Finally, Some First-Tier Data to Chew On

- Treasury yields are moving a bit higher on an early risk-on mood as the week opens, but plenty of potential potholes remain. First, 25% tariffs are scheduled to go into effect tomorrow on Mexico and Canada. The week is also full of first-tier data, including employment numbers and the latest ISM surveys. Add in the certain headlines from DC it stands to be a busy week. Currently, the 10yr Treasury is yielding 4.25%, up 2bps on the day, while the 2yr is yielding 4.03%, up 3bps on the day.

- Almost thankfully, we have a week filled with first-tier data that may temporarily distract from the onslaught of headlines from DC., not to say those won’t continue this week. Lest we forget, 25% tariffs are expected to go into place tomorrow on Mexico and Canada. The Commerce Secretary, however, has already opined that they may not be the full 25%. I guess that’s supposed to make us feel better. The administration may think it’s smart negotiating tactics to play this on-again, off-again strategy but businesses and markets hate the uncertainty and it’s showing in recent confidence polls and soft data surveys.

- Last week’s approximately 20bp rally was a function of various items, the leading factors being a slump in consumer confidence measures, a 22k jump in jobless claims, and the sharpest fall in consumer spending on an inflated-adjusted basis since March 2020. Add in huge call-buying across Treasury futures contracts, solid auction takedowns, the aforementioned tariff implementation plans and ongoing cuts in federal workers, the drop in yields into month-end had plenty of catalysts.

- The story doesn’t end there. The Atlanta Fed’s GDPNow model for the first quarter plunged Friday, the first adjustment in a week. When it last reported on Feb. 19, it was reporting first quarter GDP at 2.3%. On Friday, it updated that to a contraction of -1.5%. The big factors in the downward adjustment were the huge jump in the trade deficit ($-153 billion vs. -$122 billion in December), no doubt driven by a buy early surge in imports to avoid tariffs. In GDP math that increasing deficit is a negative in the GDP calculation. Piling on to the trade deficit spike was the drop in real personal spending from Friday’s Personal Income and Spending report for January (dropped -1.3% MoM).

- To be fair, plenty of hard data remains to be filled into the model, and the January pause in consumer spending may be just that, it wouldn’t be the first time we’ve seen the consumer catch his breath after the holidays. Also, as I’ve said many times, far be it from me to predict the demise of the US consumer, but it has been a while since we’ve been staring at a potential negative GDP. Plus, the February trade deficit is likely to repeat January’s performance with tariff implementation pushed into March.

- With that backdrop the busy data calendar begins this morning with the ISM Manufacturing Index for February with it expected to remain in positive territory, albeit barely (50.5 vs. 50.9). The bigger story will come on Wednesday when the ISM Services Index is expected to show a better services sector than the S&P Global PMI series reported last week (53.0 vs. 52.8). Speaking of the S&P Global series, its final February numbers are also expected on Wednesday with all eyes on that services index that initially reported at 49.7.

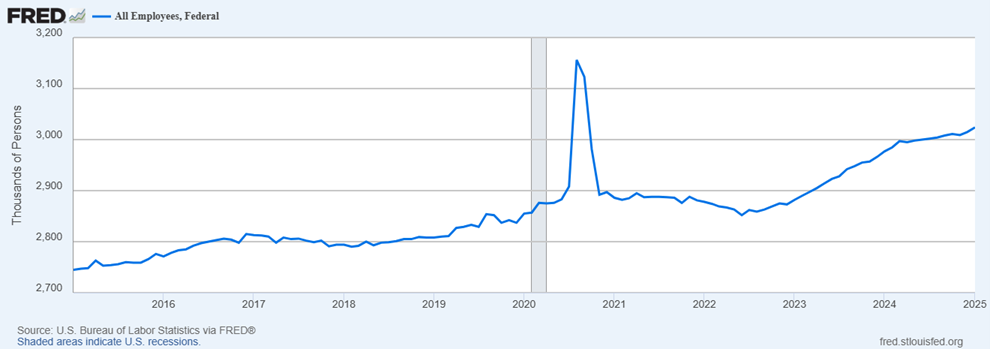

- Of course, the star of the week will be Friday’s payroll report with 158 thousand jobs expected vs. 143 thousand in January. It’s curious that private sector jobs are expected to be 130 thousand which implies 28 thousand in net new government sector jobs. Now that includes state and local jobs in addition to federal positions, but that seems a tad optimistic given what we know in DC.

- The unemployment rate is expected to remain at 4.0%. Recall, the survey week for the report was during the week of the 12th, so this report will, in some respects, be considered old news given what has transpired since. That means any upside strength will probably be shrugged off while any downside surprise will further encourage stagflation/recession fears.

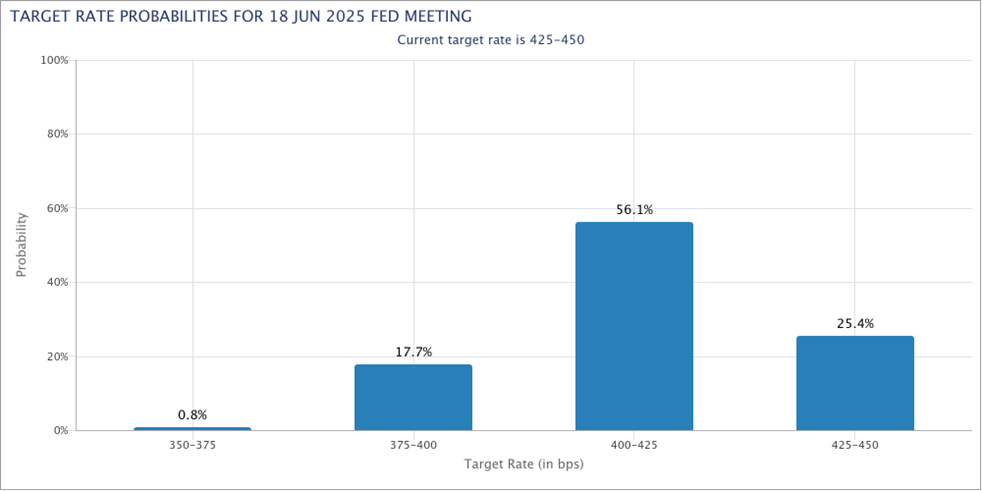

Futures Back to Predicting Rate Cut at June FOMC Meeting

Source: CME

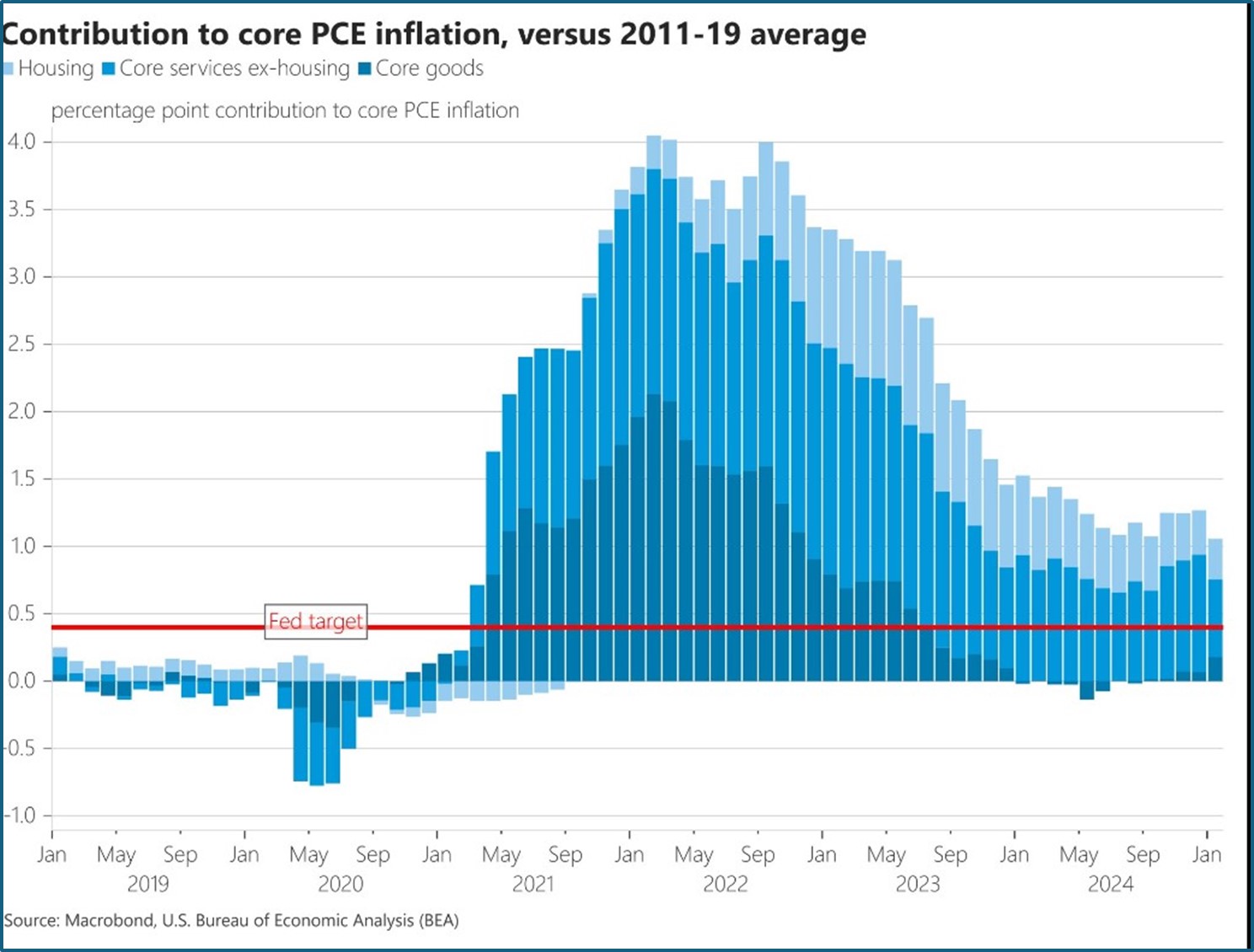

Watch This Graph Over the Next Few Months

Housing & Core Service Price Pressure Easing but Core Goods Pricing Starting to Increase

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.