FOMC Poised to Deliver First 2025 Rate Cut Today

- Treasury yields are sharply unchanged this morning as investors mark time until the FOMC rate decision at 2pm ET. While a 25bps rate cut is the overwhelming consensus, it’s the details in the updated Dot Plot, economic summary, statement, and press conference that will shape trading for the near-term. Currently, the 10yr is yielding 4.03%, unchanged on the day, while the 2yr is yielding 3.51%, also flat on the day.

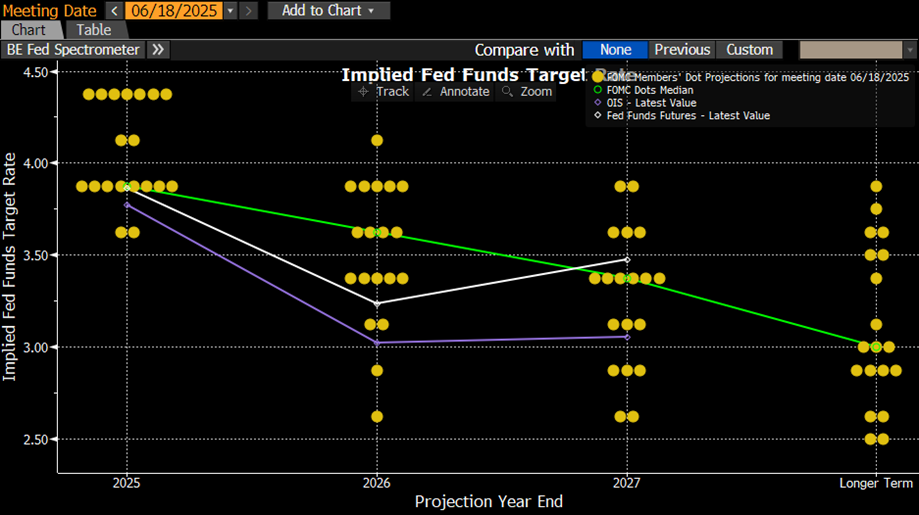

- The FOMC will announce its rate decision this afternoon and almost everyone expects it to be a 25bps cut. While that’s not much of a mystery, the market will be looking for clues as to whether this represents the beginning of a steady journey back to 3.00% (the estimated neutral rate), or is it more a course correction, like the brief period of cuts that began this time last year. We think it’s more the former as the economy slows and the scattershot fiscal policies continue to exert a downward force on economic activity.

- As we mentioned on Monday, the updated Summary of Economic Projections (SEP), Dot Plot, statement, and Powell presser will provide hints about how the Fed now sees the weighting between the inflation and employment mandates. The bigger question is whether the new information will be consistent in that regard? We think they sacrifice, or backburner, the price stability mandate and focus more on additional rate cuts in 2026 to limit labor market damage and expect the tariff-inspired cost increases will slowly play themselves out during the year, along with a softer growth outlook that dims demand, and therefore additional inflation pressure.

- Powell assumed a more dovish posture at Jackson Hole owing to the troubling signs in the labor market and nothing since then should have altered his view in that regard. That said, matching the market’s dovish expectations may prove difficult for a Fed that is probably more divided now than ever before during Powell’s tenure as chairman.

- In addition to the two or three cuts this year, we see the Fed pushing three to four additional rate cuts in 2026 dropping the funds rate to 3%, or just below, which would put it near the latest neutral rate estimate (i.e., 3.00% as of June 2025’s dot plot). We’ll be back in the afternoon with an update following the 2pm ET rate decision

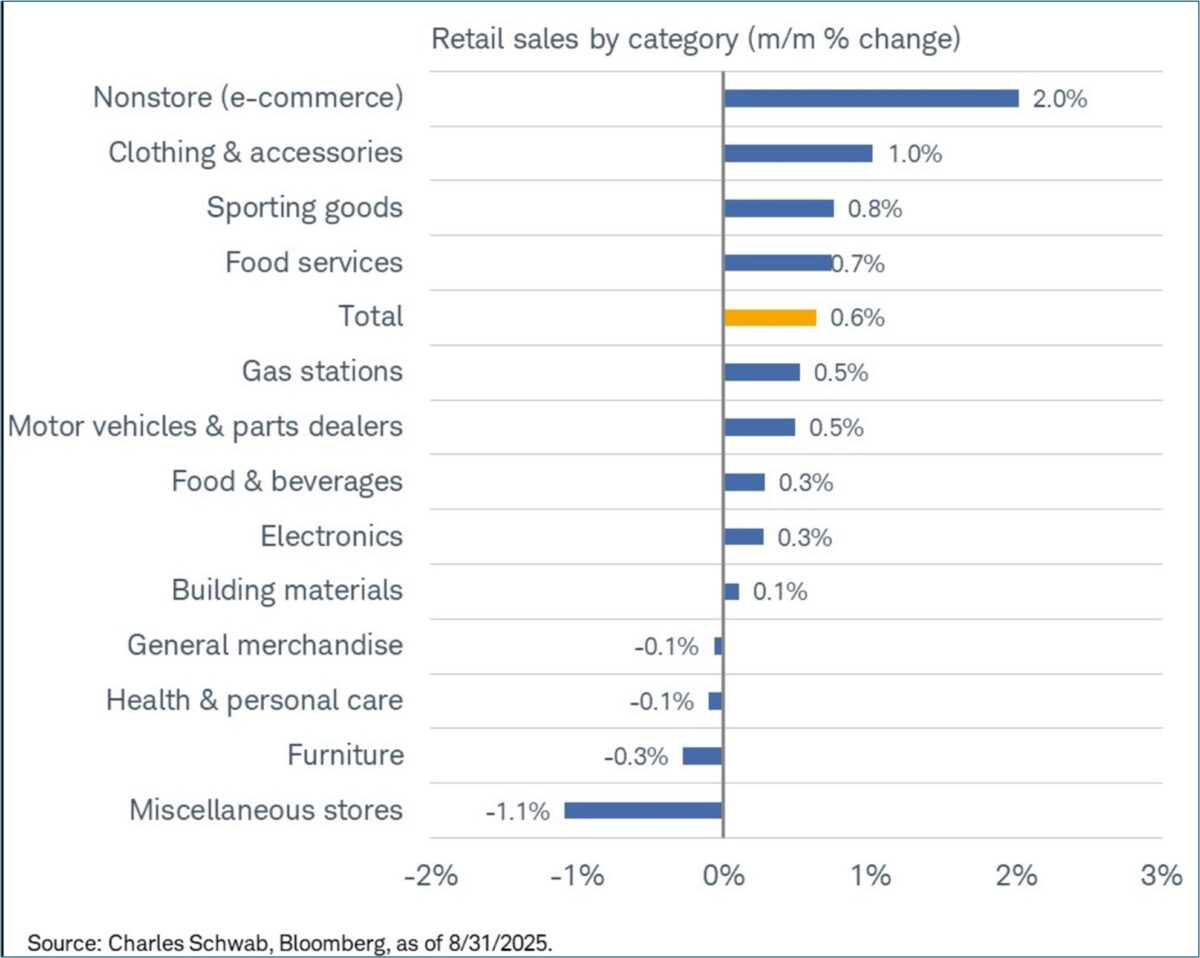

- Yesterday we got the latest look at consumer spending in the form of August Retail Sales, and it easily exceeded expectations and once again reminded market watchers not to underestimate the ability of the American consumer to, well, consume. Advance retail sales increased 0.6% vs. 0.2% expected and 0.6% the prior month. Other measures were similarly strong with the GDP feed, otherwise known as the Control Group, up 0.7% vs. 0.4% expected and 0.5% the prior month. That brings the 3-month average annualized rate to a 1-year high (+6.7% vs. +4.7% in July). That bodes well for third quarter GDP with the Atlanta Fed’s GDPNow model increasing to 3.4% from 3.1% after the report.

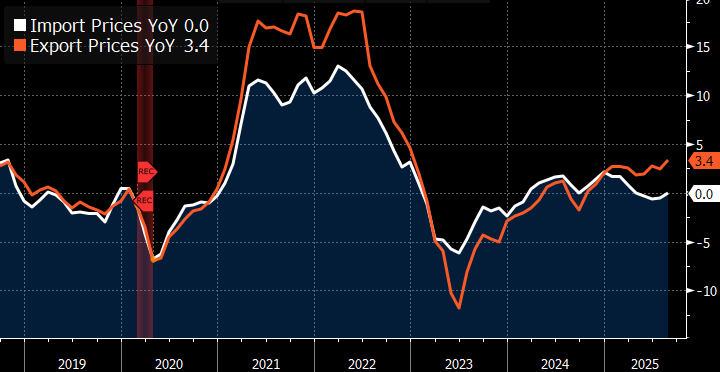

- Also, yesterday we received August import and export prices, and a few pieces of the import data will complete the items feeding into the PCE inflation series coming at month end. It’s important to note that the import/export price report reflects price changes prior to any tariff impact. Import prices for August rose 0.3% vs. -0.2% expected and 0.2% in July. Ex-petroleum, import prices rose a headier 0.4% vs. 0.1% expected and 0.0% the prior month.

- There was speculation advanced in some circles that foreign exporters have been absorbing price cuts to partially offset tariff costs, but the August data doesn’t find that to be the case. It seems, rather, domestic wholesale importers and retailers are absorbing some of the tariff costs with some leaking into higher retail prices. We expect the cost sharing to wane in the coming months as tariffs remain in place, eventually forcing more tariff costs to be shouldered by the consumer.

- The last report received this morning dealt with housing starts and permits for August in the struggling residential market. Starts fell -8.5% vs. -4.4% expected to 1.307 million starts annualized vs. 1.429 million in July. In the post-Covid period, starts peaked at 1.820 million in April 2022. Since then, they’ve been stuck in the 1.2 to 1.5 million range. Permits fell -3.7% vs. 0.6% expected to 1.312 million annualized vs. 1.362 million the prior month. In summary, yet another mediocre-at-best month but it may be the calm before increasing activity as mortgage rates, while relatively unchanged in August, have been dropping along with Treasury yields in September. Refi activity has already started to perk up, so we expect building activity will follow suit in the next few months, if lower yields hold, and the economic outlook doesn’t deteriorate more than anticipated.

Will the New Dot Plot have Three 25bps Cuts Forecast for 2025 instead of Two in the June Version?

Source: FOMC

On-Line Retailers Led the Way in August Sales

Import and Export Prices YoY – Before Tariff Costs, but Prices are Slowly Climbing

Source: US Census Bureau

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.