FOMC Minutes are the Thin Gruel on the Menu Today

- It’s day eight of the government shutdown and with missed paychecks for federal workers (10/10) and military (10/15) approaching perhaps some signs of life towards a resolution will appear soon. As the information blackout continues, we’ll at least have the FOMC minutes from September’s meeting to digest this afternoon. We’re most interested in any discussion of when QT will be wound down. With cash reserves back under $3 trillion we may be approaching that imprecisely named “ample reserves” level that Powell identified in the FOMC press conference as a benchmark towards halting balance sheet runoff. We’ll see if the minutes shed any additional light on that topic. Currently, the 10yr Treasury is yielding 4.10%, down 3bps on the day, while the 2yr note yields 3.56%, down 1bp in early trading.

- Fed speak was hot and heavy yesterday with a varied degree of responses, which is something we’ll likely see more of in the coming months. New Fed Governor Stephen Miran, on loan from the White House, said he doesn’t see as much tension between the Fed’s dual mandates as some of his colleagues and he believes the Fed can continue to cut rates due to factors such as slowing population growth, and his expectation of limited inflation risks from tariff policies. “My forecast for inflation is more sanguine than some of my colleagues, so I view the mandate as less in tension than some others do.”

- ‘Some colleagues’ includes Minneapolis Fed President Neel Kashkari who also spoke yesterday. He worried that drastic cuts in interest rates would risk stoking inflation. “ You would expect to see the economy have a burst of high inflation. Basically, if you try to drive the economy faster than its potential to grow and its potential to produce, you end up with prices going up across the economy.” He added that some of the data is signaling to him the rising risk of stagflation: rising inflation risk alongside the risk of slowing growth.

- The consensus Fed view is probably more in the Kashkari camp but expect Trump to work the group, attempting to shift it more towards the Miran view. The big opportunity there comes in nominating a new Fed chair when Jay Powell’s term expires next May. Fed communication will be thick again today with three speakers (Musalem, Barr and Kashkari) not to mention the Fed minutes from the Sept. FOMC meeting.

- Meanwhile, the NY Fed released the September 2025 Survey of Consumer Expectations yesterday, which showed inflation expectations increased at the short- and longer-term horizons. Also, despite a small rebound in the expected job finding rate, labor market expectations continued to deteriorate with consumers reporting lower expected earnings growth, greater likelihoods of losing jobs, and a higher likelihood of a rise in overall unemployment. The survey covered all of September.

- Median inflation expectations increased at the one-year horizon to 3.4% from 3.2% and at the five-year horizon to 3.0% from 2.9%. Median home price growth expectations remained unchanged at 3.0% for the fourth consecutive month. Earnings growth expectations decreased by 0.1 percentage point to 2.4%, the lowest reading since April 2021. The mean probability that the unemployment rate will be higher one year from now increased 2.0 percentage points to 41.1%. The mean perceived probability of losing one’s job in the next 12 months increased by 0.4 percentage point to 14.9%, above the trailing 12-month average of 14.1%. The mean perceived probability of finding a job in the next three months if one’s current job was lost rebounded somewhat from a series low of 44.9% in August to 47.4% in September, while remaining well below the trailing 12-month average of 51.0%.

- We tend to put more credence in this report over the Michigan and Conference Board’s offerings as it’s nationally representative, with approximately 1,300 household heads. Respondents participate in the panel for up to 12 months, with a roughly equal number rotating in and out of the panel each month. Unlike the other surveys based on varied and different respondents, this continuity approach allows observations of changes in expectations and behavior of the same individuals over time.

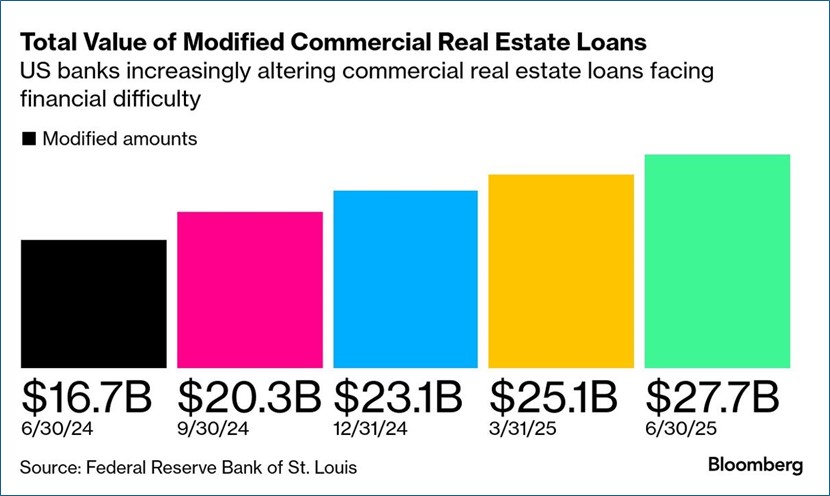

- Finally in industry news, banks have been increasingly modifying commercial real estate loans as more borrowers encounter financial difficulty. The modifications can include principal forgiveness, interest rate reductions, payment delay, term extensions or a combination of those changes. As of June 30, banks reported a 66% increase in the total value of commercial real estate loan modifications over the last four quarters. At least the modifications show a willingness by both parties to try and make the best of a challenging situation rather than the alternative of foreclosure and write-offs.

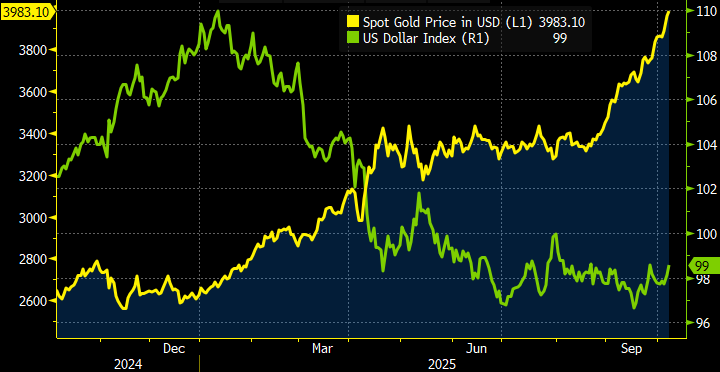

Meanwhile, Gold Rally Continues as the US Dollar Struggles

Source: Bloomberg

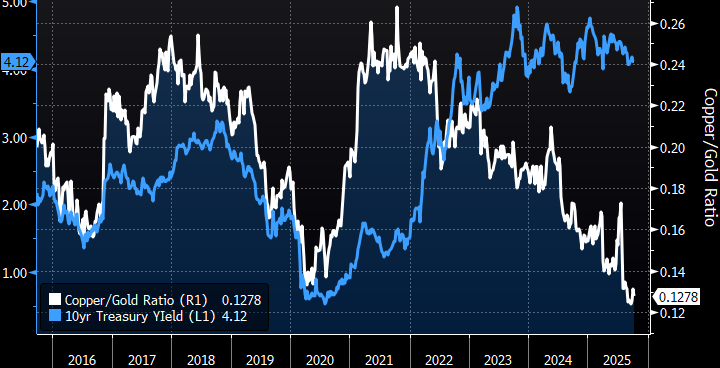

Copper/Gold Ratio Says 10yr Treasury Yields Should be Tracking Lower

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.