FOMC and CPI Share This Week’s Spotlight

FOMC and CPI Share This Week’s Spotlight

- Treasury yields are higher as they trade in sympathy with higher European yields as incumbent parties in Europe suffered weekend election losses as far-right politicians gained, and that unsettled euro markets. More Treasury supply this week will also keep Treasuries on the back foot, and of course, Wednesday’s doubleheader of FOMC and CPI will keep any rally attempts on a short leash until we get past those events. Currently, the 10yr yield is 4.46% up 3bp on the day, while the 2yr is yielding 4.88%, unchanged on the day.

- The May jobs report continues to pressure yields as well. While the strength from the establishment survey was across-the-board, it is probably the 0.4% gain in average hourly earnings, highest since January’s 0.5% gain, that will weigh most on the Fed. They view strong wage gains with ongoing stickiness in core services inflation, and we’ll get an indication of that with Wednesday’s May CPI.

- As for CPI, expectations are for overall inflation to increase 0.1% with the YoY rate unchanged at 3.4%. Core inflation is expected to increase 0.3% for the second straight month after a trio of 0.4% gains in the first quarter. With a 0.4% print rolling off from last year, the YoY rate is expected to tick lower from 3.6% to 3.5%. The core services rate will also get attention given Friday’s pop in wages. April’s core services rate was 0.42% which was an improvement from March’s 0.65% but annualizing those robust monthly gains won’t get the inflation job done. Plus, after May’s roll off of a 0.4% print from last year, base effects get more challenging with a string of 0.2% monthly gains set to depart the annual calculations. Thus, improvement in the YoY rate will be grudging at best in the second half of 2024.

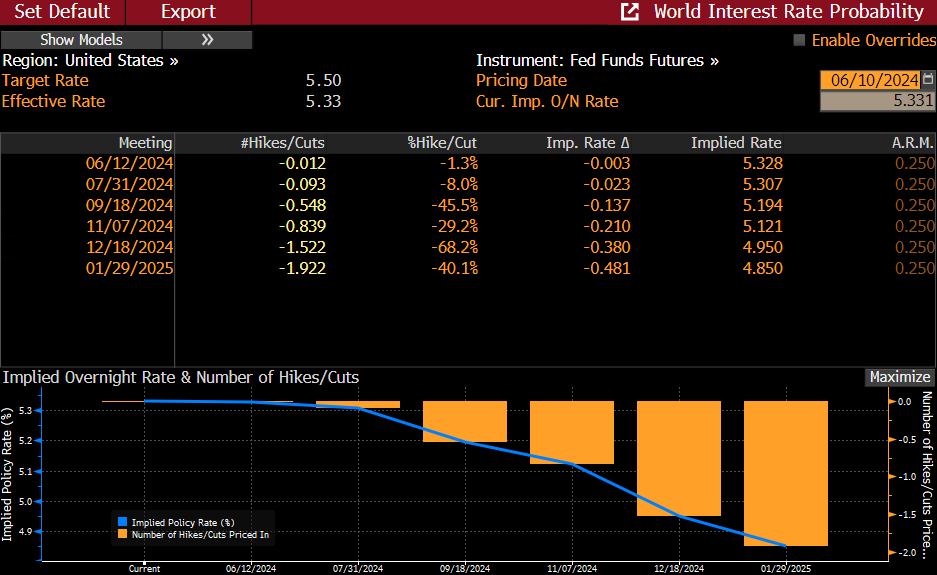

- That brings us to the FOMC and expectations for the meeting. In March, the Fed forecast core PCE to reach 2.6% by year-end. It printed at 2.8% in April so one would assume that is still achievable. Well, as we just mentioned, base effects get more challenging and with 0.4% and 0.3% prints so far this year, the Fed may just up their year-end forecast a touch higher. The updated dot plot will get attention too with most expecting the three cuts from the March forecast reduced to two. But there will be plenty in the one cut camp as well. We can easily imagine many Fed members are withholding their dot plot calls until the May CPI report is in hand Wednesday morning.

- New Treasury supply returns this week with $58 billion in 3yr notes today, $39 billion in 10yr notes tomorrow, and $22 billion in 30yr bonds on Wednesday. The combination of a Fed meeting and CPI on Wednesday will probably keep bidders playing it close to the vest so we suspect concessions will be the order of the day to move the new paper and that means higher yields are likely.

- Returning to the jobs report, we mentioned on Friday that there is increasing talk that the BLS’ birth/death model of business starts and closures has been overstating the starts and understating the closures for much of 2023 and into 2024. Benchmarking/revisions are due in August, and many expect upwards of 700 thousand jobs to be cut from the previous year ending in July. By the way, the birth/death model added 231 thousand jobs in the May report, so it’s a consequential part of the reported numbers, so expect this topic to get more attention as we approach those August revisions. It may provide additional momentum for a September rate cut if the intervening inflation reports cooperate.

- Finally, I sat down with Billy Fielding, manager of our Asset Liability Service, last week as we recorded the latest edition of The Community Bank Podcast. We talked about how the pandemic, the programs that followed, and then rate hikes created volatility for most banks in their asset liability positioning and created modeling challenges as well. For bankers curious how their AL position and modeling compares it should be required listening. You can find the link here.

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.