Fed Week Awaits Investors

- Treasury yields are trending lower this morning as some of the selling last week is reversed, but it will be tentative moves until after the FOMC rate decision on Wednesday, followed by the PCE inflation series on Thursday. While the Fed is expected to cut, it’s what Powell may say about the future of cuts in 2025 that will be of interest to investors. Currently, the 10yr Treasury is yielding 4.38%, down 2bps on the day, while the 2yr is yielding 4.23%, also down 2bps from Friday’s close.

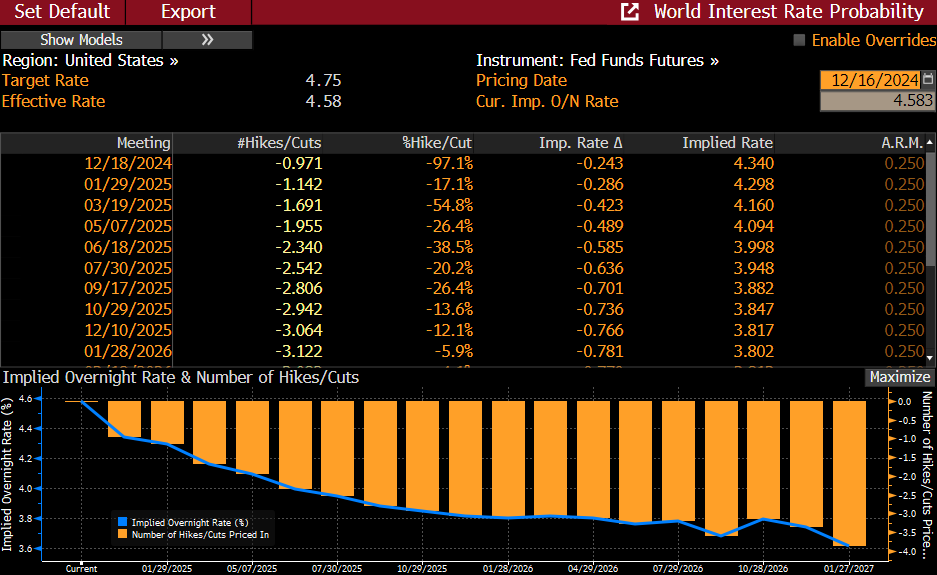

- After Inflation Week, it’s Fed Week with the FOMC rate decision on Wednesday. The overwhelming consensus is for a 25bps cut then a pause at meeting, and possibly another at the March meeting.

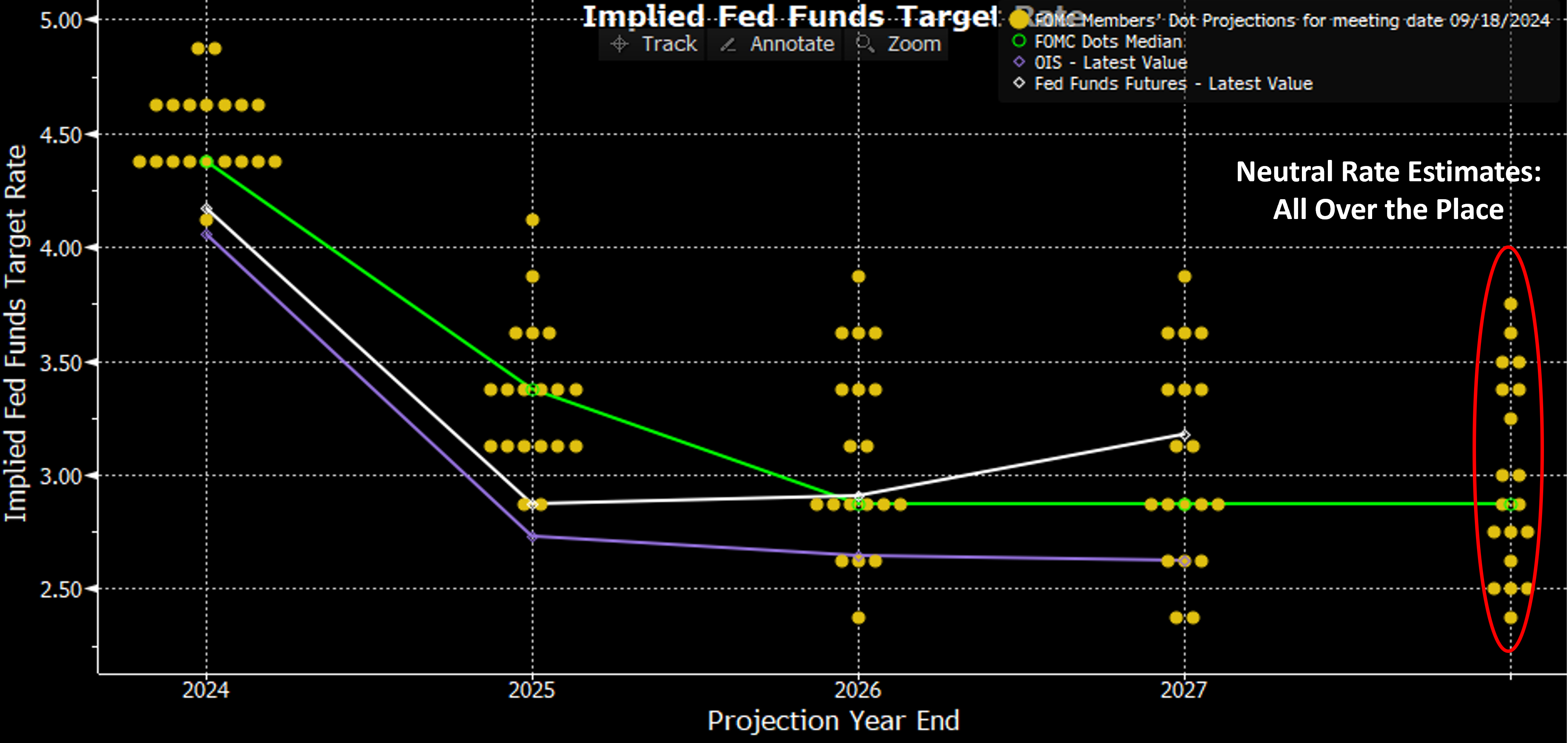

- Besides the expected rate cut, and indications of pausing, the Fed will update its Summary of Economic Projections (SEP) and the Dot Plot. It’s expected they will reduce the number of 2025 cuts from September’s forecast of four to three, with an outside possibility the cuts are reduced to two. We think with this Fed’s preference for incrementalism the median will be three, but you can expect a range of forecasts from none to four. If only we had names to go with those anonymous dots. It’s easy to call the high and low dots but it’s that cluster in the middle that is tough. Is it Jay Powell or a non-voting Fed regional bank president?

- It will also be interesting to see if the Neutral Rate is bumped higher like it has for the past three meetings. The median rate estimate started the year at 2.50% and now sits at 2.875%, after three 0.125% percent increases. We suspect it will get pushed higher again to 3.00% but expect a wide range of opinions from officials (see September’s dot plot below). This update will open the debate once again as to how tight policy is given the realization of a slowly lifting Neutral Rate estimate. While a 25bps cut on Wednesday will keep policy in restrictive territory, if the view is that the Neutral Rate has a 3-handle, the case for further cuts in 2025 becomes more difficult, especially if inflation is proving resistant to the 2% target. Thus, another reason for the expected pause when the calendar turns to 2025.

- Away from the Fed, today we will see the S&PGlobal December preliminary PMI series. Expectations are that manufacturing remains in contractionary territory (49.5 estimate vs. 49.7 in November) while the service side remains the star of the economy (55.8 v. 56.1) and firmly in expansionary territory. That’s what we saw earlier today from Europe with most countries, and the entire eurozone, reporting struggles in the manufacturing sector but services generally surprised to the upside. So, it looks like the service side strength is not just a U.S. phenomenon but a global one as well.

- Tomorrow we’ll get a look at November Retail Sales and whether the consumer is showing signs of faltering. Expectations are that the softness in October will be reversed. Overall sales are expected up 0.5% vs. 0.4% in October while sales ex autos and gas are expected up 0.4% vs. 0.1% the prior month. Meanwhile, the direct feed into GDP, the Control Group, is expected to rebound up 0.4% vs. -0.1% in October. It seems the softness in October was more about consumers just waiting for those Black Friday sales and not a trend change in consumption.

- Coming after the FOMC meeting on Wednesday will be Thursday’s release of the November PCE inflation series in addition to the income and spending results. Healthy gains in both income and spending are expected while core PCE is expected to be up 0.2% with a lean towards a possible 0.1% print, given what we’ve seen already in CPI/PPI/Import prices. Core PCE YoY is expected to tick higher from 2.8% to 2.9% as those tough comps rolling off from last year (0.1%) make YoY improvement a challenge. Coming after the Fed meeting, it won’t have an impact on Wednesday’s rate decision, but it will set the stage for discussions for the January meeting.

- Finally, we updated our Economic Outlook for 2025 and 2026 last week, with a slower pace of rate cuts due to stickier inflation and decent GDP growth as the consumer continues to carry the economy. If you’d like a copy you can find it here.

Odds for a December Rate Cut at 97%, Then only 50bps for all of 2025

Source: Bloomberg

Expectations are 2025 Median Rate Cuts will be Trimmed, While the Neutral Rate Estimate Gets Another Boost

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.