Geo-Political Risk has Entered the Chat Again

Geo-Political Risk has Entered the Chat Again

- Hawkish Fed speak and military attacks have provided a host of cross-currents for the market to deal with this week. The risk-off tone that followed initial reports of Israeli strikes in Iran were eventually reversed as the attack was termed limited in scope, and the lack of follow-through saber-rattling soothed some nerves. While there are no economic releases today we do get one more Fed speaker before the pre-meeting quiet period begins (more on that below). Currently, the 10yr is yielding 4.61% and the 2yr is yielding 4.98%, not too different than the closing levels yesterday.

- An Israeli attack on an Iranian military base overnight initially caused the usual risk-off/flight-to-safety reaction but that all but disappeared when trading opened in New York after the attack was termed limited in scope. Also, there wasn’t much said by either actor about the attack so military analysts were describing the matter as all but closed. That may be so, but with the weekend looming, any risk-on trade today is likely to be limited.

- The Fed speak was heavy yesterday with New York Fed President John Williams garnering most of the headlines. He mentioned that should the data call for a hike, the Fed wouldn’t hesitate to act. Fed Governor Michelle Bowman said essentially the same thing. Recall, she was the last of the FOMC members to retreat from a more hikes may be necessary stance late last year, so for her to return to that position is not surprising. Williams, however, has been more measured so for him to discuss possible rate hikes gets noticed. Also, Atlanta Fed President Raphael Bostic reiterated his stance that any rate cut would likely be a year-end event, and also mentioned that he wouldn’t hesitate to hike if that was what the data called for, and he is a voter this year. It’s not totally surprising that rate hikes are still on the table, but what has changed this week is for Fed members to openly mention once again the possibility of hikes. That is something new.

- The only Fed speaker scheduled today is Chicago Fed President Austin Goolsbee. If you had to pick the most dovish member at this time you probably couldn’t do better than Goolsbee. His recent comments have centered on not waiting too long to cut rates lest it bring on economic weakness. While we don’t expect he’ll join the rate-hiking chorus, it will be interesting to see if he hangs onto the “waiting too long to cut” concern. After Goolsbee, the Fed goes into radio silence before the month-end FOMC meeting.

- In light of the more hawkish comments this week, we have to bring up the latest Beige Book findings. This is the monthly look at economic conditions in each Fed district as described by business contacts and will be part of the FOMC meeting. The report described a more struggling economy than what the hard data is telling us. Comments described economic activity as “expanded slightly”, and that passing on higher costs was getting tougher, and that consumer spending “barely increased.” That certainly clashes with the hard data but is it the long-awaited beginnings of economic weakening? Given the hawkish comments this week, we’re inclined to think Fed members will wait for the weakness to show in the data versus anecdotal reports.

- Housekeeping Note: We’ll be traveling and speaking next Monday, so the next Market Update will be Wednesday, April 24th.

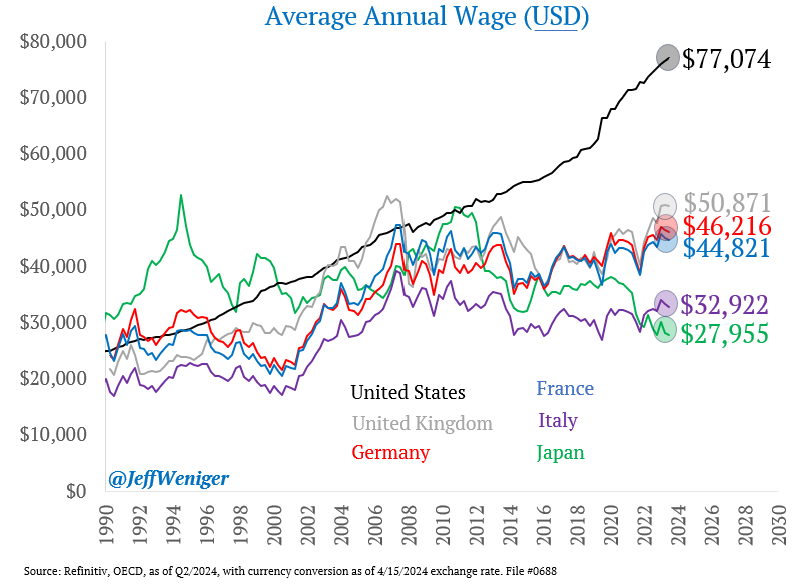

No Wonder the US Economy is Doing Better Than Practically Everywhere Else

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.