FOMC Day is Here

- Treasury prices have moved from lower to higher this morning as investors await the FOMC rate decision at 2pm ET. The November Housing Starts and Permits report provided a mixed read to distract traders until the Fed decision with starts dropping -1.8% while permits rose 6.1%. The miss in starts was mostly due to a slowdown in multi-family construction while the South was the only region to see single-family starts rise following the hurricane damage across several states. Currently, the 10yr Treasury is yielding 4.39%, down 1bp on the day, while the 2yr is yielding 4.22%, down 3bp from Friday’s close.

- The last of the consequential events for 2024 is upon us today with the FOMC rate decision this afternoon at 2pm ET. Besides the expected 25bp rate cut the Fed will update its Summary of Economic Projections (SEP) and the all-important Dot Plot. We think they will reduce the number of 2025 cuts from September’s forecast of four to three. That would find the Fed a bit more aggressive on cuts vs. the market’s two cuts in 2025 expectation, and that is probably one reason for the upward drift in longer-term yields. While we think the median rate cut expectation will be for three in 2025, the range of forecasts for next year will be of interest too which will display the level of agreement, or not, for next year’s expected rate moves.

- The other focus on the Dot Plot will be the latest median estimate of the Neutral Rate. The median started 2024 at 2.50% and now sits at 2.875%, after three consecutive 0.125% increases. We think it gets pushed higher again to 3.00%, but like the 2025 cut estimates we’ll see a wide range of opinions from the participants. The range from September’s meeting was a high of 3.75% to a low of 2.375% (we suspect that is Austin Goolsbee, typically the most dovish of members). While a 25bp cut today will keep policy in restrictive territory, as the Neutral Rate estimate gets nudged over 3%, the case for multiple cuts in 2025 will become more difficult to justify, especially if inflation proves resistant to the 2% target, as we think it will.

- As for the press conference, the expectation is that Powell will deliver a hawkish cut with some tough talk at the presser. We’re not so sure about that. Since the Fed will likely be more aggressive in estimating 2025 rate cuts than the market (3 vs. 2), it’s hard to be too hawkish with that outlook. We suspect he’ll be balanced in in his comments and fall back on the data dependent line. He’s already expressed the view that the trek to the 2% inflation target will be bumpy, and it’s proving to be just that. Meanwhile, the uptick in the unemployment rate in November does indicate continued cooling in the labor market, which is something he doesn’t want to see, according to his Jackson Hole address. Thus, we see the potential for a balanced discussion around future policy. In any event, we’ll be back this afternoon with a summary of the meeting and an early read on the press conference.

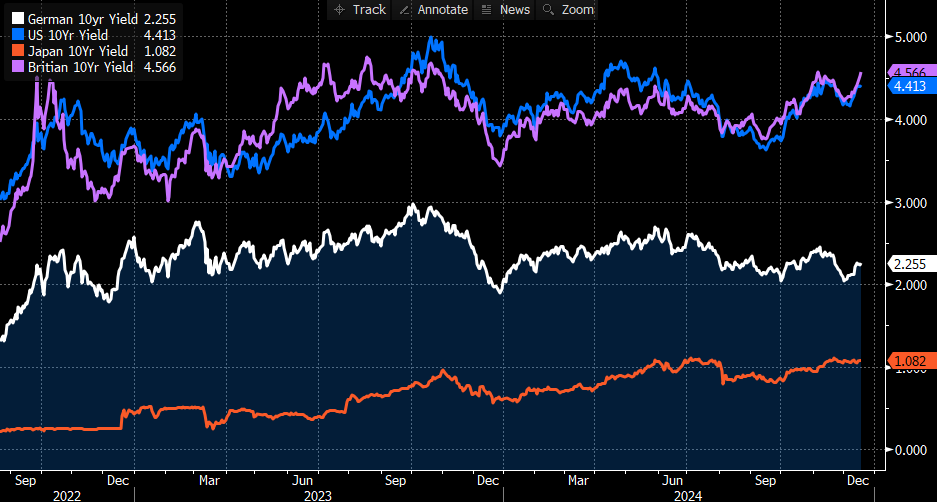

- Meanwhile, Treasury yields continue to drift higher, which is not typical in a rate-cutting cycle. So, what is prompting that action? Well, the usual suspects are the upcoming Trump Administration and its inflation-leaning policy proposals, the sticky inflation story and the Fed cutting into that stickiness and worries over upcoming Treasury supply.

- We find the supply story a compelling argument. Assuming we’re not going to see any real moves to curb the deficit, at least in 2025, the $2 trillion deficit of 2024 will be similar next year. Add to that $6 trillion in maturing Treasury debt vs. $4 trillion in 2024 and the Treasury will need to sell around $8 trillion in debt next year vs. $6 trillion this year. While we suspect the auctions will ultimately be successful (see the rate differential on sovereign debt below), it will likely keep yields elevated rather drifting lower with Fed rate cuts.

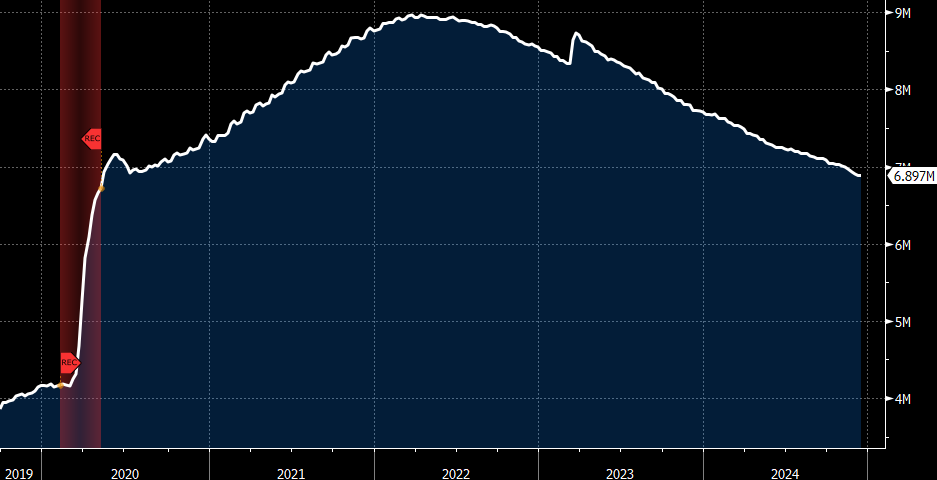

- Ending QT soon would help to alleviate some of this yield pressure, but we don’t expect to hear any shift in expectations until mid-2025. The Fed’s balance sheet is shrinking via QT (see graph below), but we think they want to see that continue. It will be, however, something that will be asked of Powell at the presser.

Treasuries Continue to Offer Some of the Best Sovereign Debt Yields in Developed Markets

Source: Bloomberg

The Fed’s Balance Sheet is Shrinking via QT, but More to Go

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.