FOMC is the Main Entrée, but Plenty of Hors D’oeuvres Await Investors

FOMC is the Main Entrée, but Plenty of Hors D’oeuvres Await Investors

- Treasuries are trading in the green this morning, but that’s all subject to what the FOMC statement and press conference provide. While the expectation is for a hawkish Powell and QT tapering information, there is always the risk something unexpected is said, although we don’t foresee it (more on the Fed meeting below). Currently, the 10yr note is yielding 4.64%, down 4bps on the day, and the 2yr is yielding 5.01%, down 4bps on the day.

- It’s FOMC decision day and while no rate moves will be made, we expect to get some details on the beginnings of the QT tapering process. Expectations are that the $60 billion/month run-off in Treasuries will be reduced to $30 billion with MBS run-off unchanged at $35 billion, (if enough prepayments oblige). That additional $30 billion in monthly Fed buying will lessen one headwind in the intermediate part of the curve.

- Given the hot inflation data so far in 2024, we expect more hawkish commentary from Powell in the press conference than we’ve heard since before December’s dovish pivot. We don’t, however, think he’ll propose rate hikes, but he won’t take them off the table, either. He may say something along the lines that rate hikes are not something the committee is considering at this time, but that they remain data dependent. We think his comments will mostly focus on the higher-for-longer theme, given the hot data this year, with no prospect for rate cuts until late in the year.

- Away from the Fed, there is still a full plate of hors d’oeuvres on which to nibble before the Fed’s afternoon main course. Yesterday’s first quarter Employment Cost Index (ECI) came in hotter-than-expected with an annualized gain of 4.2%. That rate is close to the latest Average Hourly Earnings YoY rate of 4.1%. The ECI is preferred by the Fed as it’s the most comprehensive look at compensation expense as it includes benefits and payroll taxes in addition to the normal wage and salary data. Compensation gains over 4% with inflation readings trending towards the low 3% to high 2%’s should keep the consumer in a healthy position to continue spending, not to mention the 200k to 300k new paychecks coming on-line every month. The consistently strong wage gains across several indicators will play into the higher-for-longer stance at the Fed.

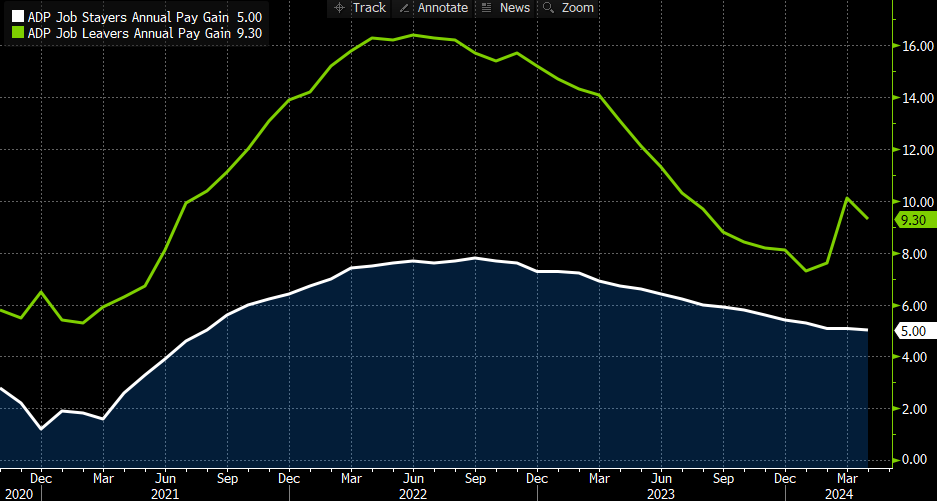

- ADP released their April employment change report this morning and it surprised slightly to the upside with 192k private sector jobs (77% service producing) vs. 183k expected while March was upwardly revised from 184k to 208k. While the correlation with the BLS report has been erratic at best, expectations are that on Friday we’ll see 190k private sector jobs compared to 232k in March. Back to the wage subject, ADP found job-stayers had annual pay increases 5.0% while job-changers saw 9.3% in annual increases. While those rates have come down in the last year (see graph below), they still represent historically high annual pay gains. Something else to consider when trying the predict the demise of the consumer.

- Later this morning we’ll get the March Job Openings and Labor Turnover Survey (JOLTS) which is expected to show minimal softening in job openings from 8.756mm February to 8.680mm. The so-called Quits Rate (those leaving jobs voluntarily) will be looked at as well as it is one measure of worker confidence. The higher the rate the more workers who are willing to quit and seek another job. The Quits Rate has been trending lower from a cycle high of 3.0% back in 2022 and has stabilized at 2.2% over the last four months. That’s just below the 2.3% that prevailed pre-pandemic. The ISM Manufacturing Index for April is the other consequential piece of data due this morning and it’s expected to hold onto its expanding sector status, but just barely, at 50.0 expected vs. 50.3 in March. The prices paid component and employment sub-indices will get attention as well with prices paid expected to dip from 55.8 to 55.4 and employment ticking up slightly to 48.2 vs. 47.4. Given the strength in service-side hiring, if manufacturing finds its mojo returning that will certainly give any rate-hike discussion a little more oxygen.

- We’ll be back this afternoon with a summary on what we learned from the FOMC meeting and from the Powell presser. See you then.

ADP Employment Report – Annual Pay Gain for Job-Stayers and Job-Leavers

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.