Finally, Some Job and Inflation Numbers

- This is no time to sit and contemplate the true meaning of last week’s FOMC meeting, or who may be heading the Fed by mid-2026, as this week greets investors with a couple first tier reports: November Nonfarm Payrolls (Tues.) and CPI (Thurs.). Other reports of some gravitas, like October Retail Sales, will provide markets with another solid dose of data to consider following the last FOMC meeting of the year. After a bout of Friday selling in the tech sector, bargain hunters appeared this morning and that’s lifting prices across both stocks and bonds. Currently, the 10yr Treasury is yielding 4.16%, down 3bps on the day, while the 2yr note yields 3.50%, down 3bps in early trading.

- We’ve finally arrived at a week where we’ll have some job and inflation numbers to chew on, and not just the thin gruel of privately sourced reports. We’re talking about a BLS Nonfarm Payrolls Report tomorrow that will encompass November and some scattered information from October. On Thursday we’ll have the November CPI Release. Both reports may have asterisks attached given the intricacies of backfilling data subsequent to the government shutdown. Last week, we had the JOLTS report where the BLS noted some statistical methods couldn’t be used given some holes in the data, and that is likely to arise again with the first couple iterations of resurrected reports.

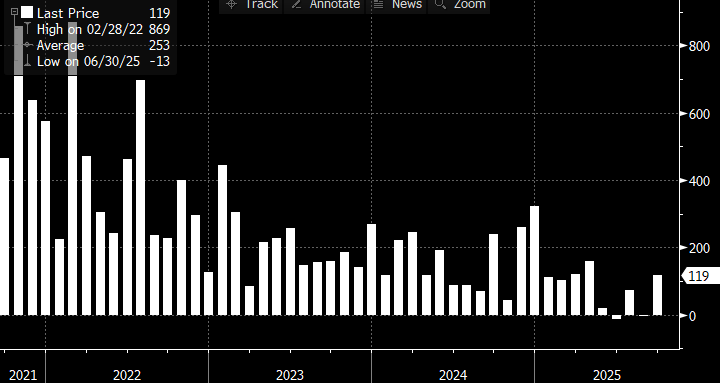

- With that word of warning, the November jobs report is expected to show 40 thousand new jobs, with all of that coming from the private sector. Recall, the September jobs report surprised with 119 thousand jobs, well above the mid five-figure mark most were expecting. We’ll see if that September number is revised lower tomorrow. The unemployment rate is expected to remain at 4.4% while wages are expected to grow 0.3% MoM and 3.7% YoY. The wage expectation is within the pre-shutdown trend.

- Also, tomorrow we’ll get retail sales for October. Expectations are for sales to have increased 0.3% vs. 0.2% in September with sales ex autos and gas up 0.4% vs. 0.1% the prior month. Control group sales are expected to rebound nicely from -0.1% in September to 0.4% which, if it comes to pass, starts the fourth quarter on a solid trajectory GDP-wise. We’ve all seen the somewhat dark consumer sentiment surveys, and honestly, they’ve been brooding for a while, but it hasn’t kept the well-heeled shoppers out of the malls and online stores. We’ll see if that was the case in October when the government shutdown story led the nightly news during the month.

- We’ll also mention that tomorrow brings the preliminary December PMI prints from S&P Global. Recall, these PMI’s have held up better this year than what ISM has reported. The November manufacturing PMI printed at 52.2, services at 54.1 and the composite at 54.2. Those numbers reflect decent expansion on both sides of the economy so compare those legacy prints to what we’ll see tomorrow.

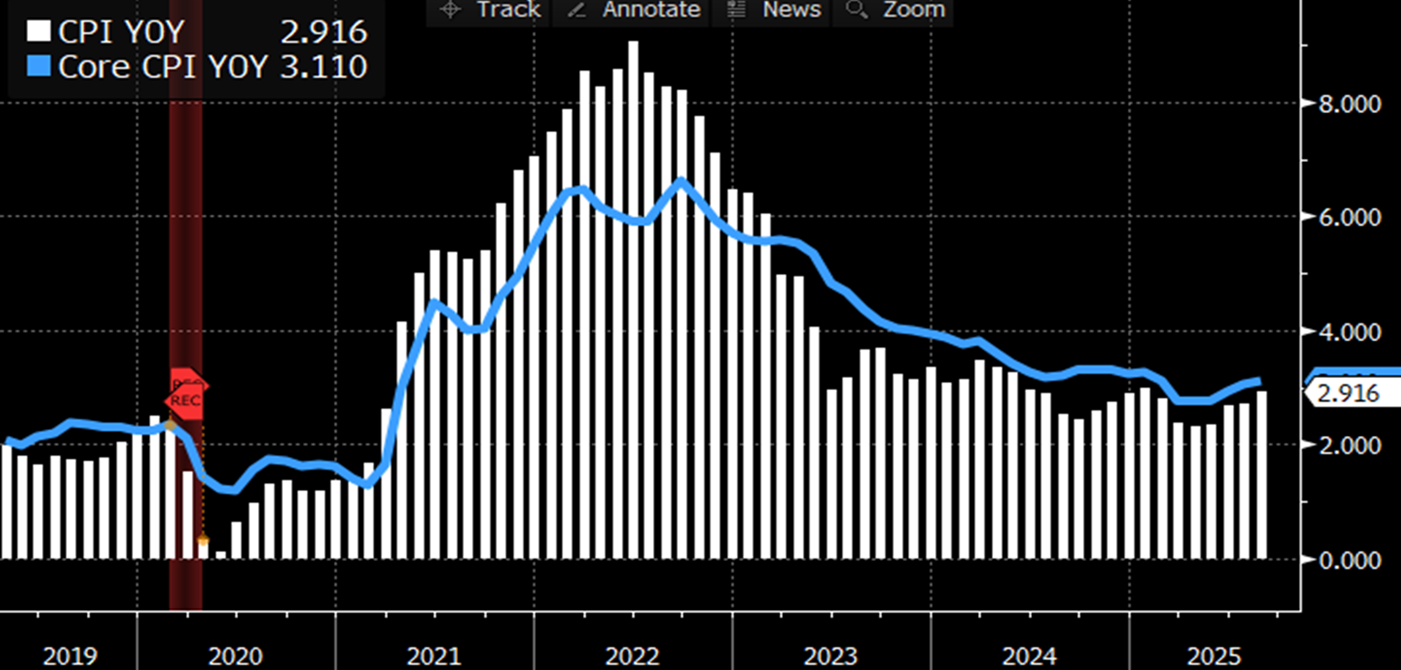

- That brings us to Thursday and November CPI. Recall, the September report had overall CPI at 0.3% MoM and 3.0% YoY and core at 0.2% MoM and 3.0% YoY. Expectations are that those levels will be roughly the same but we’re all flying somewhat blind because without an October report the month-over-month numbers cannot be provided. So, there’s that. Of course, we’ll dig into the minutiae of the report with three decimal breakdowns and how much core goods prices are behaving along with services and that critical Owner’s Equivalent Rent (OER) component that at 27% weighting drives much of the results. Recall in September OER dipped to 0.1%MoM when it had been running at 0.3%, or higher for much of the year. Alas, a month-over-month print won’t be provided given the absence of October data but the YoY level will tell us if we’re continuing to see moderation in rents which are necessary to keep YoY CPI overall and core sub 3%.

- As far as scheduled Fed speakers go, today we have Stephen Miran giving his inflation outlook at 9:30am ET at Columbia University. Given his repeated calls for 50bps rate cuts we’ll go out on a limb and predict he doesn’t see an inflation problem on the horizon. On Wednesday, Fed Governor Christopher Waller returns to the microphone at Yale giving his latest economic outlook at 8:15am ET. As another in the dovish caucus we expect similar views in his economic outlook, but we do appreciate his always well-researched and thoughtful opinions. We’ll only add that coming on the heels of the FOMC meeting we don’t expect any great departure from what we heard last week from Chair Powell.

November Nonfarm Payrolls Due Tomorrow – 40 Thousand New Jobs Expected Source: BLS

Source: BLS

CPI and Core CPI Expected at 3.0% YoY

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.