Friday the 13th has an Ominous Beginning

- Welcome to Friday the 13th, where events are already unfolding in an ominous way. Overnight, Israel attacked Iranian nuclear sites, as well as military bases, and targeted high-ranking military and nuclear officials. Iran’s initial response was a limited drone attack, but both sides say there’s more to come. Oil has predictably ramped higher (+8%) and equity futures look to open lower (Dow -400pts), and most other foreign bourses are in the red.

- Despite the risk-off trade, Treasury yields are struggling to move lower, perhaps some concern over the inflationary implications, while others offer that the safe haven status of the US has been damaged, but other sovereign debt is struggling as well to find solid bids today. Only the Preliminary June Michigan Sentiment Survey is on offer later this morning, so trading will take its cues from the ongoing military actions. Currently, the 10yr is yielding 4.39%, up 3bps on the day, while the 2yr is yielding 3.94%, up 4bps on the day.

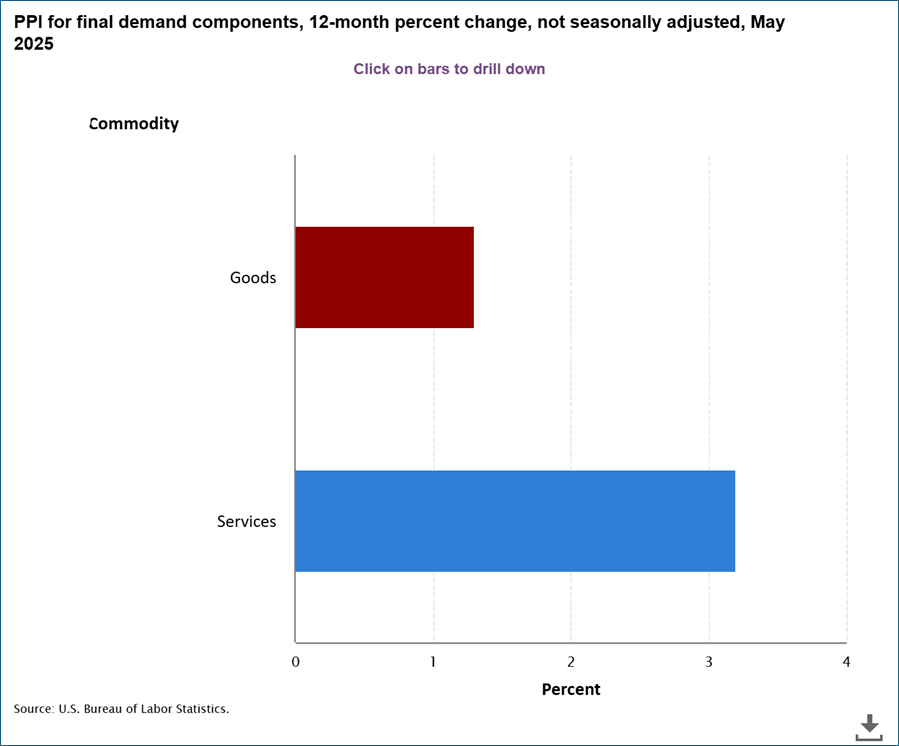

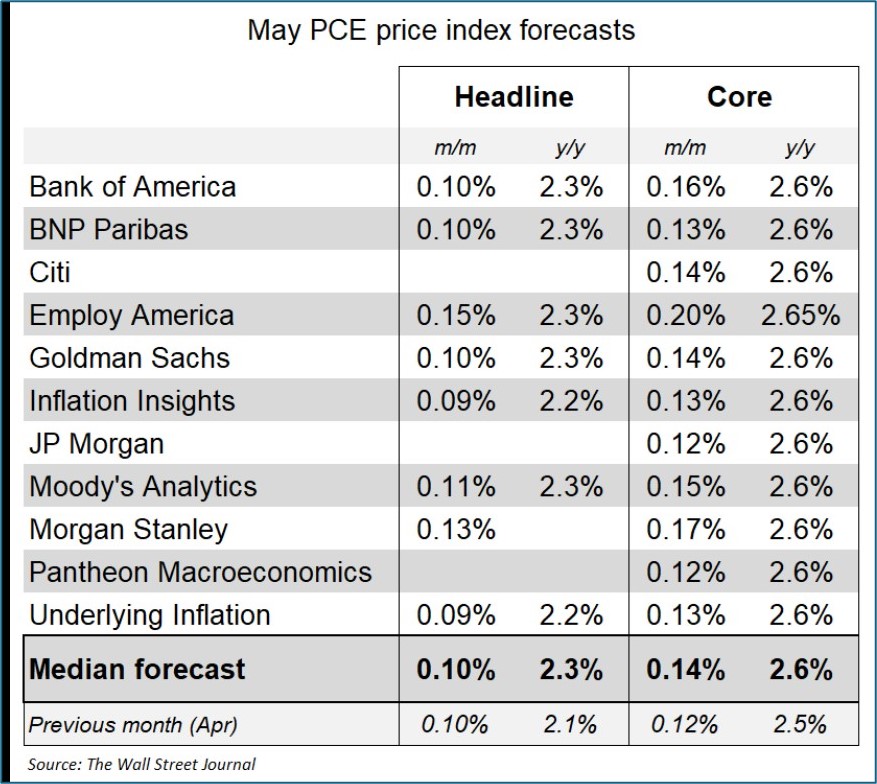

- A cool CPI report was followed by a cool PPI release, and elements inside that report hint at a docile PCE read when released at month-end. Early indications are core PCE at 0.13% and overall PCE at 0.10%. Suffice it to say that just like the CPI report, evidence of tariff-related price hikes were scant with falling energy prices aiding the lower-than-expected wholesale prices along with a softening in services which may speak to reduced consumer demand, which has been what the soft survey data has been signaling.

- While the Fed’s preferred inflation gauge will come after next week’s meeting it will be interesting to see the results and whether it could pressure the Fed into a possible cut at its July 30 meeting. While the consensus view is that the Fed will cut in September, followed by another in December, if the June employment report is weak, and PCE benign, expect the White House to up the rate cut messaging, increasing the tension around what was heretofore labeled as a sleepy, summer placeholder session before September’s meeting. Well, maybe not so fast. A September cut is still our view, along with the market consensus, but expect the White House pressure offensive to intensify, especially as other central banks, like the UK and ECB, cut their rates.

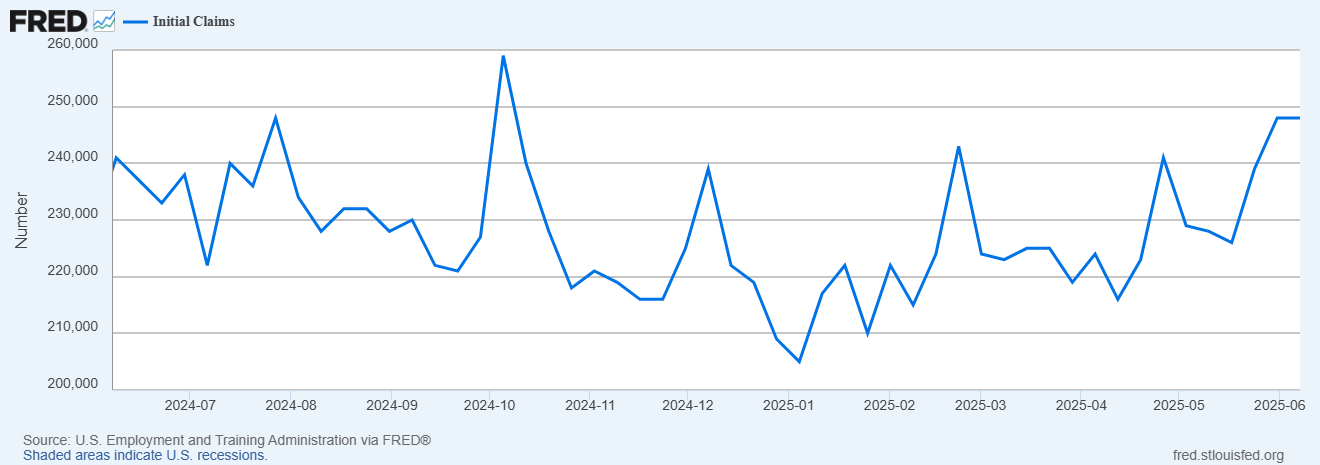

- Meanwhile, initial jobless claims continue to trend upward. In the week ending June 7, seasonally adjusted initial claims were 248,000, unchanged from the previous week’s revised level. The previous week’s level was revised up by 1,000 from 247,000 to 248,000. The 4-week moving average was 240,250, an increase of 5,000 from the previous week’s revised average. This is the highest level for this average since August 26, 2023, when it was 245,000. The largest increases in initial claims for the week ending May 31 were in Kentucky (+3,967), Minnesota (+2,364), Tennessee (+1,764), Ohio (+1,271), and North Dakota (+593), while the largest decreases were in Michigan (-3,783), Massachusetts (-1,585), Florida (-1,456), Iowa (-1,074), and Nebraska (-1,065).

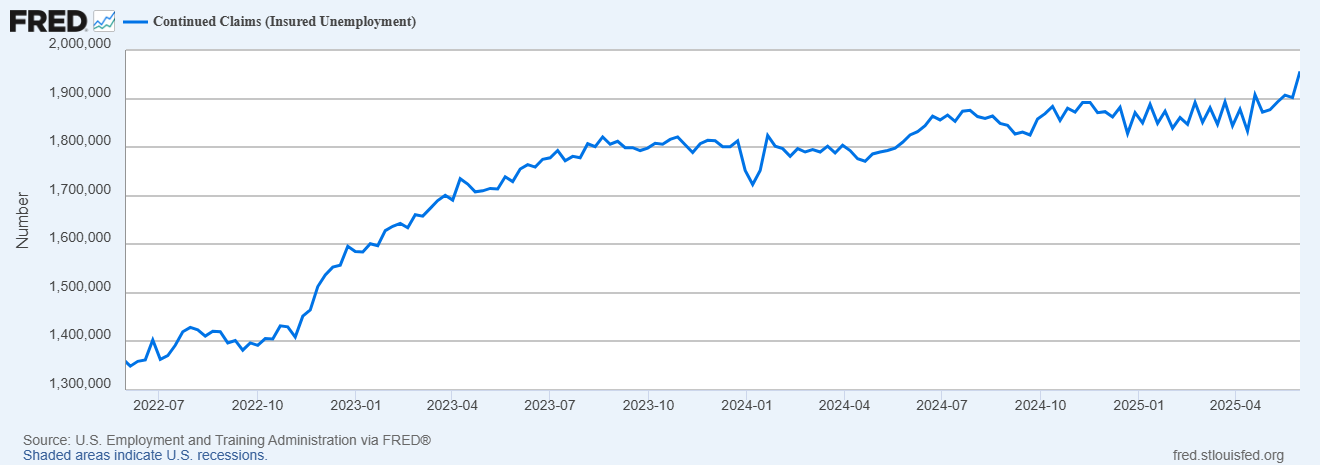

- The seasonally adjusted continuing claims during the week ending May 31 was 1,956,000, an increase of 54,000 from the previous week’s revised level. This is the highest level since November 13, 2021, when it was 1,970,000 (see graph below). The 4-week moving average was 1,914,500, an increase of 19,750 from the previous week’s average. This is the highest level since November27, 2021 when it was 1,923,500. Unequivocally, claims and continuing claims are edging higher indicating layoffs, while still historically low, are inching higher, and more concerning continuing claims continue to move into multi-year high levels, albeit still historically moderate. The low-fire, low-hire economy seems to be hardening in place.

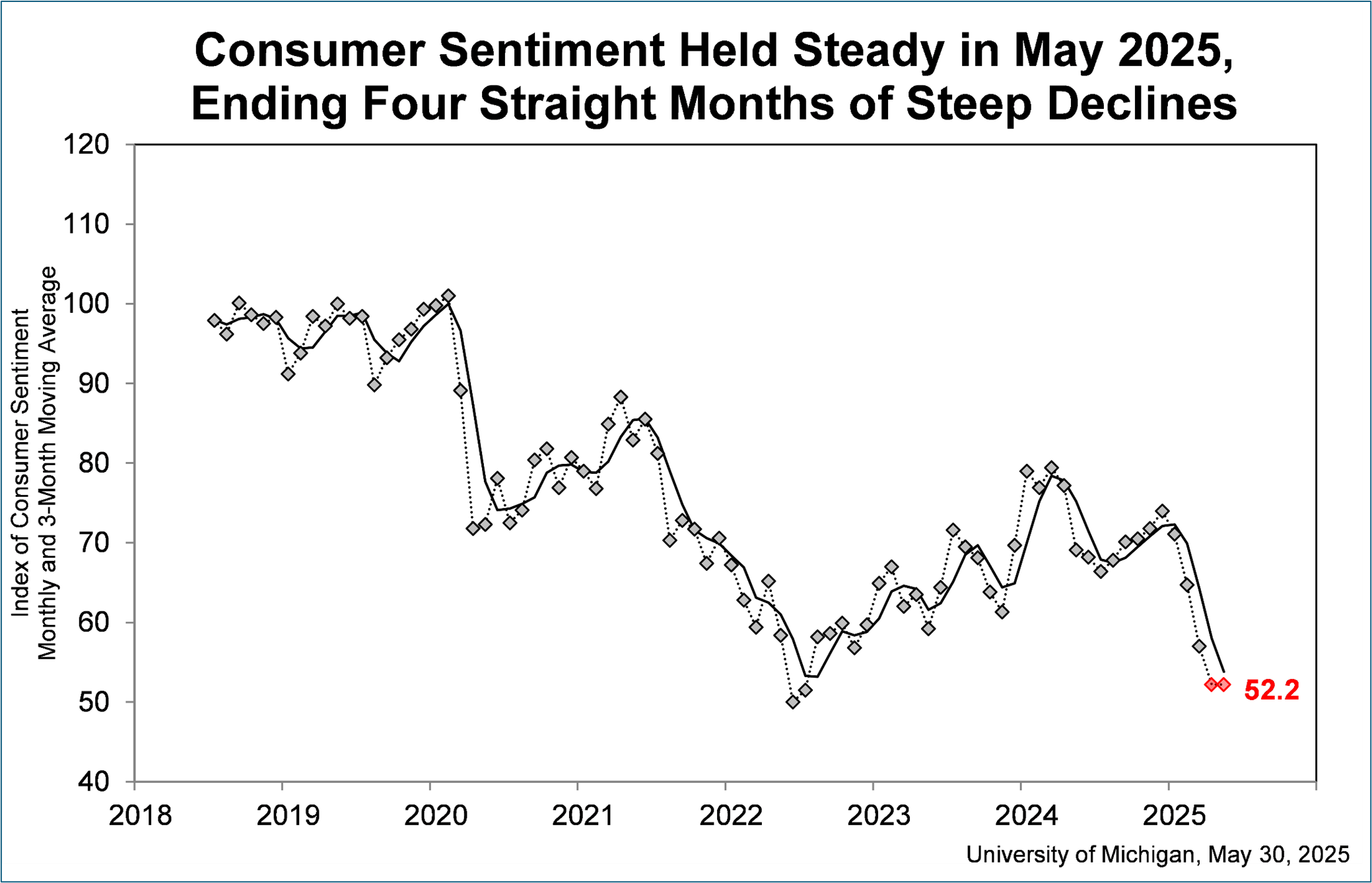

- At 10am ET, the final release of the week will come in the form of the University of Michigan’s Preliminary Consumer Sentiment Survey. The series has been dogged by some extreme inflation forecasts which have rendered the report somewhat questionable as a forecasting tool. Especially as the New York Fed’s latest consumer survey reflected a more benign levels of inflation expectations. The 1yr outlook fell 0.43% to 3.2%, which is the first decline since the election and the 3yr and 5yr inflation expectations also fell.

- For comparison, the previous UMich survey had the 1yr inflation expectation at 6.6% with the expectation of a 6.4% print today. Oh, and the headline sentiment index is expected to improve ever-so-slightly from 52.2 to 53.6. Still, that would represent the lowest sentiment since early 2022 when it dipped on the Fed beginning its rate-hiking cycle.

- The spike in inflation expectations has been goosed on by politically partisan views which makes the report somewhat suspect as a legitimate forecasting tool. The NY Fed report uses a different methodology where more than 1,000 households are tracked for a year before being replaced by another (on a staggered basis), so it has more continuity of opinion, and perhaps participants more engaged long-term than the web-based Univ. of Michigan constituents. Expect to hear the Fed leaning on this NY survey vs. the U. of Michigan version, at least for this year, as it pertains to keeping longer-term inflation expectations “well anchored.”

May PPI – Comparison of Goods-Side vs. Services-Side

With PPI & CPI in Hand, Estimates for PCE Look Cool as Well for May

Initial Jobless Claims Remain at Highest Level This Year and Highest Since October 2024 Spike

Continuing Unemployment Claims Increase to Highest Since Post-Pandemic Period

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.