Geopolitical Risk Comes off the Boil, for Now

Geopolitical Risk Comes off the Boil, for Now

- With the worse-case scenario in the Israel/Iran conflict not happening over the weekend, Treasuries are under early pressure and the strong retail sales numbers for March (more on that below) are contributing to the selling pressure. Of course, the last chapter in the Israel/Iran issue is a long way from being written, but for now, a risk-on trade opens the week. Currently, the 10yr is yielding 4.62%, up 13bps from Friday’s close, while the 2yr is yielding 4.98%, up 10bps from Friday’s close. Year-to-date highs are once again being set.

- Going into the weekend, there probably not many willing to bet that equity futures and bond yields would be higher but here we are. Despite the firing of hundreds of drones, along with missiles, the Israeli defense along with US assistance downed most of the projectiles. Iran said they considered the matter closed, absent a retaliation from Israel, which can’t be dismissed.

- The absence of the worst-case scenario developing has oil retreating but the unwinding of flight-to-safety trades in Treasuries put on before the weekend added to the early Monday pressure and an upbeat Retail Sales Report for March has Treasuries pushing to year-to-date highs. Again, not many would have guessed that leaving the office on Friday. As they say, life comes at you fast.

- Regarding those retail sales numbers, they were solid across the board. As is customary, we’ll offer the usual caveats with the report and that is the numbers are not inflation-adjusted and more heavily weighted toward the goods category vs. the more comprehensive Personal Consumption Expenditure numbers that will come at the end of the month. That said, overall retail sales rose 0.7% in March vs. 0.4% expected and 0.9% in February. Sales ex-autos and gas were up 1.0% vs. 0.3% expected and 0.5% the prior month. The control group category, which feeds directly into GDP rose a strong 1.1% vs. 0.4% expected. It was interesting to note too that non-store retailers (think Amazon, etc.), increased 2.7% for the month vs. 0.2% in February. For the past twelve months, this category has grown sales by an impressive 11.3%. The consumer is getting increasingly comfortable using this channel to consume which seems certain to only increase. The result is likely to boost the Atlanta Fed’s GDPNow estimate of first quarter GDP, which currently stands at 2.46% before these new numbers are incorporated.

- So what does the Fed think of all this? Well, this week will be the last chance for them to voice those opinions before the pre-FOMC quiet period begins next week. It does seem we’ll hear plenty about this ongoing strength of the consumer which will buy them time to keep the higher-for-longer theme going, and further diminish rate-cutting odds.

- The rest of the week sports only secondary data points like housing starts, industrial production, and the Fed’s Beige Book which may make for some interesting reading to see if the on-the-ground anecdotes fit with the generally impressive state of the consumer and whether any cracks in their armor are starting to appear. It’s been a mostly fruitless search so far but the search will continue, nonetheless.

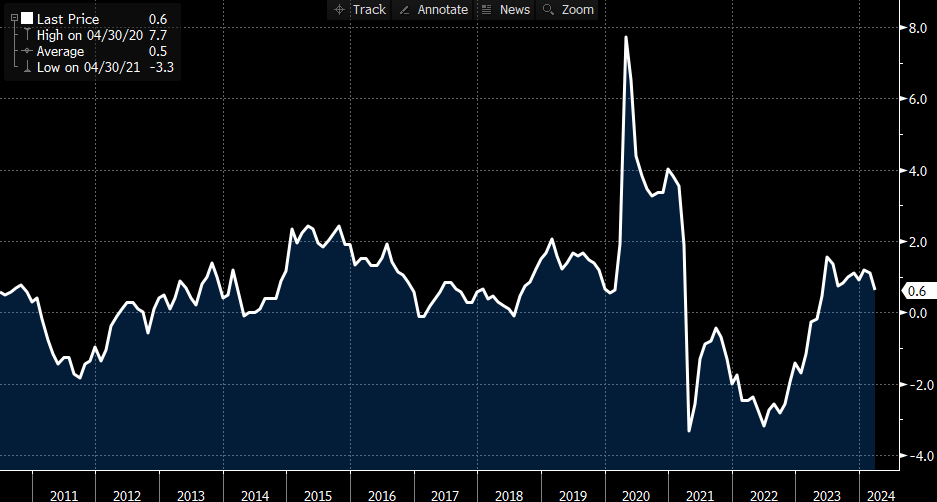

Real Wages – Nominal Wages Less Inflation – Have Turned Positive Perhaps Fueling Consumption

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.