Geopolitical Risk Overrides Inflation Concerns For Now

Geopolitical Risk Overrides Inflation Concerns For Now

- Increased geopolitical risk is providing a reprieve to higher yields this morning as flight-to-safety trades are the flavor of the day as the weekend looms. This may be just a brief respite, however, before inflation angst returns (more on that below). Currently, the 10yr is yielding 4.49%, down from 4.58% yesterday, while the 2yr is yielding 4.88%, down from 4.98% yesterday, but as mentioned those levels could be tested once again.

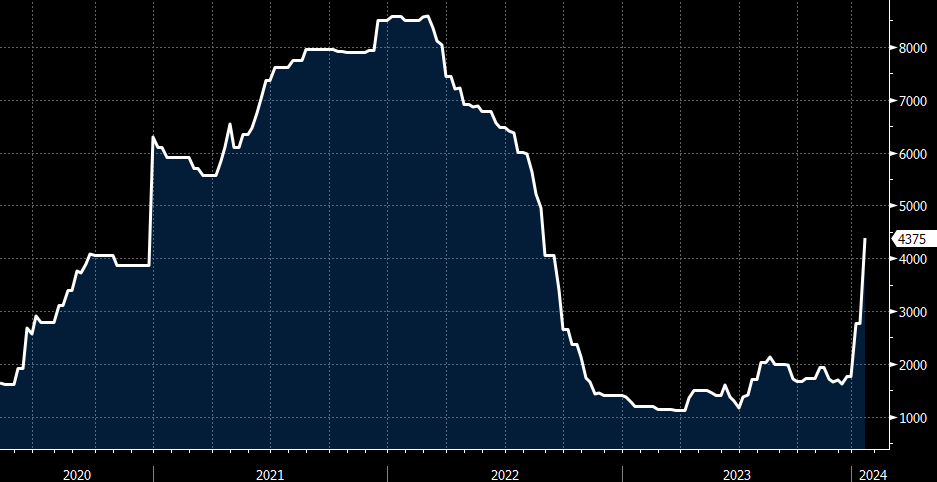

- With saber-rattling intensifying between Israel and Iran it seems sadly inevitable that something will happen soon and so flight-to-safety trades are occurring as the weekend looms. The other implication is that the prospect of increased conflict will increases costs, especially for shipping, which has already suffered higher rates given the Red Sea attacks (see graph below). So, while a flight-to-safety trade benefits Treasuries today, higher costs, and thus yields, seems to be the longer-term eventuality.

- After the CPI numbers on Wednesday, investors could be excused for approaching the PPI report with some trepidation, but thankfully the monthly numbers met or beat expectations. Overall PPI rose 0.2% vs. 0.3% expected and that’s much improved from the 0.6% print in February. Yet, given that last year we were regularly seeing monthly wholesale deflation, the YoY rate increased from 1.6% to 2.1%. PPI ex-food and energy increased 0.3% matching February’s increase but above the 0.2% expectation. Again, because 2023 featured wholesale deflation, the YoY pace increased from 2.0% to 2.4%. Finally, PPI ex-food, energy, and trade increased 0.2% matching expectations, but again YoY rose from 2.7% to 2.8%.

- There are two things to glean from the report: (1) The as-expected monthly prints, at levels generally below February’s, bode well for the final inflation piece, PCE, the Fed’s preferred measure. There are several elements of PPI that flow into PCE so the somewhat docile March numbers imply a core PCE print in the 0.2% – 0.3% range. That should be enough, given favorable base effects, to lower the YoY pace a tenth or two from the current 2.8% rate. (2) The other issue from the report is not so favorable. Wholesale prices led CPI lower in 2023 with many months printing negative, reflecting outright price declines. That has mostly played out so the deflationary tailwinds from wholesale prices in 2023 will not repeat in 2024, and that adds to the challenge of covering that last mile from 3% to 2%.

- Given what looks like what could be a market and Fed friendly PCE report for March, the Fed speak this week has been relatively benign with comments that inflation rarely moves in a straight line so patience remains the order of the day. There was not much mention of the CPI report and the higher trend in 2024. Given they prefer PCE, and the outlook for a decent report, perhaps it’s not surprising that alarm bells are not going off within the walls of the Eccles Building. There are more Fed speakers on tap for today (Collins, Schmid, Bostic, Daly). The final two are FOMC voters this year and Bostic has already been vocal in expecting only one cut this year with it coming late in the year. He seems to be ahead of the group in that regard but we expect he’ll reiterate that view again given what we’ve learned this week on inflation.

- Perhaps adding a little more last-mile concern, the tailwind from deflationary import prices appears at an end as well. Today’s import/export price report for March was a touch hotter than expected. The bigger concern is that in the twelve months ended March 2023, imports declined -4.7%, while the twelve months ended March 2024 increased 0.4%. The era of importing of deflation appears over. Another interesting aspect of the report was that import prices from China declined -0.1%, still deflationary but by a scant margin. Import prices from China last rose in October 2022. While imports are not a big piece of the US economy, it does look like yet another inflationary tailwind from 2022/2023 is ending if not reversing.

- Taking in the above information, the increased geopolitical risks and the higher cost fallout it implies (oil is already jumping again), and commodity prices that look to have bottomed, it does seem the so-called last mile will be a struggle, and if the Fed is serious about maintaining the 2% target, the higher-for-longer patient approach appears will be the policy for much of 2024. To us, the market seems in pushing rate cut expectations to late second half 2024, with one, or two at most, being the number.

Shipping Container Rates – Price Increases Reflect Heightened Geopolitical Risks

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.