Fed Week Arrives with Modest Expectations

- Welcome to Fed Week, where once upon a time it was thought we would have the first rate cut of 2025 delivered this week. Well, like a hot sports prospect that doesn’t quite live up to the hype, we’re left with a meeting that will be known for the updated dot plot and perhaps not much more. Anyway, markets are in a surprisingly upbeat mood despite the trading of rocket salvos between Israel and Iran over the weekend. The current thinking is the military actions will remain limited and not spread to the wider Persian Gulf region and that has earlier oil price spikes partially repealed and that has boosted the risk-on mood. Equities are set to open higher (Dow indicated 280 points higher) and that has Treasuries treading water. Currently, the 10yr Treasury is yielding 4.43%, up 1bp on the day, while the 2yr is yielding 3.97%, also up 1bp on the day.

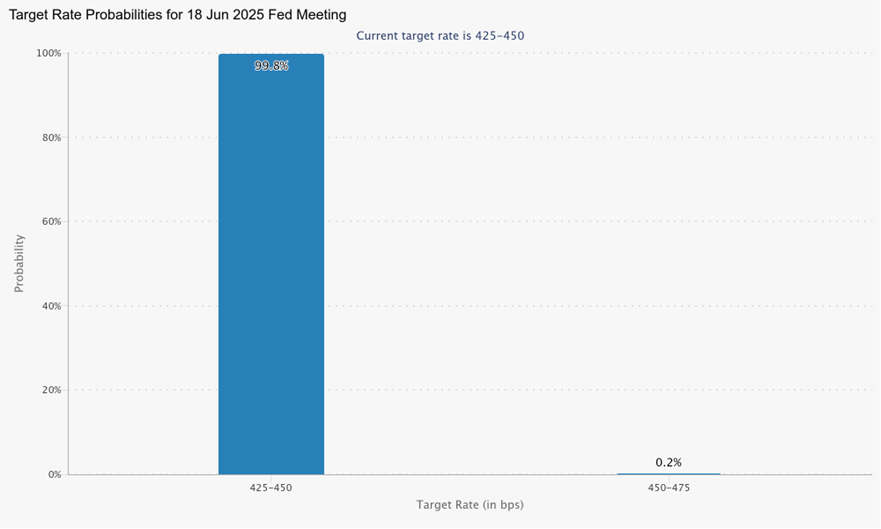

- As mentioned, we’ll get the FOMC’s rate decision on Wednesday. Earlier in the year, this week’s meeting was identified as having the real possibility of delivering the first rate cut in 2025. Now, expectations have been reduced to what the updated dot plot and economic forecast will tell us about future Fed expectations.

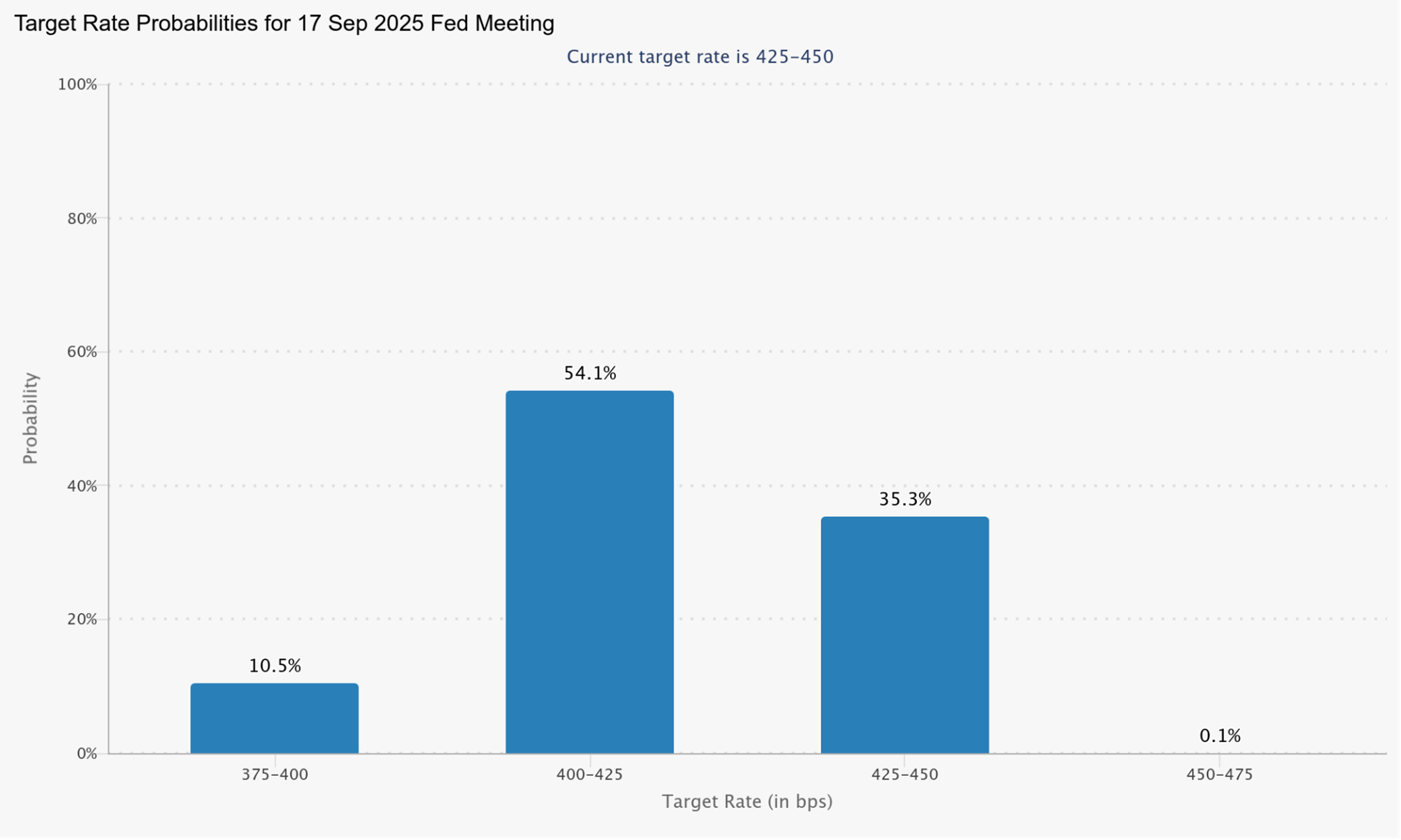

- As the threat of higher inflation from tariffs entered the picture, and as the economy continued to resist rolling over, rate cut odds for this week’s meeting slowly melted away with September now the meeting on which rate cut hopes rest. That being said, we’re not giving a pass yet to the July 29-30 meeting. It occurs late enough into the month such that most of the June data, both on inflation and the economy, will be known. If inflation continues to show little ill effects from tariffs, and economic/labor market momentum continues to wane, the possibility for a cut will grow.

- Perhaps the biggest unknown the market will be looking to have answered on Wednesday is will the Fed still project two 25bps cuts this year, as it had in the March dot plot? After this week, four meetings remain in 2025 (July 29-30, Sept. 16-17, Oct. 28-29, and Dec. 9-10). So, plenty of time to get the job done, but quarter-end meetings are always heavier favorites for rate cuts as they come with updated rate and economic information that buttress the Fed’s actions. So, if the dot plot projection is still for two cuts that will leave September and December to get the rate-cutting job done. We’ve been in the September/December rate-cutting camp for some time but as we said above, we’re not writing off July yet.

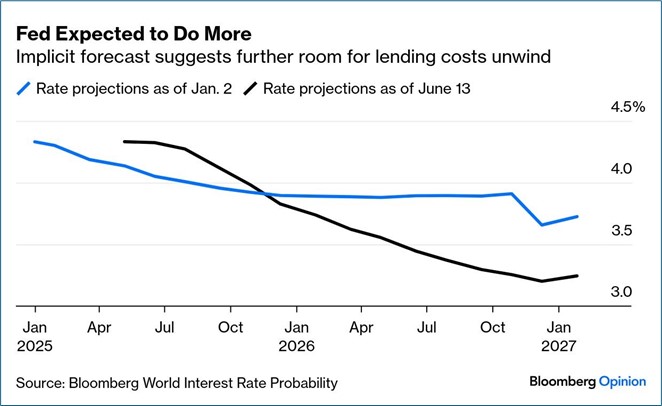

- Surprisingly, while odds of a first rate cut have consistently been shifted further into 2025, the number of expected cuts has increased from earlier in the year. It seems a bit of policy error is creeping into market forecasts as investors are beginning to come around to the view, like President Trump, that Powell will be late to make the shift from pause to cuts (see graph below).

- It’s not all about the Fed this week as we do have some first-tier data to chew on which will also go right to the heart of the Fed’s reaction function. Namely, the Retail Sales Report for May is due tomorrow. The news there is expected to be better than April. Overall sales are expected down -0.6% vs. 0.1% gain in April, but that’s mostly from soft car sales. Ex the volatile auto and gas category expectations improve to a gain of 0.4% vs. 0.2% in April. The direct feed into GDP, known as the Control Group, is expected to post an impressive 0.5% MoM gain compared to -0.2% the prior month. If the expectations are realized it will give the Fed comfort that the consumer is not folding up camp and will play into their summer pause plans.

- The final set of inflation data will also come tomorrow with the Import/Export Price Index. While the previously released inflation reports for May were uniformly cool, we’ll see if this one follows suit, or if there are some tariff-related hiccups in the numbers. Admittedly, this report has less bearing on overall inflation as CPI, PPI, and PCE but it does provide a couple more elements that feed into PCE, the Fed’s preferred measure, which is currently expected to post a cool core PCE of 0.1% MoM in next week’s release.

- The weekly initial and continuing jobless claims will garner attention, especially both measures have been creeping higher signifying a labor market that is losing momentum. The question to be answered is just how fast is it slowing? That will weigh on the Fed’s reaction function as well.

Not Much Guessing Where the Market Stands on This Week’s FOMC Meeting

Futures Market Firmly in the September Rate Cut Camp

Meanwhile, Market Now Expecting Powell to be “Late” Requiring More Rate Cuts

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.