which should be confirmed when we see the updated dot plots later this afternoon. We go into more detail below on the May CPI report but suffice it to say it came in cooler than expected across-the-board. Currently, the 10yr note is yielding 4.27%, down 13bp in yield, and the 2yr is yielding 4.67%, down 16bp in yield. It’s the lowest yield since April 4th.

- It’s hard to ask for a better inflation report than what we got this morning. Core CPI increased 0.2% (0.16% unrounded vs. 0.3% (0.292% unrounded) in April. It’s the lowest core print since August 2021. Expectations were at 0.3% with some leaning towards a “high” 0.2%. Recall, in the first quarter core printed a trio of 0.4% MoM readings followed by April’s dip to 0.3% so the drop to 0.2% core is indeed good news. The YoY pace dipped to 3.4% vs. 3.6% in April and better than the 3.5% expectation. It is the lowest YoY core rate in three years with shelter expense accounting for two-thirds of the YoY increase. Getting that long-awaited slowing in shelter costs seems key to getting that last mile in inflation. The 6-month annualized rate is now 3.8% (down from 4.1% in April) and the 3-month annualized rate dipped to 3.3% vs. 4.1% in April.

- The overall CPI rate was unchanged on the month beating the 0.1% expectation and much improved from the 0.3% print in April. The YoY pace dipped to 3.3% from 3.4% in April which was also the pre-release expectation. Gas prices decreased 3.6% during the month, but shelter expense increased 0.4% for the fourth straight month. So, the long-awaited slowing in shelter costs will have to wait yet another month. After two months of hefty gains, car insurance dipped -0.1%, much improved from a 1.8% increase in April and 2.6% in March. New cars prices declined for a third straight month (-0.3%) while used car prices rose slightly (0.6%) after two months of declines.

- The all-important but horribly lagging Owner’s Equivalent Rent component rose 0.4% for a fourth straight month and is up 5.6% YoY. With a CPI weighting of 27% it’s going to have to move lower to get closer to the Fed’s 2% target. It was averaging 0.2% – 0.3% MoM pre-pandemic.

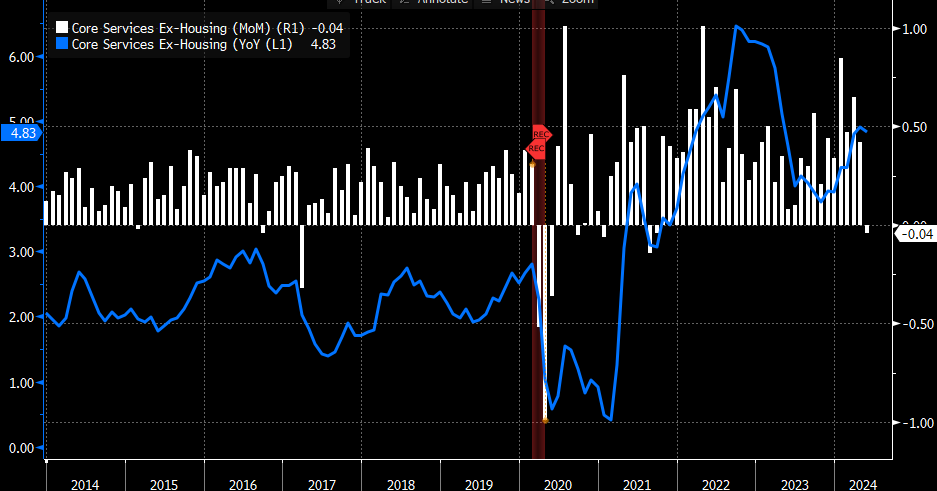

- The other key Fed metric. core services ex-housing, deflated during the month, albeit slightly, at -0.04% vs a 0.4% increase in April. It’s the lowest MoM rate since September 2021. The decline in core services ex-housing is somewhat surprising given the 0.4% wage gains in May which had many expecting another lofty number, but it just adds more head scratching to the noisy jobs report.

- Another interesting observation from this report, food at home was unchanged while food away from home (think restaurants) rose 0.4% for a second straight month. On an annual basis it’s 1.0% at home vs. 4.0% away. Those are similar rates to April, so it seems time to push-back on the ongoing price increases at our favorite eateries. Enough already!

- It’s hard to ask for a better inflation report, especially prior to the FOMC rate decision. The unchanged overall rate, drop in core to 0.16%, and core services ex-housing dipping into negative territory should set the stage for a possible September rate cut if the next three inflation reports are somewhat similar. It does show that in most areas, the inflation battle is being won but to get to the 2% target shelter costs (OER) are going to have to tick lower than the string of 0.4% readings of late. Given the complex and lagging methodology in calculating OER, the Fed is wise to look past it in certain respects which is what they are doing with the core services ex-housing metric.

- As far as the Fed meeting goes, this report likely seals the deal on a two-cut projection for this year in the updated dot plots. That puts a September rate cut back on the table. We’ll be back this afternoon with a post-FOMC analysis so look for that around 3pm ET.

Core Services Ex-Housing – Goes Negative in May, Lowest Since September 2021

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.