GDP and PCE Vie for Attention in a Week Sure to be Full of Political News

GDP and PCE Vie for Attention in a Week Sure to be Full of Political News

- Treasury yields are a bit lower this morning as investors process the latest political developments, and they are treating it rather calmly with little volatility. We discuss the political developments below, but for now the market is treating it as a sideshow with GDP and PCE numbers looming later this week. Currently, the 10yr note is yielding 4.21%, down 3bp on the day, and the 2yr is yielding 4.51%, unchanged on the day.

- The weekend announcement that President Biden was stepping away from the Democratic nomination and endorsing Vice President Kamala Harris has turned the political world on its head, but for now the markets are taking it rather calmly. Perhaps it’s seeing her chances not too differently than Biden’s, or it could be too soon to handicap what will happen in uncharted waters so steady-as-she-goes may be the best advice in the early days of a new campaign.

- Endorsements are flowing in for Harris from Democratic legislators, governors, and party leaders, but it remains to be seen if this is a fait accompli or will one or two Democrats throw their proverbial hats in the ring and force a contested convention that runs from August 19-22. The DNC does not want that outcome as it will delay campaigning against Trump until the convention decides a candidate, and this is where one envisions a smoky backroom where such negotiations are hashed out, out of the eyes of the prying public. Ain’t politics fun!

- While the presidential campaign will provide non-stop headlines for the foreseeable future, the Fed has gone into radio silence before next week’s meeting with no cut expected. It makes the political news even more dominant except for the occasional quarterly earnings reports from market leaders.

- The headline economic data this week will be the first look at second quarter GDP on Thursday and PCE inflation on Friday. Expectations are for GDP to grow 1.9% annualized vs. 1.4% in the first quarter. Personal consumption is expected to increase slightly from 1.5% to 1.8%. The price index is expected to dip from 3.1% to 2.6% annualized with the core price index dropping to 2.7% vs. 3.7%. The drop in inflation, if it comes to pass, will add more ammunition to a potential September rate cut. Meanwhile, the Atlanta Fed’s GDPNow model forecasts second quarter GDP at a stout 2.7%.

- The week’s next biggest report will be Friday’s Personal Income and Spending figures for June, and while they are part of the GDP release on Thursday at least we’ll see the trajectory heading into the third quarter. Personal income is expected to increase 0.4% vs. 0.5% in May with personal spending up 0.3% vs. 0.2% in May and real personal spending (net of inflation) is expected to match May’s 0.3% increase. The expected spending numbers align with the strong Retal Sales report from last week and may provide additional evidence the consumer isn’t finished yet.

- The all-important inflation indices are expected to see headline PCE unchanged for a second straight month with the YoY rate dipping to 2.4% vs. 2.6%. Core PCE is expected to increase 0.1%, matching the increase in May with the YoY pace slowing from 2.6% to 2.5%, and the lowest in more than three years. Again, if these numbers come to pass it will buttress the case for a September rate cut.

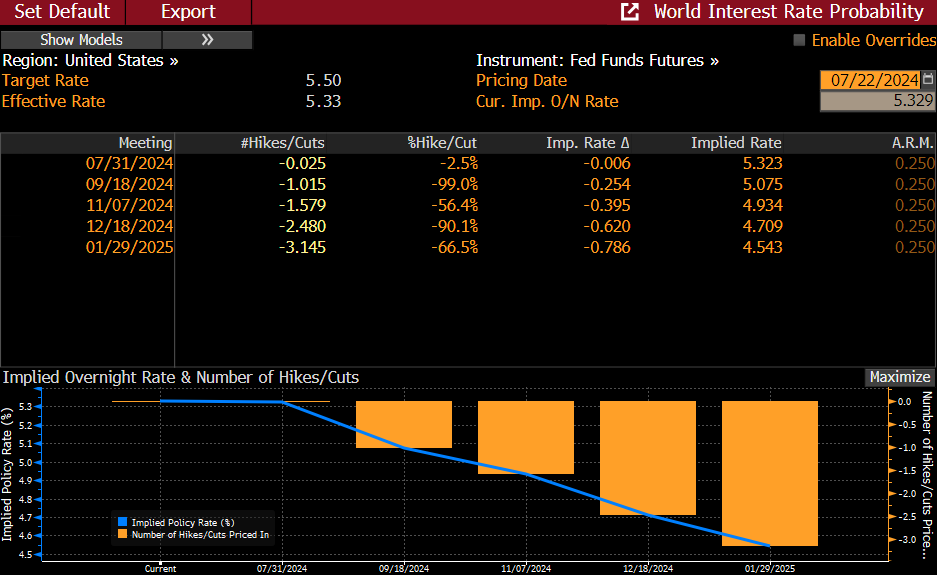

99% Odds of September Cut and 2.5 Cuts by Year-End – Seems too Optimistic

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.