GDP Goes Negative While Inflation Pressure Remains

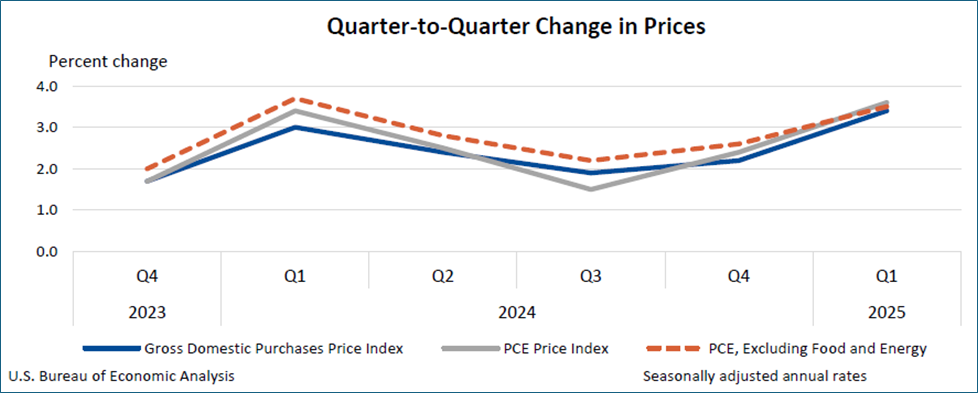

- The initial estimate of first quarter GDP was negative (-0.3% YoY), owing to the huge front-running in import purchases, but the hotter-than-expected inflation numbers from the report also concern traders as it may limit the Fed’s response function to a slowing economy. As a result, we’re seeing an early risk-off trade that is keeping Treasury yields lower despite some wider intra-day swings. There’s plenty more to come this week, headlined by the April Employment Report on Friday, so continue to keep that seat belt on. Currently, the 10yr is yielding 4.16%, down 2 bps on the day, while the 2yr is yielding 3.62%, down 4bps on the day.

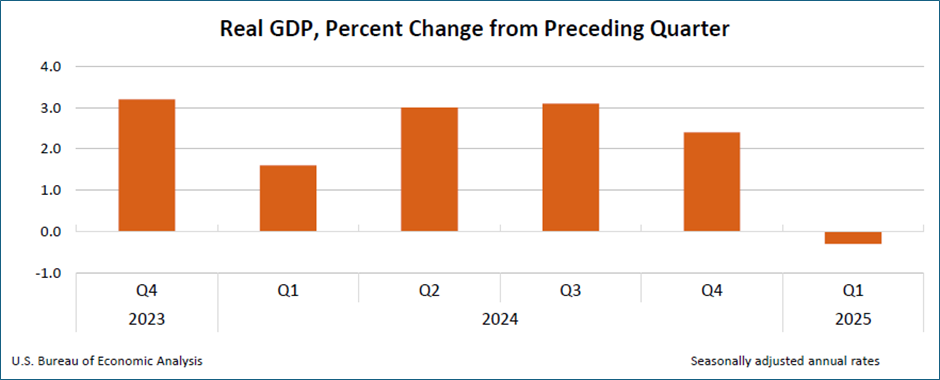

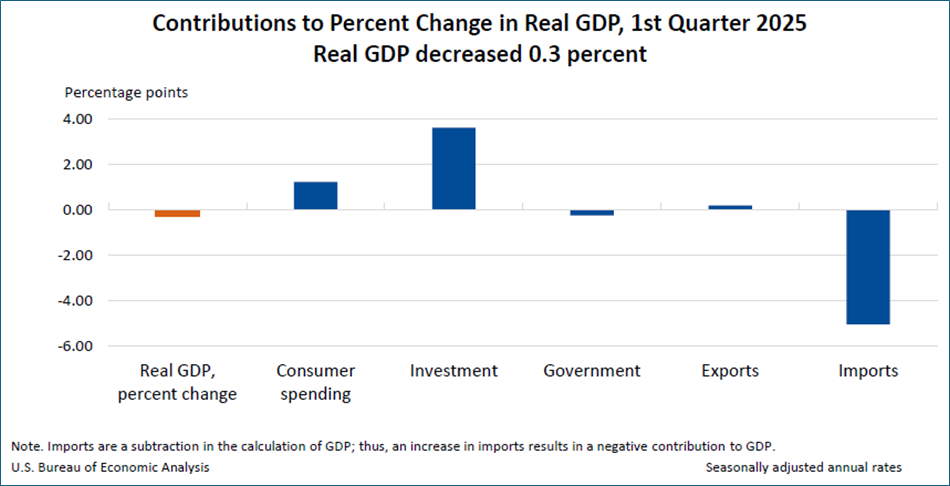

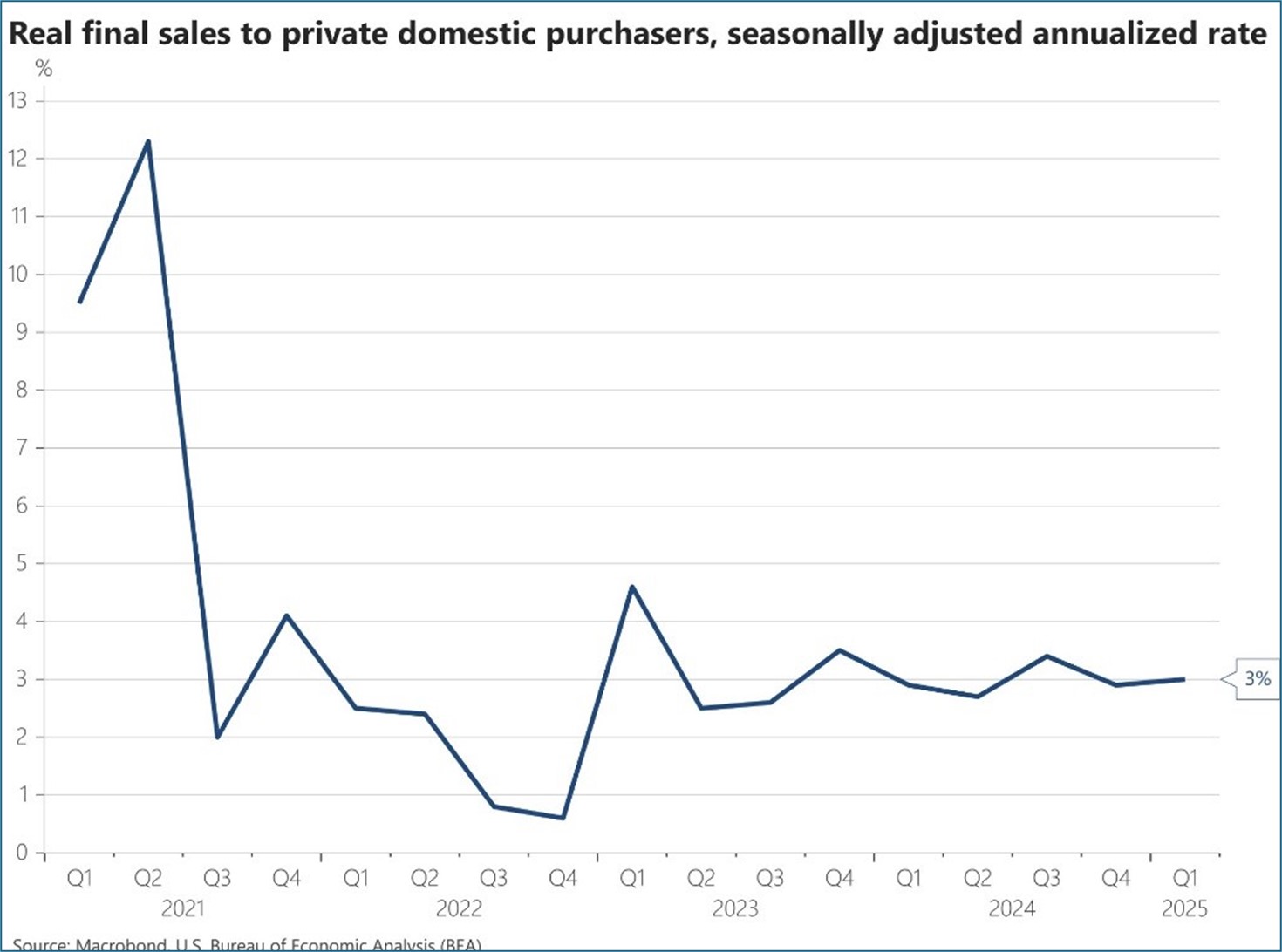

- The initial estimate of first quarter GDP is out, and it declined -0.3%, slightly worse than the -0.2% expectation. The widely reported front-running of imports to avoid tariffs swung the number to a negative. The consumer, while weaker than in prior quarters, continued to carry the day. Consumption increased 1.8% vs. 1.2% expected but that was well short of the robust 4.0% spending surge in the fourth quarter. In another note of the consumer continuing to do their part, Final Sales to Private Domestic Purchasers, which excludes trade, inventory, and government items, rose 3.0%. It was 2.9% in the fourth quarter so that’s one positive in today’s report.

- Also, out this morning, ADP reported that private sector payrolls rose by just 62,000 for the month, the smallest gain since July 2024, and short of the 115,000 in private sector growth that was expected. The total also marked a deceleration from the downwardly revised gain of 147,000 in March. Wage gains also took a step backwards, rising 4.5% from a year ago for those staying in their jobs, down 0.1 percentage point from March. However, job changers saw an increase to 6.9%, up 0.2 percentage point. From a sector standpoint, leisure and hospitality posted the biggest gain, adding 27,000 jobs. Others that showed increases included trade, transportation, and utilities (21,000), financial activities (20,000) and construction (16,000). Education and health services lost 23,000 positions while information services fell by 8,000. The ADP estimate serves as a precursor to Friday’s nonfarm payrolls report. Expectations are looking for private sector job growth of 118,000.

- One more first-tier item released today was the Employment Cost Index (ECI) for the first quarter. This is the Fed’s preferred measure of wage growth as it is the most comprehensive in that it accounts for the usual pay items but also includes benefits and payroll taxes as well. For the quarter, the ECI rose 0.9%, same as the prior quarter and matching expectations. Wages and salaries increased 0.8% for the quarter as benefits rose 1.2%. On an annual basis, earnings increased 3.6% vs. 4.2% a year ago. So, pricing pressure doesn’t seem to be coming from increasing wages, which are moderating in line with the Fed’s wishes. That could be important in future Fed deliberations as they weigh the twin mandate of price stability and full employment. If employment starts to weaken but most of the uptick in prices can be blamed on one-off tariffs, that may give the Fed flexibility to cut despite sticky inflation numbers.

- Yesterday, we received the latest consumer confidence reading from the Conference Board and it was full of disappointments. The Confidence Index fell by 7.9 points in April to 86.0 (1985=100). The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—decreased 0.9 points to 133.5. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—dropped 12.5 points to 54.4, the lowest level since October 2011 and well below the threshold of 80 that usually signals a recession ahead. The confidence reading represents a fifth straight monthly decline, down to levels last seen at the beginning of the COVID pandemic. The decline was largely driven by consumers’ expectations. The three expectation components—business conditions, employment prospects, and future income—all deteriorated sharply, reflecting pervasive pessimism about the future.

- Notably, the share of consumers expecting fewer jobs in the next six months (32.1%) was nearly as high as in April 2009, in the middle of the Great Recession. In addition, expectations about future income prospects turned clearly negative for the first time in five years, suggesting that concerns about the economy have now spread to consumers worrying about their own personal situations. However, consumers’ views of the present have held up, containing the overall decline in the Index. April’s fall in confidence was broad-based across all age groups and most income groups but the decline was sharpest among consumers between 35 and 55 years old, and consumers in households earning more than $125,000 a year. The decline in confidence was shared across all political affiliations.

- The earlier release of first quarter GDP steals some of the thunder from the March Personal Income and Spending Report that will also be released at 10am ET. While that report is incorporated in the GDP totals, it will give us the breakdown for March. As for inflation, overall PCE is expected to be unchanged for the month vs. 0.3% in February with the YoY dipping from 2.5% to 2.2%. Core PCE is expected to be 0.1% MoM vs. 0.4% in February with the YoY rate dipping from 2.8% to 2.6%. With today’s GDP inflation numbers coming in hotter than expected, there is the risk that the March numbers are worse than expected and that is contributing to the higher yields off the GDP release.

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.