Flying Blind for Another Week

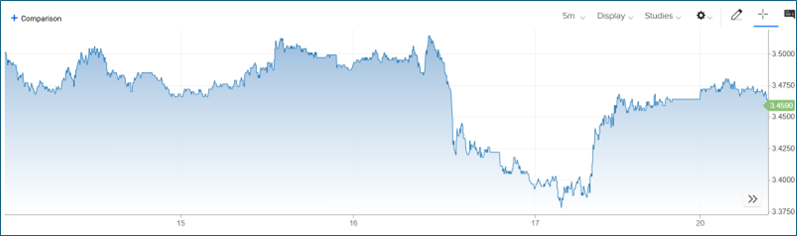

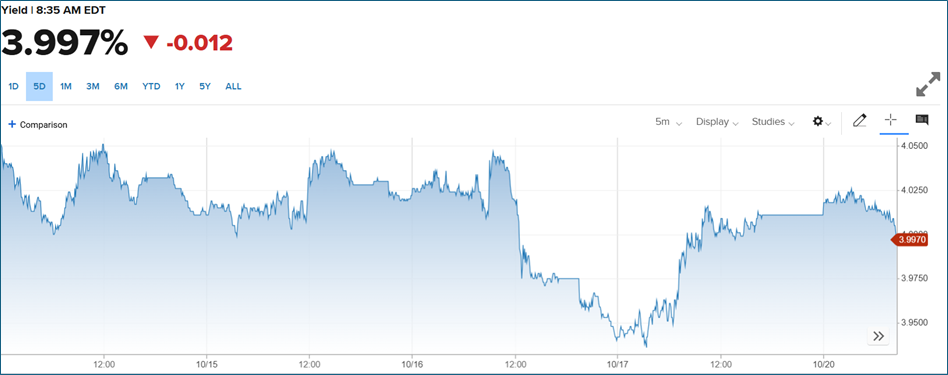

- Treasuries are waffling around unchanged levels this morning with equity futures pointing higher and risk sentiment improving. With the government shutdown entering its 19th day and firmly eyeing the 34-day record, we’ll be once again left to regional Fed reports and the varied mix of privately issued offerings. We will get, however, something resembling the CPI report on Friday. And with the Fed in radio silence prior to the FOMC meeting next week it only adds to the flying blind feeling right now. Currently, the 10yr Treasury is yielding 4.00%, down 1bp on the day, while the 2yr note yields 3.46%, also down 1bp in early trading.

- Not to sound like a broken record, but this week promises more of the same in that official data releases will be delayed for the foreseeable future. The one exception comes in the form of the September CPI report, which is scheduled to be published on Friday at 8:30am ET. The BLS called back staff to prepare the September report but as far as we know it only includes the CPI report. Not other BLS-related reports, like the monthly nonfarm payrolls.

- While the inflation data will contribute to the Fed’s messaging at its upcoming meeting, it’s not likely to change the outcome of the rate decision. Even if we see a core CPI print near or just above the Bloomberg estimates (+0.3%), count on a 25bps cut in October. The overall rate is expected at 0.4% with the YoY at 3.1%, same for the core rate.

- Even with staff called back to prepare the report it’s on a skeleton basis so the thorough data collection and analysis that we took for granted will instead be filled with more estimates and less data sourced from direct observation. And that’s where the government reporting differs in large respects from private sources. The government has developed and resourced a battalion of data collectors that literally go into the field to conduct price-level assessments. That level of detail is being lost and perhaps may never return to its prior state even with a breakthrough in the budget impasse. It’s something to consider as the fallout of the shutdown reveals itself in many small but important ways.

- The BLS has similar in-the-field operators with the jobs report that no doubt are sitting idle at the present time. And even if some staff, like with the CPI report, are called back to prepare something resembling the nonfarm payrolls report for October, it’s likely to be filled with even more estimates than is currently the case, and with their track record of recent large revisions, it begs the question as to how the shutdown will further damage the accuracy, or lack thereof, in reported numbers. There are a plethora of labor stats that can be had from various private sources but again, not every data point can be captured and reported by computers. Some amount of shoe leather has to be sacrificed and that’s something we won’t get from private sources.

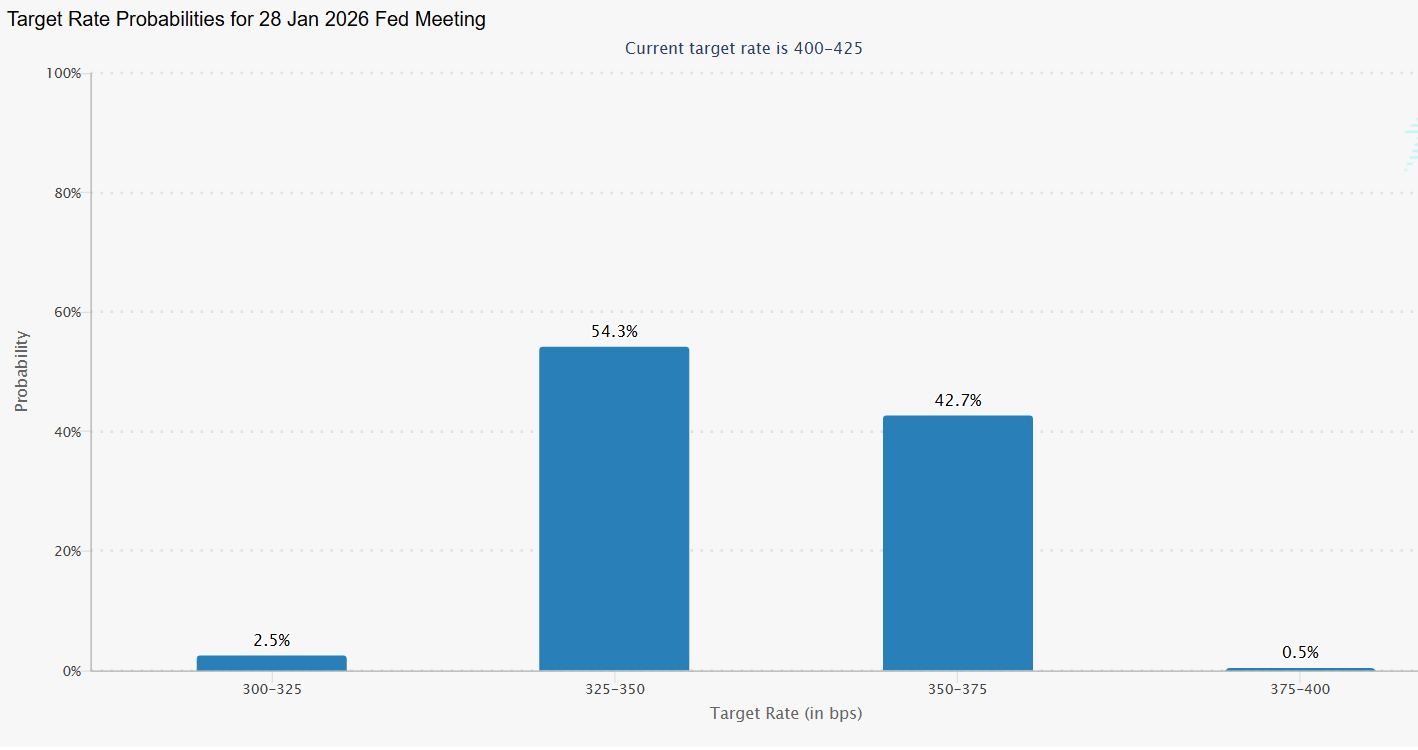

- On top of the lack of data, the Fed has entered blackout period prior to the October 29 FOMC meeting, so no Fed speak this week to generate headlines. Odds still heavily favor a 25bps cut at next week’s meeting and another on December 10. So, the limited reporting we’re likely to get, namely Friday’s CPI report, will be far more important to the gaming of odds for cuts in the first quarter of 2026. Futures markets currently see January and March as a toss-up, but those odds will be fine-tuned as new information is received on both the inflation and jobs front.

- Moving into 2026 at an assumed 3.50% – 3.75% funds rate doesn’t leave many cuts to return to estimates of neutral in the 3.00% -3.25% range. Of course, should economic weakness spread then cuts into the 2-handle funds range would be possible but only in the event of a recession-like economic environment

Futures Market Leaning Towards Another 25bps Cut Next January  Source: CME Group

Source: CME Group

2Yr Treasury Yield – Holding Below 3.50%  Source: CNBC

Source: CNBC

10Yr Treasury Yield – Breaking Below 4.00%

Source: CNBC

Source: CNBC

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.