Fed Week Arrives with a Rate Cut Expected

-

- Treasury yields are a tick lower this morning as a soft Empire Manufacturing number kicks off the week’s new information. The action is likely to be limited until we’re past the event risk known as the FOMC Rate Decision, due on Wednesday at 2pm ET. We review our expectations for the meeting below, but spoiler alert, we’re on board with a 25bps cut and three in total by year end. Currently, the 10yr is yielding 4.04%, down 2bps, while the 2yr is yielding 3.53%, down 3 bps on the day.

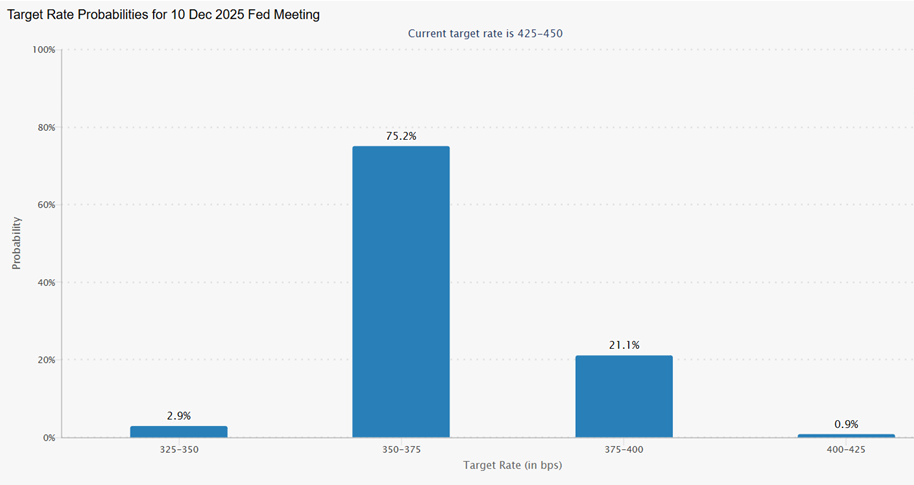

- The FOMC will announce its rate decision on Wednesday afternoon and while almost everyone expects a rate cut, some are still harboring thoughts that it could be the jumbo 50bps cut vs. the more traditional 25bps variety. Futures still see only low probability of a jumbo cut, and with a fair amount of inflation angst still alive and well in the committee that’s our bet too, a 25bps cut.

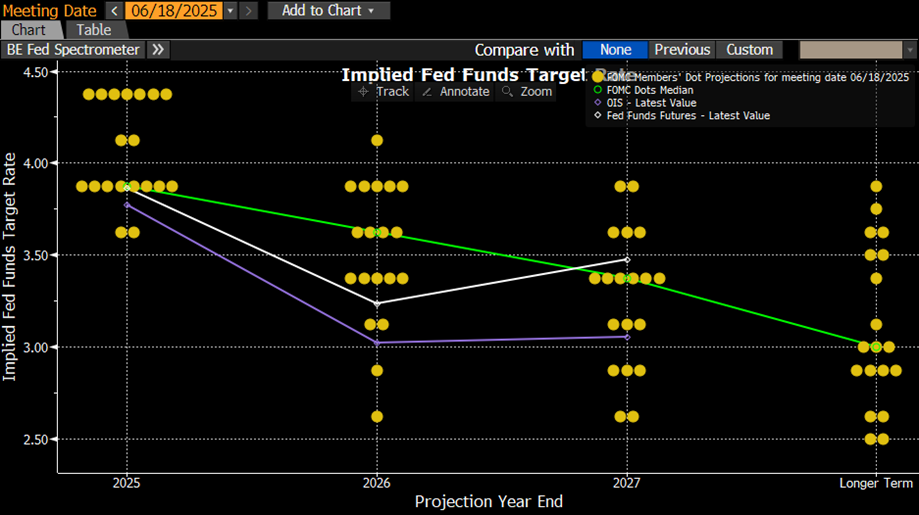

- The updated Summary of Economic Projections (SEP) will be interesting too from the perspective of the interplay between inflation and employment. The dual mandate and how they intend to react to both will be on full display in the update. We think they sacrifice, or backburner, the price stability mandate and focus more on additional rate cuts in 2026 in order to limit labor market damage and hope that the tariff-inspired cost increases will have played themselves out along with a softer growth outlook that dims demand, and as a consequence limits additional inflation pressure. Thus, we can see the Fed pushing three to four additional cuts in 2026 leaving the funds rate at 3%, or just below, which would put it at or below their latest neutral rate estimate (i.e., 3.00% as of June 2025’s dot plot).

- Before the Fed we will get the latest look at the latest consumer spending numbers in the form of August Retail Sales, due tomorrow. Expectations are for another solid month of consumption, but perhaps a bit below the July numbers. Advance retail sales are expected to have increased 0.3% vs. 0.5% the prior month, while sales ex auto & gas are expected up 0.5% vs. 0.2% in July. The GDP feed, otherwise known as the Control Group, is expected up 0.3% vs. 0.5% the prior month. If those expectations come to pass that would keep the economy on solid footing despite the obvious slowing in hiring, and that would be another reason for the Fed to opt for a slow, methodical decrease in rates rather than the more extreme looking jumbo move.

- Also tomorrow, we get the latest look at import and export prices and some of the data will complete the missing pieces for the PCE inflation series coming at month end. It’s important to note that the import/export price report reflects price changes prior to any tariff impact so it’s a real apples-to-apples comparison. There was some talk that foreign exporters are absorbing price cuts in order to offset some of the tariff costs, but the most recent monthly reports show import prices increasing, which only adds to the cost of tariffs, not offsetting them. We’ll see if tomorrow’s read delivers a similar pattern.

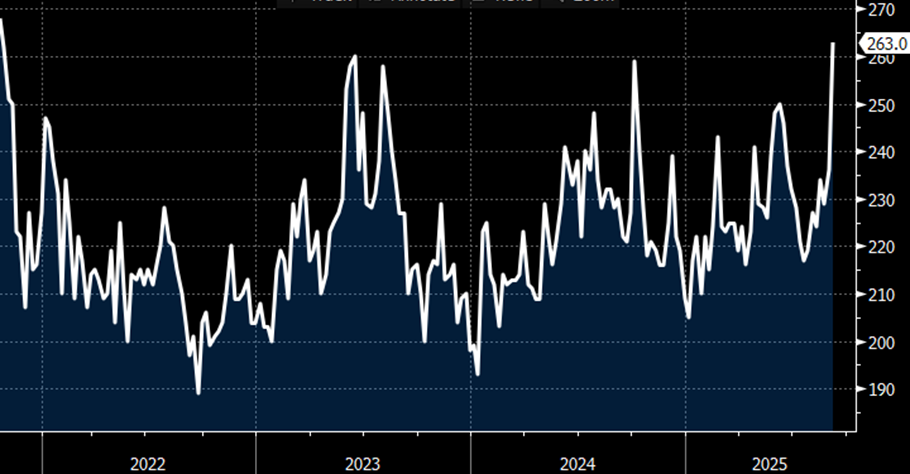

- Following the FOMC meeting on Wednesday the next big event will be the usually pedestrian release of the Weekly Initial Jobless Claims for the week ending Sept. 13. The spike last week to 263 thousand, the highest since October 2021, has sparked additional concern over the labor market that employers, after months of uninspired hiring, are now moving to the next step of cutting existing headcount. While one week does not a trend make, that report will be anxiously awaited to see if last week an outlier, or a harbinger of another leg lower in the labor market.

Futures Market Still Sees 75bps in Rate Cuts by Year End – We See the Fed Cutting 25bps for Next 3 Meetings

Source: CME Group

Will the New Dot Plot have Three 25bps Cuts Forecast for 2025 instead of Two in the June Version? We Think So

Source: FOMC

Last Week’s Spike in Initial Jobless Claims Has Investors Worried it may Signal another Weakening in Labor

Source: Dept. of Labor

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.